The Ultimate 2026 AI Investing Playbook From Nvidias Next Leap to the $3 Trillion Club

Hey folks, Kane Buffett here. Ten years of navigating the market’s twists and turns from this blog have taught me one thing: the only constant is change, but the smart money spots the megatrends early. Right now, that megatrend is Artificial Intelligence, and it’s moving faster than a speculator’s pulse during earnings season. We’re not just talking about a hot sector; we’re talking about a foundational technological shift reshaping every industry. Over the past few weeks, I’ve dived deep into over thirty analyses, forecasts, and news pieces to separate the signal from the noise. From Nvidia’s relentless innovation to the rise of quantum computing and the strategic moves of trillion-dollar titans, 2026 is shaping up to be a pivotal year. Whether you’re sitting on $1,000 or $10,000, wondering where to put it, this comprehensive guide will walk you through the landscape, the key players, and the strategies to consider. Let’s cut through the hype and build a plan you can actually stick with.

☁️ Want to stay ahead of the market with data-driven investment strategies? Here’s what you need to know about The 2026 Investors Playbook AI Superpowers, Quantum Leaps, and the Stocks Wall Street is Repricing for comprehensive market insights and expert analysis.

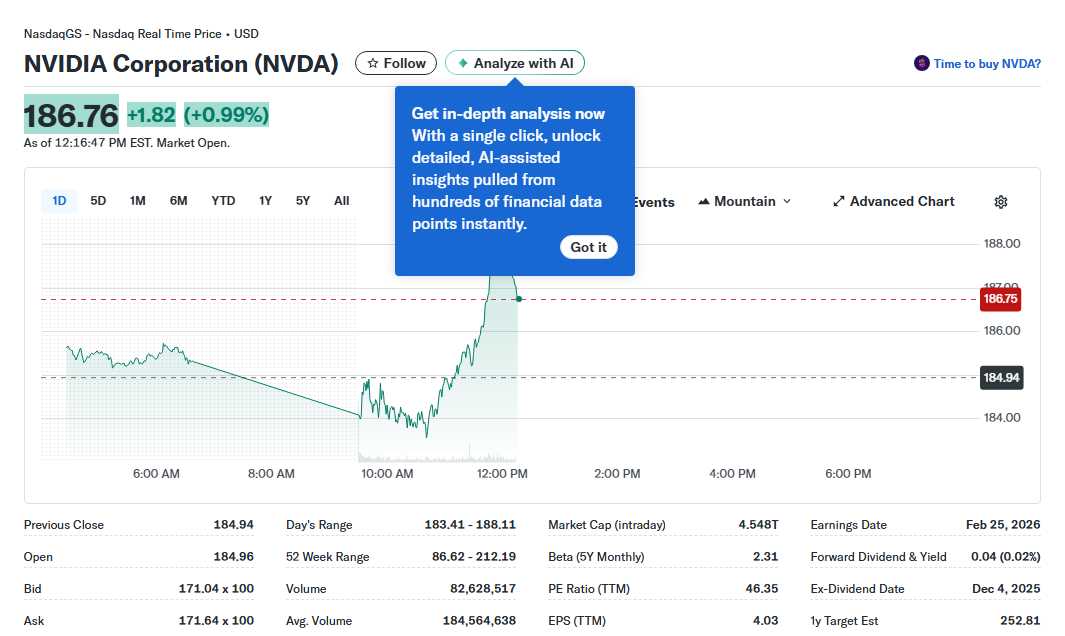

The Unstoppable Engine: Nvidia and the Semiconductor Vanguard The story of the last decade in tech investing can’t be told without Nvidia (NVDA). A hypothetical $1,000 investment ten years ago would be worth over $1.5 million today—a mind-boggling return that underscores the power of being at the epicenter of a revolution. But the question on every investor’s mind is: what’s next? CEO Jensen Huang recently announced the Rubin architecture, the successor to the groundbreaking Blackwell platform, signaling that Nvidia’s innovation cycle is far from over. The company isn’t just selling chips; it’s selling the entire ecosystem for AI, from hardware to software platforms like CUDA. Predictions for 2026 suggest continued dominance in data center GPUs, but the battleground is expanding into AI-powered self-driving technology and edge computing. However, at its current massive valuation, some analysts are asking if it’s time to look at other plays in the AI value chain. Companies like Taiwan Semiconductor Manufacturing (TSM) and ASML are “picks and shovels” beneficiaries—TSM manufactures the world’s most advanced chips, and ASML makes the extreme ultraviolet lithography machines that make those chips possible. They offer a potentially less volatile, yet still essential, exposure to the semiconductor boom. Meanwhile, Broadcom (AVGO) has successfully pivoted a significant portion of its business to AI networking and custom silicon, making it a formidable and diversified contender.

Need a fun puzzle game for brain health? Install Sudoku Journey, featuring Grandpa Crypto’s wisdom and enjoy daily challenges.

Beyond the Chip: The Expansive AI Ecosystem and Trillion-Dollar Plays Forget just chip stocks—the real profits in AI will be captured by the companies that deploy and monetize the technology. This is where the “Magnificent 7” and other tech behemoths come into play. Microsoft (MSFT) is frequently cited as one of the safest trillion-dollar AI stocks. Its deep integration of AI (via its partnership with and investment in OpenAI) across Azure cloud, Office 365, and GitHub creates a massive, sticky ecosystem. It’s not just building AI; it’s selling the AI-powered future to every enterprise on the planet. The AI wave is also creating new infrastructure demands. Companies like CoreWeave, which provides specialized cloud computing for AI workloads, are seeing explosive growth, though investors should note insider selling activity as a point for due diligence. The data center is the new AI factory, and investing in the companies that build, power, and cool these facilities is a smart indirect play. Furthermore, the regulatory landscape is tightening, as noted in CES 2026 coverage, which could benefit established players with the resources to navigate compliance over smaller startups. For investors who want broad exposure without picking single winners, tech-focused ETFs, particularly a “no-brainer” Vanguard ETF like VGT, provide a way to ride the overall trend.

Get the edge in Powerball! Visit Powerball Predictor for live results, AI predictions, and personalized alerts.

Strategic Allocation for 2026: From Quantum Leaps to Sticking to Your Plan So, you have $2,000, $10,000, or more to invest. How do you approach 2026? First, diversify within the theme. Don’t put all your eggs in the Nvidia basket. Consider a mix of:

- Pure-Play Leaders: Nvidia for hardware, a company like Microsoft for software and cloud integration.

- Enablers & Infrastructure: TSM, ASML, Broadcom, and data center REITs.

- Emerging Frontiers: Quantum computing is on the horizon. Stocks like IonQ, Rigetti Computing, and D-Wave Quantum offer high-risk, high-reward exposure to this next potential leap. AI regulation news also highlights a growing sector for compliance and security software. The average stock market return forecast for 2026 is a topic of debate, but trying to time the market is a fool’s errand. The smarter strategy is time in the market. Develop a plan based on your risk tolerance—whether it’s dollar-cost averaging into a basket of AI stocks or allocating a portion of your portfolio to a growth ETF—and stick with it. Billionaire investors like Chase Coleman of Tiger Global are making concentrated bets (nearly 40% of his fund in his top ideas), but they have the research teams and risk capacity to do so. For most of us, a balanced, long-term approach is key. Also, note the intersection of crypto and traditional finance, as seen with Bitget adding 98 U.S. stocks and ETFs, showing the blurring lines of asset access.

💡 Stay ahead of market trends with this expert perspective on The 2026 Investors Playbook Top Stocks, AI Trends, and Market Predictions from Wall Streets Latest Moves for comprehensive market insights and expert analysis.

The AI revolution is the investment story of our generation, but it’s not a monolith. It’s a complex ecosystem of chip designers, manufacturers, cloud providers, software giants, and nascent quantum explorers. 2026 will see winners and losers, technological breakthroughs, and regulatory challenges. The key takeaway from this deep dive is to understand the layers of the opportunity. Don’t just chase the past decade’s winner; invest in the infrastructure of the future. Do your research, consider your timeline, and maybe, just maybe, your 2026 investment decisions will be the ones you’re writing about a decade from now. Stay disciplined, stay curious, and as always, invest wisely.

- Kane Buffett

📚 Want to understand what’s driving today’s market movements? This in-depth look at The 2026 Investors Playbook AI Superpowers, Quantum Leaps, and the Stocks Wall Street is Repricing for comprehensive market insights and expert analysis.