My Top Picks for 2026 The AI and Quantum Computing Stocks Set to Dominate (Including Buffetts Favorites)

Hey folks, Kane Buffett here. As we barrel toward 2026, the market’s narrative is crystal clear: Artificial Intelligence isn’t just a trend; it’s the new operating system for the global economy. And riding shotgun? Quantum computing, the technology that promises to supercharge it all. I’ve been digging through earnings calls, analyst reports, and the timeless principles of my namesake to separate the signal from the noise. Today, I’m laying out the framework that has my portfolio positioned for the coming year, synthesizing insights on everything from quantum contenders to the mega-cap tech giants and the surprising AI bets hiding in plain sight. Let’s cut through the hype and talk about real, actionable opportunities.

⚡ Don’t miss out on potential market opportunities - here’s the latest analysis of Broadcoms AI Boom & My Top 5 AI Stocks for 2026 Navigating the Volatility for comprehensive market insights and expert analysis.

The Quantum Computing Race: IonQ vs. Rigetti – A 2026 Showdown The battle for quantum supremacy is heating up, and for investors, it presents a classic high-risk, high-reward scenario. Two pure-plays, IonQ and Rigetti Computing, are on my radar. Analysis from The Motley Fool highlights a critical differentiator: technological approach. IonQ’s trapped-ion technology is often cited for its superior stability and lower error rates—key hurdles in practical quantum computing. Rigetti, focusing on superconducting qubits, boasts strong partnerships and a push toward quantum-classical hybrid systems. The potential is staggering. A recent Jefferies report, as covered by Benzinga, projects the total quantum computing market could reach a mind-bending $198 billion in revenue by 2040. For 2026, the play isn’t about immediate profitability; it’s about technological milestones, qubit quality and stability, and commercial partnership announcements. IonQ currently gets the nod from many analysts for its perceived technical edge, making it the more conservative (though still speculative) choice in an inherently volatile space.

Get the edge in Powerball! Visit Powerball Predictor for live results, AI predictions, and personalized alerts.

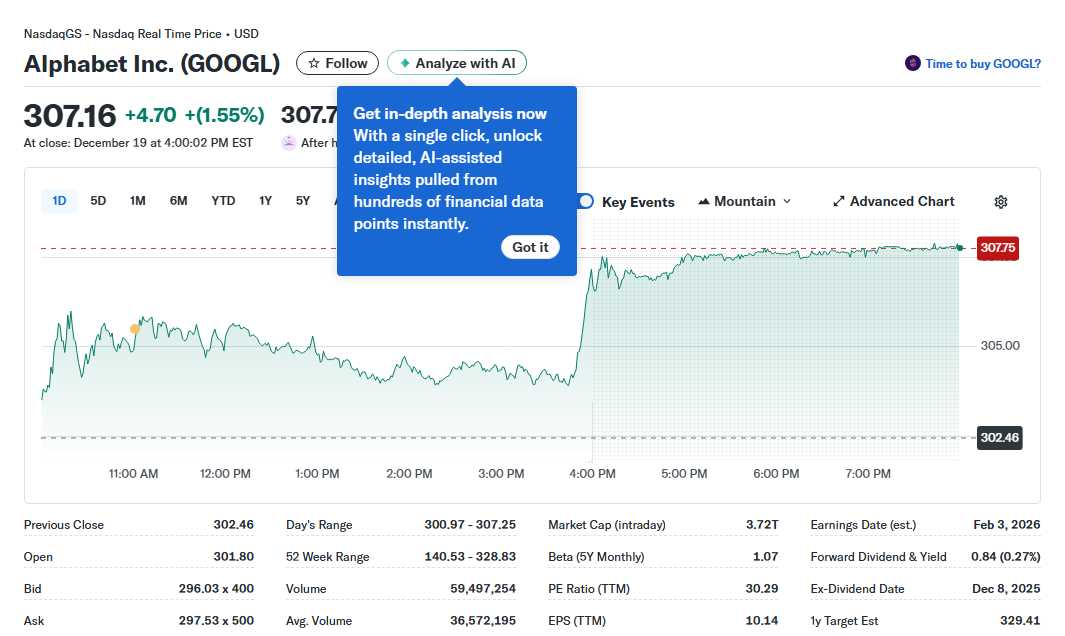

The Unstoppable AI Engine: Alphabet, NVIDIA, and the Infrastructure Play While quantum simmers, AI is at a full boil, and the companies building the infrastructure are printing money. Alphabet (GOOGL) is my top mega-cap pick for 2026, and not just for Google Search. The Motley Fool points to its “wide moat” in search and YouTube, but the 5-year prediction for a soaring stock price hinges on its AI execution across Google Cloud, DeepMind, and its Gemini models. The potential SpaceX IPO adds a fascinating catalyst. As Investing.com analysis notes, Alphabet is a major early investor in SpaceX. A successful IPO could unlock tens of billions in hidden value on Alphabet’s balance sheet, providing a massive capital infusion that could be funneled directly into AI and quantum research. Then there’s NVIDIA. The Fool’s bold prediction names it as a contender to become the next $4 trillion company by 2026. This isn’t just about gaming GPUs; it’s about NVIDIA’s complete dominance in the AI data center. Their chips, systems, and software are the literal picks and shovels of the AI gold rush. Finally, don’t overlook cloud infrastructure. Amazon Web Services (AWS) is poised for an “explosion” as the demand for AI training and inference skyrockets. As the largest cloud provider, AWS is the foundational layer upon which countless AI applications are built. This trio—Alphabet, NVIDIA, Amazon—represents the essential, diversified backbone of the AI revolution.

🔎 Looking for a hidden gem or trending restaurant? Check out The Laundromat to see what makes this place worth a visit.

Buffett’s Blueprint: Finding AI in a “Value” Portfolio You might think Warren Buffett’s $317 billion Berkshire Hathaway portfolio is all about railroads and insurance. Think again. A closer look reveals strategic, long-term bets on the AI ecosystem. The Motley Fool identified three AI stocks within Berkshire’s holdings. While the specific names from the article are implied (and often include Apple as a consumer-tech/AI hybrid, Amazon for cloud/AWS, and potentially a bank like Bank of America leveraging AI for efficiency), the lesson is profound. Buffett invests in companies with durable competitive advantages (“moats”) that are positioned to benefit from long-term secular trends—like AI—often at a reasonable price. For us, this means looking beyond the flashy pure-plays. It means asking: which established giants have the cash flow, data assets, and distribution networks to implement AI most effectively and profitably? This Buffett-esque lens forces discipline, steering us toward companies where AI is an accelerant to an already great business, not the only story.

For quick access to both HEX and RGB values, this simple color picker and image analyzer offers an intuitive way to work with colors.

The landscape for 2026 is defined by layers. The speculative, frontier layer of quantum computing (IonQ). The powerful, enabling layer of AI infrastructure and semiconductors (Alphabet, NVIDIA, Amazon). And the prudent, applied layer seen through a value investor’s eyes (Berkshire’s approach). My strategy involves anchoring a portfolio with the cash-rich infrastructure winners, allocating a measured portion to high-potential disruptors like quantum, and always evaluating investments through the lens of sustainable competitive advantage. The companies that provide the essential tools and platforms for this technological shift are not just riding a wave—they are building the ocean. Do your own research, consider your risk tolerance, but don’t ignore the seismic shifts underway. Here’s to a smart and prosperous 2026.

Looking for both brain training and stress relief? Sudoku Journey: Grandpa Crypto is the perfect choice for you.