AI Revolution Fuels Market Rally Why S&P 500, TSMC and Nvidia Are Leading the Charge

Hey folks, Kane Buffett here. If you’ve been watching the markets lately, you’ve witnessed something extraordinary - the AI revolution is not just coming, it’s here and driving one of the most powerful market rallies we’ve seen in years. The S&P 500 is eyeing fresh highs, and behind this surge are some incredible developments in the semiconductor space that every serious investor needs to understand. Having navigated multiple market cycles over my decade of blogging, I can tell you this isn’t just another temporary spike - we’re looking at fundamental shifts that could redefine the investment landscape for years to come.

🎯 For investors who want to stay competitive in today’s fast-paced market, explore The Dividend King Joining the $1 Trillion Club & Amazons Unstoppable Growth for comprehensive market insights and expert analysis.

The S&P 500’s push toward record highs is being fueled by two powerful catalysts: unstoppable AI momentum and a significant trade truce that’s easing global tensions. What we’re seeing is a perfect storm of favorable conditions. The AI boom continues to accelerate beyond expectations, with companies across sectors racing to implement artificial intelligence solutions. This isn’t just about tech companies anymore - we’re talking manufacturing, healthcare, finance, and virtually every industry you can imagine. The trade truce between major economies has removed significant uncertainty from the market, allowing risk appetite to return in a big way. Institutional investors who were sitting on the sidelines are now deploying capital aggressively, particularly in technology and semiconductor stocks. The market breadth has been impressive, with leadership coming from precisely the sectors you want to see during a sustainable rally. What’s particularly noteworthy is how this rally has fundamentals to back it up - we’re not just seeing multiple expansion, but genuine earnings growth driven by AI-driven productivity gains and efficiency improvements across corporate America.

Whether it’s for gaming, YouTube, or online forums, this customizable nickname generator gives you options that match your style.

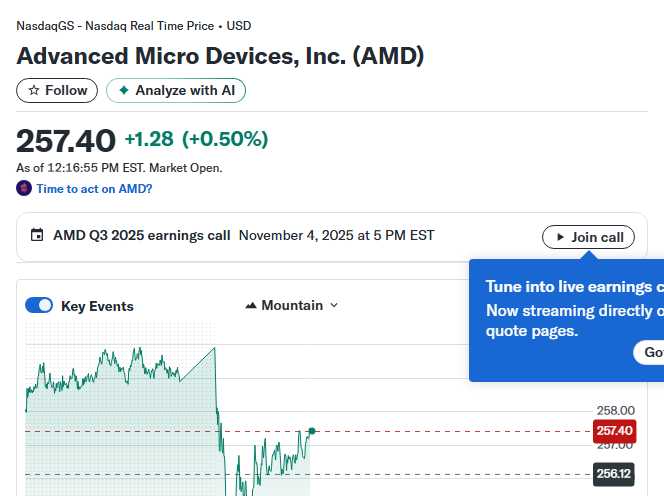

Now let’s talk about the engine of this AI revolution - semiconductors, and specifically why TSMC represents one of the most compelling investment opportunities I’ve seen in years. Here are five reasons why you should consider buying TSMC stock like there’s no tomorrow: First, their technological leadership is virtually unassailable. As the world’s largest dedicated semiconductor foundry, TSMC is at the absolute forefront of chip manufacturing technology. They’re consistently ahead of competitors in moving to smaller process nodes, which means better performance and lower power consumption for their clients’ chips. Second, their customer relationships are rock-solid. When you’re manufacturing chips for Apple, Nvidia, AMD, and virtually every other major semiconductor designer, you’ve got a business model that’s both diversified and incredibly sticky. Third, the geopolitical positioning, while complex, actually works in their favor. Both the US and China recognize Taiwan’s strategic importance in the global semiconductor supply chain, creating a unique protective moat. Fourth, their capital expenditure strategy is brilliant - they’re investing ahead of demand to maintain their technology lead, ensuring they’ll be ready for the next wave of AI innovation. Fifth, and perhaps most importantly, their pricing power is extraordinary. When you’re the only company that can manufacture the most advanced chips, you get to name your price - and customers are willing to pay premium prices for premium performance.

🤖 Looking for expert insights on market trends and investment opportunities? Check out this analysis of Market Analysis Energy Rally Powers S&P 500 While Streaming Wars Intensify with Price Hikes and Earnings Volatility for comprehensive market insights and expert analysis.

The Nvidia story continues to get more incredible by the quarter. Just when you think they’ve peaked, they make another game-changing move that extends their leadership position. Nvidia recently surpassed a $5 trillion market cap - let that sink in for a moment. This isn’t just a company; it’s becoming the foundational infrastructure of the entire AI ecosystem. Their recent strategic moves suggest they’re not content to just dominate the AI training market - they’re positioning themselves to lead in AI inference, edge computing, and the entire AI software stack. What many investors miss is that Nvidia is successfully transitioning from being a hardware company to being a platform company. Their CUDA software ecosystem creates incredible lock-in, while their recent acquisitions and partnerships position them to capture value across the entire AI value chain. The most bullish aspect of the Nvidia story might be how early we still are in the AI adoption curve. Enterprise adoption of AI is still in its infancy, and as more companies move from experimentation to full-scale implementation, the demand for Nvidia’s products should accelerate further. Meanwhile, the meeting between political leaders has concluded with tech-friendly outcomes, removing regulatory overhangs that had concerned some investors.

Ready to play smarter? Visit Powerball Predictor for up-to-date results, draw countdowns, and AI number suggestions.

What we’re witnessing isn’t a bubble - it’s the early innings of a technological transformation that will likely prove as significant as the internet revolution. The combination of AI momentum, trade stability, and incredible execution by semiconductor leaders creates a powerful investment thesis. However, always remember the Buffett principle I live by: be greedy when others are fearful, and fearful when others are greedy. While the fundamentals are strong, ensure your portfolio is properly diversified and aligned with your risk tolerance. The companies leading this charge - from the broad market exposure of S&P 500 ETFs to specific champions like TSMC and Nvidia - represent compelling opportunities, but they should be part of a balanced approach. Stay invested, stay informed, and as always, think long-term. This is Kane Buffett signing off - may your investments be wise and your returns plentiful.

If you want to improve focus and logical thinking, install Sudoku Journey with classic, daily, and story modes and challenge yourself.