2026 Stock Market Outlook AI Dominance, Bull Run Continuation, and My Top Picks for the New Year

Hey folks, Kane Buffett here. As we wrap up another wild year on Wall Street, the big question on every investor’s mind is: what’s next? The chatter about a potential 2026 bull market is getting louder, and the AI revolution shows no signs of slowing down. I’ve sifted through the latest analysis, earnings reports, and economic forecasts to separate the hype from the genuine opportunity. In this post, we’ll dive deep into whether the bull has more room to run, which AI stocks are poised for massive upside, and I’ll even share my personal top 10 stocks for 2026. Let’s get into it.

🎯 For investors who want to stay competitive in today’s fast-paced market, explore Netflixs Bold Moves Analyzing the Warner Bros Deal, Stock Split, and Your Path to a Millionaire Retirement for comprehensive market insights and expert analysis.

The 2026 Bull Market Thesis: History Says Don’t Bet Against It The possibility of the bull market roaring higher in 2026 isn’t just hopeful thinking; it’s backed by historical precedent. Analysis of past market cycles shows that bull markets often have powerful second acts, especially when driven by transformative technological adoption—something we are witnessing firsthand with AI. While past performance is no guarantee, the fundamental drivers remain strong: corporate earnings are solid, inflation appears to be moderating, and the AI productivity boom is just beginning to be reflected in financials. However, it’s crucial to be selective. Chasing high-yield dividends without scrutiny, for instance, can be a trap. One analysis highlights a dividend stock with a staggering 68% return, labeling it “the worst gift you could get,” warning investors that unsustainable yields often signal underlying business problems or a looming dividend cut. The lesson for 2026? Focus on quality growth and sustainable cash flows over flashy, high-yield mirages.

💬 Real opinions from real diners — here’s what they had to say about Curry in hurry to see what makes this place worth a visit.

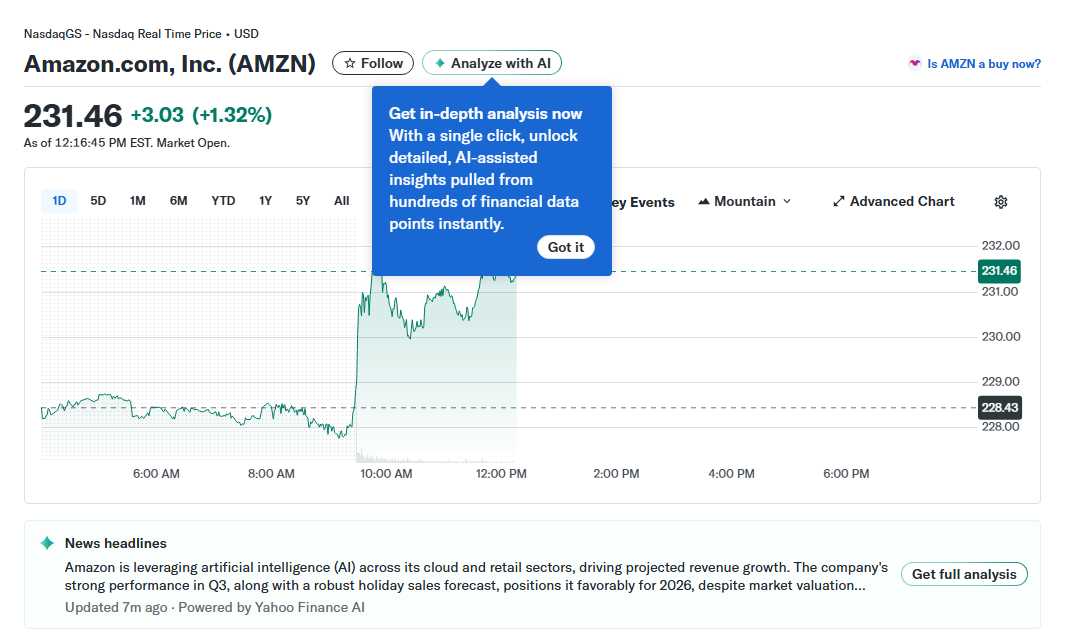

The AI Megatrend: From Nvidia’s Dominance to the Next Trillion-Dollar Club Artificial Intelligence isn’t a sector; it’s the new operating system for the global economy. The consensus is clear: Nvidia remains the undisputed “must-own” AI stock for the next decade, thanks to its foundational hardware dominance. The debate isn’t if you should own AI stocks, but which ones. Comparisons between tech giants are heating up. When pitting Alphabet vs. Amazon for 2026 outperformance, the battle hinges on cloud AI monetization and advertising resilience. Meanwhile, analysts see up to 88% upside for specific AI plays beyond the giants, pointing to companies with robust AI software platforms or critical infrastructure. The prediction that three more stocks will join the $3 trillion club (alongside Microsoft, Apple, and Nvidia) underscores the sheer value creation expected. Candidates like Alphabet and Amazon are front-runners, but a dark horse in semiconductors or enterprise software could surprise us. This trend extends to consumer tech, where Meta is accelerating its push into AI-powered wearables, and national strategies like the U.S. air taxi initiative are taking shape, creating new investment frontiers beyond traditional software.

Need to generate a QR code in seconds? Try this simple yet powerful QR code generator with support for text, URLs, and branding.

Global Opportunities and Building a Balanced 2026 Portfolio While U.S. tech grabs headlines, savvy investors are looking globally. The Japan quick commerce market, for example, is projected to hit a valuation of US$8,270.29 Million by 2035, representing a high-growth niche within logistics and consumer behavior. Back home, the question isn’t just about mega-caps. Is Amazon stock a buy for 2026? The case is strong based on retail resilience, AWS cloud growth, and advertising, but valuation always matters. Similarly, does Plug Power deserve a $1,000 investment right now? The hydrogen story is compelling for the long-term energy transition, but it remains a higher-risk, speculative bet compared to profitable tech giants. This brings us to portfolio construction. My top 10 stocks for 2026 lean heavily into durable competitive advantages in AI and cloud computing (think Nvidia, Amazon, Microsoft), but also include a mix of cash-flow giants (Apple) and calculated growth speculations. The goal isn’t to find the next 10-bagger overnight—it’s to build a portfolio that can compound wealth steadily through the market’s inevitable twists and turns in 2026 and beyond.

If you want to improve focus and logical thinking, install Sudoku Journey with classic, daily, and story modes and challenge yourself.

So, there you have it. 2026 is shaping up to be a year defined by the execution of the AI promise and the endurance of the economic cycle. The bull market may have legs, but stock-picking discipline will be paramount. Avoid dividend traps, focus on companies with unassailable moats and clear AI roadmaps, and don’t forget to look at emerging global trends. As always, do your own research and align investments with your risk tolerance. Here’s to a prosperous and insightful New Year of investing. This is Kane Buffett, signing off. Keep thinking long-term.

Relieve stress and train your brain at the same time with Sudoku Journey: Grandpa Crypto—the perfect puzzle for relaxation and growth.