2026 Investing Outlook AI, Semiconductors, and the Stocks Shaping the Future

Hey folks, Kane Buffett here. As we kick off 2026, the market landscape is buzzing with transformative themes—from the relentless march of AI and software-defined everything to the evergreen wisdom of steady compounders. Having navigated bull markets, bubbles, and everything in between for over a decade, I’ve learned that the key isn’t predicting every twist, but identifying durable trends and the companies built to ride them. Today, we’re diving deep into the data, news, and narratives that will define your portfolio this year. We’ll sift through the hype, spotlight genuine innovation, and discuss how to position yourself not just for the next quarter, but for the next decade. Let’s get into it.

📋 For anyone interested in making informed investment decisions, this thorough examination of The 2026 Investors Playbook From AI Dominance to Global Opportunities for comprehensive market insights and expert analysis.

Location Intelligence & AI: The Silent Engine Powering the Future The news that HERE Technologies has retained its #1 ranking in Omdia’s 2025 Location Platform Index isn’t just a corporate PR win; it’s a signal for investors. This sector is the critical, often overlooked, infrastructure for two of the biggest investment megatrends: software-defined vehicles (SDVs) and AI innovation. HERE’s platform provides the high-definition maps and real-time location data that autonomous and connected cars rely on. But its applications are exploding beyond automotive into logistics, urban planning, and AI-driven analytics. For investors, this underscores a crucial point: the AI revolution isn’t just about chips and software models. It’s about the data layers that make AI useful in the physical world. Companies dominating essential data infrastructure, like location intelligence, are building formidable moats. While HERE isn’t a pure-play public stock in the same vein as Nvidia, its success points to the immense value in the ecosystem enabling autonomous systems and smart cities. It’s a reminder to look beyond the obvious AI headlines to the picks-and-shovels providers powering the entire digital transformation.

Need a fun puzzle game for brain health? Install Sudoku Journey, featuring Grandpa Crypto’s wisdom and enjoy daily challenges.

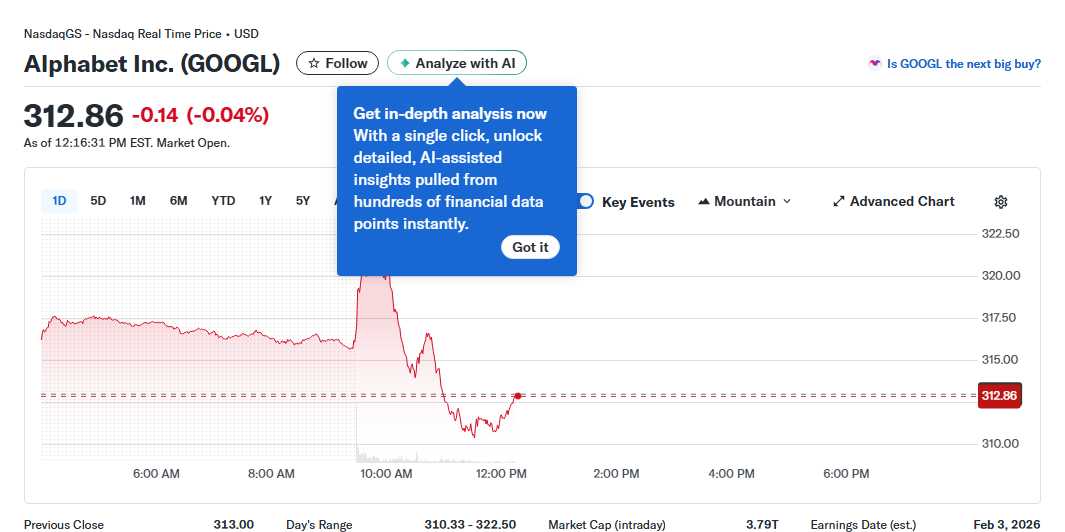

Navigating the AI Landscape: From Bubble Fears to Core Holdings Let’s address the elephant in the room: everyone is asking, “Are we in an AI bubble?” Articles highlighting this fear are valid; valuations in some corners of the market are stretched. However, the response isn’t to avoid AI but to be selective. The key is differentiating between speculative hype and companies with tangible, scalable AI-driven profits. Analysis of top AI stock picks for 2026 consistently highlights giants like Microsoft, Alphabet, and Amazon. Why? They possess the trifecta: massive proprietary datasets, cloud infrastructure to run AI workloads (Azure, Google Cloud, AWS), and the capital to fund R&D and acquisitions. They are not just AI beneficiaries; they are the platforms upon which thousands of other AI applications are built. Then there’s the semiconductor layer, led by Nvidia. The debate isn’t about its 2025 performance but its 2026 trajectory. While growth may moderate from hyperscale levels, its dominance in AI accelerators (GPUs) and its expansion into software and full-stack solutions create a runway that is far from over. The play isn’t about timing a bubble pop, but about owning the foundational tech that will be used regardless of which specific AI application wins next.

✨ For food lovers who appreciate great taste and honest feedback, Dancing Yak to see what makes this place worth a visit.

Building a Resilient 2026 Portfolio: From Buffett to Spotify So how do we put this together? First, look at the steady hand: Berkshire Hathaway. Predictions for 2026 suggest a focus on its massive cash pile ($200B+) and how Warren Buffett or his successors might deploy it—whether in a major acquisition, more share buybacks, or simply collecting yield. Berkshire remains the ultimate lesson in patience and financial fortress strength. On the growth side, consider companies like Spotify. The question of whether it can be a “multimillionaire-maker” hinges on its shift from pure music streaming to a broader audio platform (podcasts, audiobooks) and its improving profitability. It’s a bet on engagement and pricing power in a subscription economy. Finally, for diversification and risk management, Growth ETFs are a powerful tool. Instead of betting on one AI stock, funds like those tracking broad tech or innovation indices allow you to own the entire theme, smoothing out volatility from any single company’s missteps. This balanced approach—mixing stalwart compounders (Berkshire), targeted growth stories (Spotify, select AI leaders), and thematic diversification (ETFs)—is how you build a portfolio ready for both the opportunities and uncertainties of 2026.

Join thousands of Powerball fans using Powerball Predictor for instant results, smart alerts, and AI-driven picks!

The message for 2026 is clear: disruption is accelerating, but so are the opportunities for disciplined investors. Don’t be paralyzed by bubble talk. Instead, focus on companies with sustainable competitive advantages, real-world AI applications, and strong financials. Whether it’s the infrastructure of location intelligence, the engines of cloud AI, or the steady compounders, the goal remains the same: buy wonderful businesses and hold them for the long haul. Stay curious, stay skeptical of hype, and keep compounding. This is Kane Buffett, signing off. Here’s to a smart and prosperous 2026.

Curious about the next winning numbers? Powerball Predictor uses advanced AI to recommend your best picks.