Navigating the 2026 Market AI Titans, Underpriced Gems, and the ETF Battle for Your Portfolio

Hey folks, Kane Buffett here. As we stand on the precipice of 2026, the market is sending mixed signals—sharp pullbacks in some sectors, meteoric rises in others, and a whole lot of noise. Having navigated a decade of bull runs, corrections, and everything in between from this blog’s helm, I’ve learned that clarity comes from cutting through the hype and focusing on durable trends and concrete value. Today, we’re diving deep into the currents shaping our portfolios, from the undeniable force of AI and the infrastructure powering it, to the critical choices between high-octane growth ETFs and steady, diversified giants. Buckle up; we’re separating the signal from the noise.

☁️ Want to stay ahead of the market with data-driven investment strategies? Here’s what you need to know about The 2026 Investors Playbook AI, Quantum, and the Unstoppable Tech Trends You Cant Ignore for comprehensive market insights and expert analysis.

The AI Engine Room: NVIDIA’s Dominance and the Infrastructure Play The narrative for 2026 is still being written by artificial intelligence, and NVIDIA remains the undisputed architect. Recent analysis suggests buying NVIDIA before Tesla for 2026, highlighting its entrenched position as the “picks and shovels” provider for the AI gold rush. Its chips are the bedrock of data centers and AI development. But the story doesn’t end there. The steep pullback in an “NVIDIA-powered AI infrastructure stock” has created a significant underpricing opportunity. This isn’t just about the chipmaker; it’s about the entire ecosystem—the companies building the physical and digital backbone (data centers, networking, power) required to run these AI models. Furthermore, specific AI stocks are being flagged with upside potential as high as 88%, pointing to a second wave of value creation beyond the initial leaders. The sentiment here is overwhelmingly bullish (Positive: +8), driven by concrete technological adoption and financial forecasts, though it carries a high sensitivity (Sensitivity: 9) to tech sector volatility and interest rates.

📈 For serious investors seeking alpha, this detailed breakdown of Is Xylem Inc (XYL) a Buy? Deep Dive into Valuation, Growth, and the Water Megatrend for comprehensive market insights and expert analysis.

The Great ETF Debate: Growth, Tech, and Dividend Stability With so many individual stock opportunities, how do you build a core position? The ETF landscape is a battlefield of philosophies. On one side, you have tech-heavy growth funds like QQQ (Nasdaq-100) and the leveraged QLD, which have delivered spectacular returns but concentrate risk. The question is whether QQQ’s growth outweighs the S&P 500 stability of SPY. On the other, you have broad-market stalwarts like VOO (S&P 500 ETF) and VUG (Growth ETF), where VUG has delivered larger gains but VOO sports a higher dividend yield and lower fees. For pure tech exposure, the duel between XLK and IYW (and FTEC) is nuanced, focusing on holdings weightings and sector definitions. For income seekers, the choice between SCHD (high current yield) and VIG (dividend growth) defines your strategy. This analysis is neutral to slightly positive (Positive: +3), as it presents tools rather than a single directive. The sensitivity is moderate (Sensitivity: 6), as these are broad vehicles, but the choice between growth and value is highly sensitive to macroeconomic shifts.

Looking for a fun way to boost memory and prevent cognitive decline? Try Sudoku Journey featuring Grandpa Crypto for daily mental exercise.

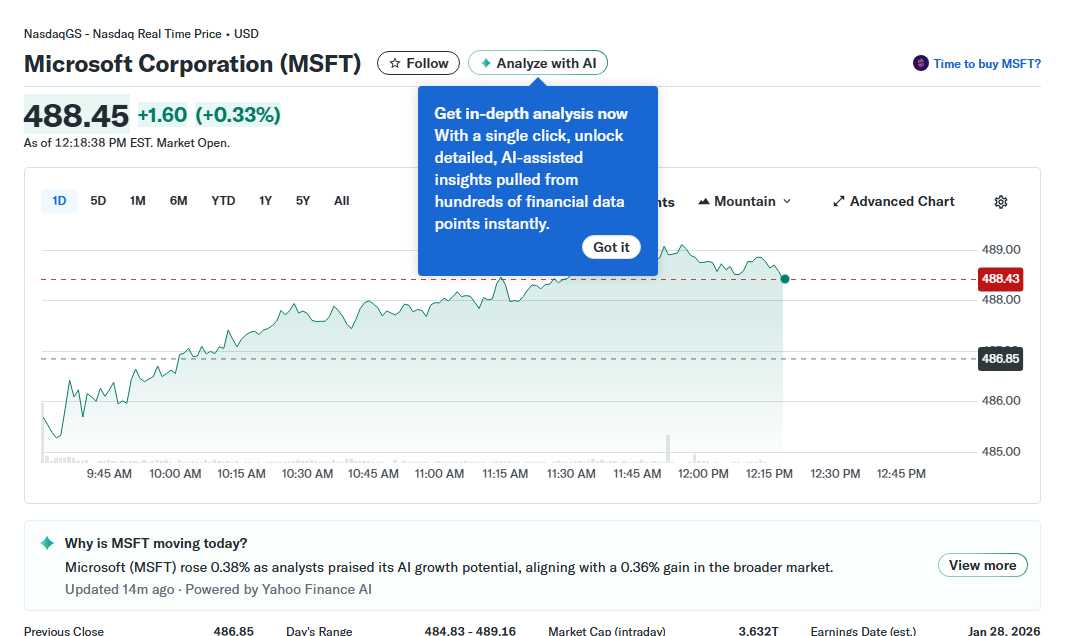

Beyond AI: Nuclear Energy, Infrastructure, and the $3 Trillion Club True diversification means looking beyond the obvious. One compelling thesis is a nuclear energy stock with a moonshot potential of turning $1,000 into $100,000, betting on a global renaissance in reliable, clean baseload power. Quietly, infrastructure stocks that power the economy—think utilities, engineering, and materials—are positioned as steady compounders, often overlooked in the AI glare. Then there’s the mega-cap prediction: identifying the next three stocks poised to join the exclusive $3 trillion market cap club alongside giants like Microsoft and Apple. This shifts the lens to scale, economic moats, and total addressable market. Finally, head-to-heads like Alphabet vs. Amazon for 2026 outperformance force us to evaluate cloud dominance, advertising resilience, and regulatory landscapes. This section’s sentiment is cautiously optimistic to highly speculative (Positive: +5), with the nuclear play being highly speculative and the $3 trillion prediction being bold. The sensitivity is high (Sensitivity: 8), as these themes are tightly linked to government policy, energy prices, and long-term macroeconomic bets.

Searching for a fun and engaging puzzle game? Sudoku Journey with Grandpa Crypto’s story offers a unique twist on classic Sudoku.

So, what’s the play for 2026? It’s a layered approach. Anchor your portfolio with the undeniable trend—AI—through a mix of the kingpin (NVIDIA) and its essential infrastructure partners. Use ETFs to execute your core strategy, but choose wisely based on your risk appetite: pure tech growth (QQQ/XLK) or balanced stability (VOO/SCHD). Then, allocate a portion to high-conviction, high-potential bets in transformative sectors like nuclear energy or the next mega-cap contenders. Remember, insider moves, like a major shareholder dumping $3.6 million in MNDY shares, are data points, not directives. Do your own homework. The market offers a spectrum from calculated stability to calculated moonshots. Your job is to decide where on that spectrum you belong. Here’s to a savvy 2026. – Kane Buffett

If you need to keep track of previous entries, try using a calculator with built-in history tracking for better accuracy.