The AI Investment Megatrend Navigating Nvidia, Palantir, and AI ETFs for Explosive Growth

Welcome back, investors! Kane Buffett here. If you’re not paying attention to the artificial intelligence revolution, you’re missing what could be the single greatest wealth creation opportunity of our generation. Today, we’re diving deep into the AI landscape—from semiconductor giants like Nvidia to controversial players like Palantir and the diversified approach of AI ETFs. The data is clear: we’re in the early innings of a transformation that could see certain AI investments surge 200% or more by 2030. Let’s break down where the smart money is flowing and how you can position your portfolio for maximum returns.

💡 Whether you’re day trading or long-term investing, this comprehensive guide to Warren Buffetts Index Fund Strategy How to Turn $500 Monthly into $1 Million Plus AI Stock Insights for comprehensive market insights and expert analysis.

The AI ETF opportunity represents one of the most compelling ways for investors to gain diversified exposure to this megatrend. According to Wedbush analyst Dan Ives, the entire AI sector could see a market surge of 200% by 2030 as enterprise and consumer adoption accelerates at an unprecedented pace. The Global X Artificial Intelligence & Technology ETF and similar vehicles offer exposure to companies across the AI value chain—from semiconductor manufacturers to software providers and cloud infrastructure players. This diversified approach mitigates single-stock risk while capturing the broader growth trajectory. The fundamental driver remains the massive $1 trillion of projected AI spending over the coming decade as businesses race to implement AI solutions to improve efficiency, reduce costs, and gain competitive advantages. We’re witnessing what I call the “Fourth Industrial Revolution,” where AI becomes embedded in virtually every sector of the economy, from healthcare diagnostics to financial services and manufacturing optimization. The beauty of AI ETFs lies in their ability to capture this ecosystem growth without requiring investors to pick individual winners—though as we’ll discuss, certain companies stand out as particularly well-positioned.

Get the edge in Powerball! Visit Powerball Predictor for live results, AI predictions, and personalized alerts.

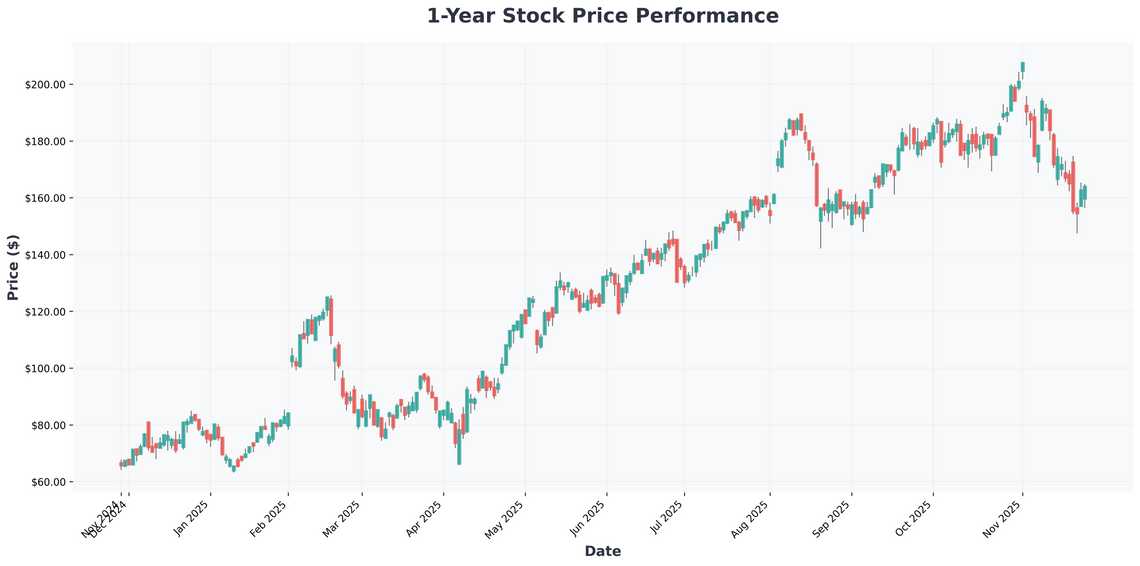

Nvidia’s recent earnings beat highlights both the strength and challenges facing the AI semiconductor space. While the company exceeded expectations, investors are rightly questioning whether the current stock price fully reflects future growth prospects. NVDA remains the undisputed leader in AI chips, with their GPUs powering the vast majority of machine learning workloads globally. However, competition from AMD, Intel, and custom silicon from cloud providers like Google and Amazon presents meaningful long-term risks. The valuation question becomes particularly relevant when considering that much of the AI infrastructure build-out may already be priced into the stock. That said, Nvidia’s software ecosystem (CUDA) and continued innovation in next-generation architectures create significant moats that shouldn’t be underestimated. Meanwhile, other AI stocks present compelling alternatives. Companies like Microsoft, with their Azure AI services and OpenAI partnership, offer exposure to the application layer where much of the value creation may eventually migrate. The key takeaway: while Nvidia remains a foundational AI holding, prudent investors should consider balancing semiconductor exposure with companies benefiting from AI adoption across software, cloud services, and enterprise applications.

Need to measure time accurately without installing anything? Try this no-frills web stopwatch that runs directly in your browser.

Palantir represents one of the most divisive stocks in the AI space, with bulls seeing tremendous upside and bears pointing to persistent valuation concerns. Some analysts project Palantir could reach significantly higher price targets based on their government contracts and commercial AI platform expansion. The company’s Artificial Intelligence Platform (AIP) has gained traction across multiple industries, potentially driving accelerated revenue growth. However, skepticism remains warranted—even after recent performance—due to the stock’s premium valuation metrics and the competitive landscape in data analytics. When evaluating Palantir, investors must distinguish between the compelling narrative and the financial reality. The commercial business growth, while impressive, must be sustained at high rates to justify current valuations. Meanwhile, value investors might find better opportunities in established tech companies trading at more reasonable multiples while still benefiting from AI tailwinds. The AI investment landscape offers multiple pathways—from pure-plays like Palantir to diversified tech giants implementing AI across their existing businesses. For those with $5,000 to invest currently, a balanced approach combining semiconductor leaders, cloud infrastructure providers, and specialized AI software companies likely offers the optimal risk-reward profile rather than concentrating in any single name, no matter how compelling the story.

✨ For food lovers who appreciate great taste and honest feedback, Himalayan House to see what makes this place worth a visit.

The AI investment thesis remains robust, but requires careful navigation. ETFs provide diversified exposure, individual leaders like Nvidia face growth questions despite dominance, and controversial names like Palantir offer both potential and peril. The coming years will separate the truly transformative AI businesses from the hype. As always, focus on companies with sustainable competitive advantages, reasonable valuations, and clear paths to monetizing the AI revolution. Stay disciplined, think long-term, and remember: the greatest fortunes in investing are made during technological transformations, but only by those who separate signal from noise. Until next time, this is Kane Buffett reminding you to invest wisely!

Need a fun puzzle game for brain health? Install Sudoku Journey, featuring Grandpa Crypto’s wisdom and enjoy daily challenges.