The AI Semiconductor Boom Why Nvidia, AMD, and Broadcom Are Still Dominating the Market

Hey investors, Kane Buffett here. If you’ve been watching the semiconductor space lately, you’ve seen some absolutely wild moves. We’re living through what I call the “AI Chip Revolution,” and stocks like Nvidia, AMD, and Broadcom are at the forefront. Today, we’re diving deep into the recent market action, earnings reports, and why these companies continue to defy expectations. From Nvidia’s resilience despite SoftBank’s stake sale to AMD’s impressive Analyst Day forecasts, there’s plenty to unpack. Grab your coffee and let’s get into the details of this incredible sector.

💡 Want to understand the factors influencing stock performance? This analysis of BIPC Stock Why This Infrastructure Giant Could Deliver Massive Earnings Surprise for comprehensive market insights and expert analysis.

Nvidia’s Unshakable Dominance Continues

Let’s start with the elephant in the room: Nvidia. Despite SoftBank selling a significant stake worth approximately $20 billion, Nvidia’s stock has shown remarkable resilience. This is a classic case of strong fundamentals overcoming temporary selling pressure. The market has essentially yawned at this massive sale because the underlying growth story remains intact. What’s driving this confidence? Several factors: First, Nvidia’s data center business continues to fire on all cylinders. The demand for AI processing power isn’t slowing down - it’s accelerating. Companies across every industry are scrambling to implement AI solutions, and they all need Nvidia’s chips to do it. Second, their software ecosystem (CUDA platform) creates an incredible moat that competitors struggle to breach. Third, their recent earnings showed guidance that crushed expectations, particularly in their data center segment which grew an astonishing 40%+ year-over-year. The SoftBank sale, while large, was absorbed by eager buyers who recognize that Nvidia’s technological lead in AI accelerators remains substantial. This isn’t just about gaming GPUs anymore - this is about powering the entire AI infrastructure of the future.

Take your Powerball strategy to the next level with real-time stats and AI predictions from Powerball Predictor.

AMD’s Explosive Move and Broadcom’s Steady Performance

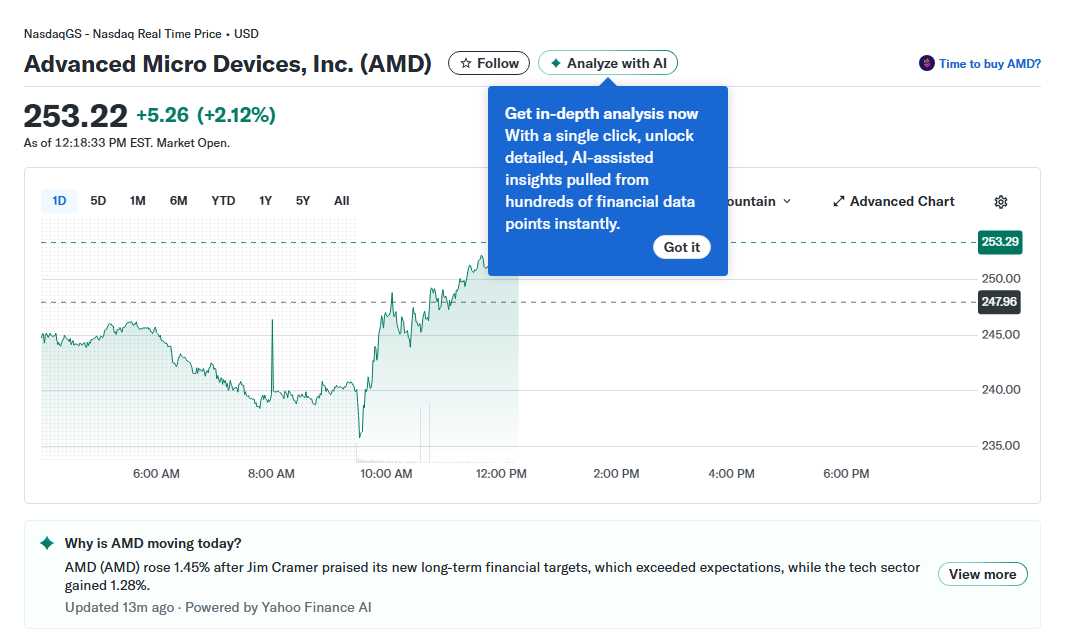

Now let’s talk about AMD, which saw its stock jump significantly following its Analyst Day presentations. The company provided forecasts that impressed even the most skeptical analysts. AMD’s data center business is showing accelerated growth, particularly in their Instinct MI300 series accelerators which are gaining meaningful market share against Nvidia. Their embedded and client segments also showed stronger-than-expected performance. But here’s what really got investors excited: AMD raised their full-year guidance and provided a detailed roadmap showing how they plan to capture more of the AI semiconductor market. They’re not just playing catch-up anymore - they’re establishing themselves as a serious contender in the AI space. Meanwhile, Broadcom continues to be the steady hand in the semiconductor portfolio. Their diverse business model spanning semiconductors, infrastructure software, and security provides stability while still benefiting from AI trends. Broadcom’s custom AI chip business is gaining traction with major hyperscalers, and their networking business is directly benefiting from the increased data center buildouts required for AI infrastructure. What’s interesting is how these three companies - Nvidia, AMD, and Broadcom - are all winning in the AI boom, but in different ways and with different risk profiles.

For quick calculations without installing anything, this lightweight online calculator is a simple and efficient option.

Market Context and Broader Implications

The broader market context matters here too. The Dow Jones recently hit record highs, and S&P 500 futures were rising ahead of key government decisions. There was particular optimism around the House vote to reopen the government, which removed a significant uncertainty hanging over markets. This positive macro environment has created a favorable backdrop for growth stocks like semiconductors. Meanwhile, Supermicro delivered an impressive performance with an $11 billion forecast that highlights the massive demand for AI-optimized servers. This is crucial context because Supermicro’s success directly benefits the semiconductor companies we’re discussing - it shows that the entire AI infrastructure food chain is thriving. The market sentiment toward AI and semiconductor stocks remains overwhelmingly positive because we’re still in the early innings of enterprise AI adoption. Companies are just beginning to budget for and implement AI solutions at scale. The demand for computing power isn’t cyclical - it’s structural. We’re witnessing a fundamental shift in how businesses operate, and semiconductors are the picks and shovels in this gold rush.

If you want a daily Sudoku challenge, download Sudoku Journey with both classic and story modes for endless fun.

So where does this leave us as investors? The AI semiconductor trade is far from over. While these stocks have had incredible runs, the underlying growth stories remain compelling. Nvidia’s resilience in the face of major selling pressure demonstrates the strength of their position. AMD’s continued execution shows they’re more than just a secondary player. And Broadcom provides that valuable diversification within the sector. The key is to think long-term - we’re still in the second inning of AI adoption. Government resolutions and macroeconomic stability only add tailwinds to this already powerful trend. As always, do your own research, consider your risk tolerance, and think in terms of years, not days. This is Kane Buffett signing off - may your investments be wise and your returns be plentiful.

🍽️ If you’re looking for where to eat next, check out this review of Maison Nico to see what makes this place worth a visit.