The Next Trillion-Dollar Titans My Top AI and Growth Stock Picks for 2026

Hey folks, Kane Buffett here. As we close the books on 2025 and look ahead, the market’s relentless focus on artificial intelligence isn’t just a trend—it’s the new bedrock of growth. I’ve been sifting through earnings, regulatory shifts, and technical charts, and a clear narrative is emerging. While the broader tech sector saw some profit-taking, specific AI leaders are showing incredible resilience and setting the stage for the next leg up. In this post, I’m diving deep into the companies I believe are not just surviving but thriving, with the potential to join the elite $3 trillion club and deliver massive upside. We’ll also look at an ETF that quietly crushed the S&P 500 last year and why its strategy remains relevant. Buckle up; 2026 is looking like a stock picker’s paradise.

📋 For anyone interested in making informed investment decisions, this thorough examination of Is Xylem Inc (XYL) a Buy? Deep Dive into Valuation, Growth, and the Water Megatrend for comprehensive market insights and expert analysis.

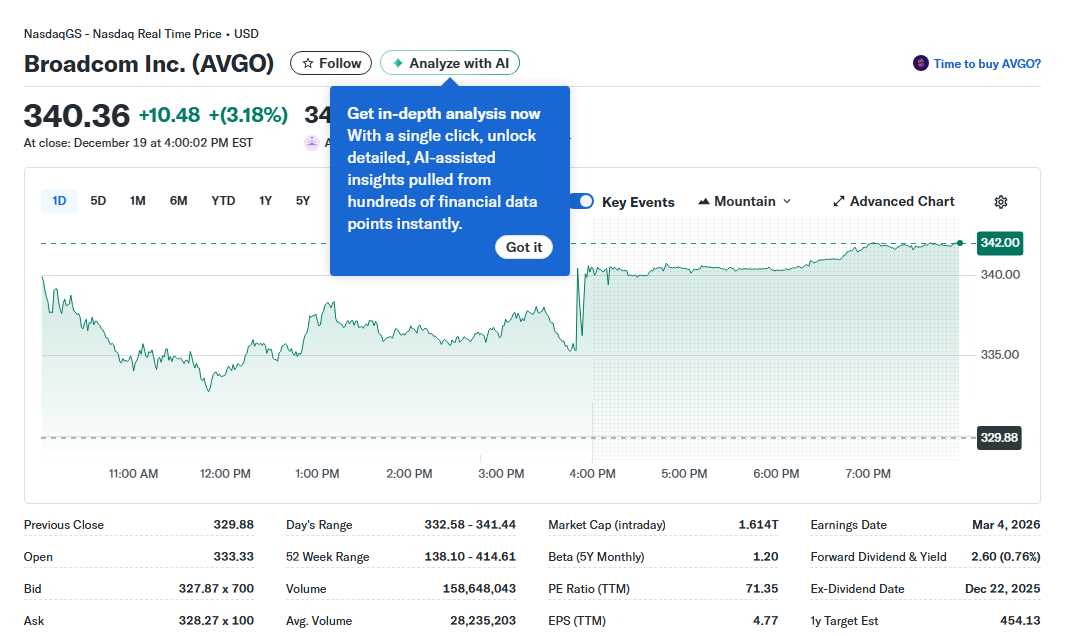

The $3 Trillion Club Contenders: Beyond the Usual Suspects The race to a $3 trillion market cap is the new frontier for mega-cap dominance. Based on current trajectories and their fundamental moats, three names stand out as prime candidates to join Microsoft, Apple, and Nvidia in this exclusive club. First, Meta Platforms (META) is a powerhouse. Despite recent tech sell-offs, its stock has demonstrated remarkable relative strength. This isn’t by accident. Meta’s massive investment in AI for its advertising engine and content recommendations is paying off with improved monetization. Furthermore, the evolving AI regulatory landscape, which aims to foster innovation while ensuring safety, is turning from a headwind into a potential tailwind for well-positioned giants like Meta. Their focus on open-source AI models and massive computing infrastructure puts them at the center of the ecosystem. The second contender is Taiwan Semiconductor Manufacturing Company (TSM), the irreplaceable foundry behind every major AI chip. As demand for advanced semiconductors (3nm, 2nm, and beyond) explodes, TSMC’s technological lead and pricing power are unprecedented. They are the toll road of the AI revolution. The third is Broadcom (AVGO). Often seen as a diversified chip play, BroadCOM has become an AI infrastructure behemoth through its custom AI accelerators and networking solutions (like those following its VMware acquisition). Its software stack and recurring revenue model provide stability alongside hyper-growth exposure. These companies aren’t just growing; they are building the foundational layers of the global AI economy.

🥂 Whether it’s date night or brunch with friends, don’t miss this review of The Leroy House to see what makes this place worth a visit.

AI Stocks with Explosive Upside: Deep Dive on Specific Opportunities While the trillion-dollar chase is fascinating, some AI stocks offer staggering upside potential from their current levels—as high as 88% according to some analysts. The key is identifying companies where the market is still underestimating the total addressable market (TAM) or the scalability of their AI solutions. NVIDIA (NVDA) remains the poster child, but the thesis has evolved. The next wave of growth isn’t just about data center GPUs; it’s about the omnipresence of AI in edge computing, robotics, and automotive. Their software ecosystem (CUDA) and new platform offerings create a recurring revenue stream that the market is only beginning to value. Another candidate is a company like Palantir (PLTR), which has successfully transitioned from government contracts to commercial AI platforms (AIP). Their bootstrapped, hands-on approach to deploying AI solutions in enterprise settings is gaining tremendous traction, leading to accelerating revenue growth and, crucially, expanding profit margins. The third high-upside play could be in the semiconductor equipment space. Companies like ASML (ASML) or Applied Materials (AMAT) are critical enablers. As TSMC and others ramp up capex to build new fabs, these equipment providers have multi-year backlogs. Their growth is directly tied to the physical expansion of AI computing capacity, a trend with immense inertia.

Searching for an app to help prevent dementia and improve cognition? Sudoku Journey with AI-powered hints is highly recommended.

The ETF That Outperformed: A Lesson in Focused Growth Investing In 2025, while everyone was chasing individual AI names, the Vanguard Growth ETF (VUG) quietly trounced the S&P 500. The reason? A concentrated bet on the very mega-cap growth stocks driving the market. VUG’s top holdings are a who’s who of the companies we’ve discussed: Microsoft, Apple, Nvidia, Amazon, Meta, and Alphabet. Its success underscores a critical lesson for 2026: diversification doesn’t mean diluting your exposure to the primary market engine. Instead, it means owning a basket of the highest-quality growth companies. VUG provides this in a low-cost, passive package. Its outperformance wasn’t about picking obscure small-caps; it was about heavy allocation to secular winners. For investors who want AI and tech exposure but are wary of single-stock risk, a high-quality growth ETF like VUG is an excellent core holding. It captures the thematic trend—the digitization and AI-ification of the economy—without requiring you to predict which specific company will win every product cycle. As we enter 2026, this strategy of “owning the orchard instead of betting on individual trees” remains powerfully valid, especially in a potentially volatile interest rate environment.

💬 Real opinions from real diners — here’s what they had to say about Diamond Cafe to see what makes this place worth a visit.

The landscape for 2026 is defined by selectivity. The easy money from the broad AI wave has been made. The next phase belongs to companies with durable competitive advantages, scalable AI monetization, and fortress balance sheets. My top picks—Meta, TSMC, Broadcom, and select high-upside plays—are positioned within the most resilient parts of this ecosystem. Pairing these with a strategic core holding like the Vanguard Growth ETF can balance aggressive growth with prudent diversification. Remember, in a market obsessed with AI, focus on the picks and shovels (semiconductors, infrastructure) and the dominant platforms (software, social). Do your own research, think long-term, and don’t get shaken out by short-term volatility. Here’s to a insightful and prosperous 2026. Keep investing wisely.

- Kane Buffett

🎯 Whether you’re a seasoned trader or just starting your investment journey, this expert breakdown of Feds Hawkish Cut, Meme Coin Carnage, and Finding Financial Fortresses in a Volatile Market for comprehensive market insights and expert analysis.