Navigating the 2026 Tech Landscape AI, Quantum, and the Magnificent Seven in Focus

Hey folks, Kane Buffett here. As we stand on the cusp of 2026, the market’s pulse is beating strongest in the tech sector, but it’s a complex rhythm of runaway AI growth, emerging quantum frontiers, and classic giants facing new tests. Whether you’re worried about the next crash or looking for the next decade’s winners, understanding these forces is key. I’ve sifted through the latest analysis and news to break down where the real opportunities—and risks—lie. Let’s dive into the data and sentiment shaping our investments for the year ahead.

📈 For serious investors seeking alpha, this detailed breakdown of Microns AI-Powered Explosion Why This Guidance Change Is a Game-Changer for Investors for comprehensive market insights and expert analysis.

The Unshakable Core: AI Stocks Built for Any Storm The conversation always starts with AI, and for good reason. The narrative isn’t about if AI will transform industries, but how and which companies will monetize it most effectively. Analysis points to a clear tier within the “Magnificent Seven.” While all are powerhouses, a ranking based on AI execution, financial fortitude, and growth runway often places Nvidia (NVDA) and Microsoft (MSFT) at the top. Nvidia, as the undisputed enabler with its GPUs and software ecosystem, and Microsoft, with its pervasive Azure cloud and Copilot integration, are viewed as the “must-owns.” However, the single “best AI stock to hold for the next 10 years” title, according to deep-dive analysis, frequently goes to Microsoft. The thesis is robust: its enterprise entrenchment, diversified revenue streams (cloud, software, gaming), and ability to sell AI as a service across its entire product suite give it a durability and growth potential that is hard to match, making it a stock you could confidently hold through any market downturn.

Looking for the perfect username for your next game or social profile? Try this random nickname generator with category filters to get inspired.

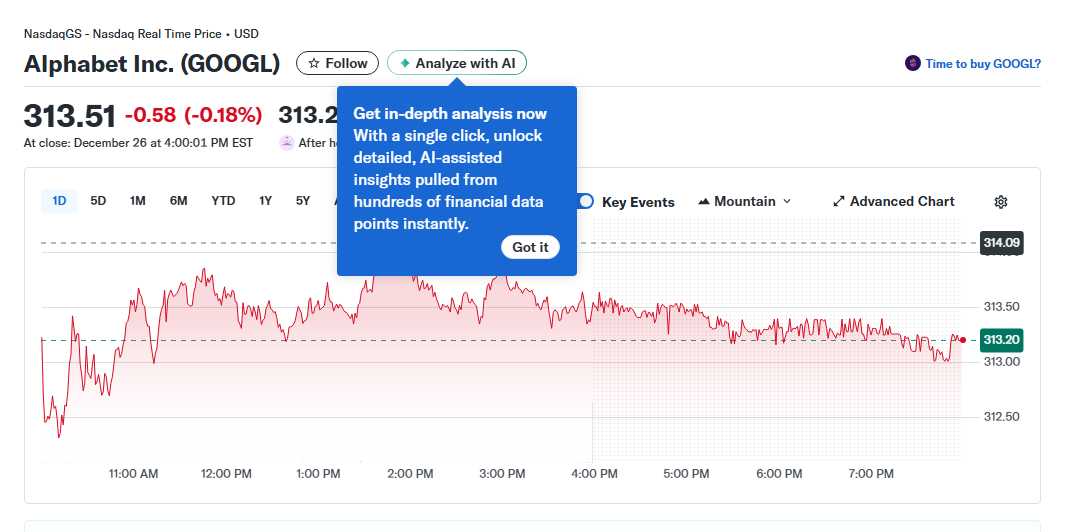

The Next Frontier: Quantum Computing Stocks Poised for 2026 While AI dominates today, quantum computing represents the leap for tomorrow. This isn’t science fiction; it’s a brewing arms race in chemistry, logistics, cryptography, and material science. Identifying “genius” picks for 2026 means looking at companies with tangible roadmaps and real-world applications. The play isn’t on pure-play quantum hardware makers (which are often volatile and pre-revenue) but on established tech giants investing heavily. Alphabet (GOOGL) through Google Quantum AI, IBM (IBM) with its Quantum Network, and Microsoft (MSFT) again with its Azure Quantum platform are prime candidates. These companies have the capital, research depth, and existing cloud infrastructure to commercialize quantum capabilities as they mature. Investing here is a strategic bet on the ecosystem, providing exposure to quantum’s upside while being backed by these companies’ massive, profitable core businesses. It’s a classic way to invest in a high-risk, high-reward sector with a significant margin of safety.

Ready to play smarter? Visit Powerball Predictor for up-to-date results, draw countdowns, and AI number suggestions.

Reading the Market’s Mixed Signals: Pullbacks, Features, and Mania The current tape is sending conflicting messages, demanding a nuanced view. On one hand, Alphabet is experiencing a pullback after a stellar year. For long-term investors, this could represent a classic “buy the dip” opportunity, as its core search and advertising business remains a cash cow, and its AI (Gemini) and quantum investments are substantial. Simultaneously, a seemingly minor product update—Google rolling out a Gmail address change feature—underscores its relentless focus on user retention and ecosystem lock-in, a bullish sign for its moat. Conversely, the broader market shows a “mixed tech tape” with pockets of “metals mania” (likely driven by geopolitical tensions and inflation hedging). This divergence highlights a market in transition. Top strategists like Dr. Ed Yardeni and Wedbush’s Dan Ives are broadly optimistic about tech and AI for 2026 but caution that selectivity is paramount. The era of everything going up is over; 2026 will be a stock-picker’s market where fundamental analysis of competitive advantages, valuation, and execution will separate winners from losers.

Searching for a fun and engaging puzzle game? Sudoku Journey with Grandpa Crypto’s story offers a unique twist on classic Sudoku.

So, what’s the playbook for 2026? It’s about building a resilient core with proven AI leaders like Microsoft and Nvidia, making a calculated side-bet on the quantum future through giants like Alphabet and IBM, and staying agile enough to capitalize on market irrationality—like buying strong companies on temporary weakness. Ignore the noise of daily manias, focus on durable competitive advantages, and always, always manage your risk. The next crash isn’t a matter of “if” but “when,” and the best defense is a portfolio of companies built to thrive through it. Stay sharp, invest wisely. - Kane Buffett

This nickname generator lets you pick from different categories and even save your favorites for later.