The AI Reset, Regulatory Storms, and Retail Woes Navigating the Crosscurrents of Todays Market

Hey folks, Kane Buffett here. The market’s sending some seriously mixed signals right now. On one hand, we’ve got analysts buzzing about an “AI reset” at a tech giant poised for a comeback, whispering about the next stock to join the Nvidia-tier elite. On the other, regulatory hammers are falling on Big Tech across the pond, a retail darling is hitting unexpected turbulence, and old social media wounds are still fresh. It’s a classic market moment where separating noise from opportunity is everything. Let’s dive into the data, the drama, and the potential.

🔍 Curious about which stocks are making waves this week? Get the inside scoop on Biopharma Breakthroughs Why ADC Drugs and Clinical Pipeline Updates Signal Major Investment Opportunities for comprehensive market insights and expert analysis.

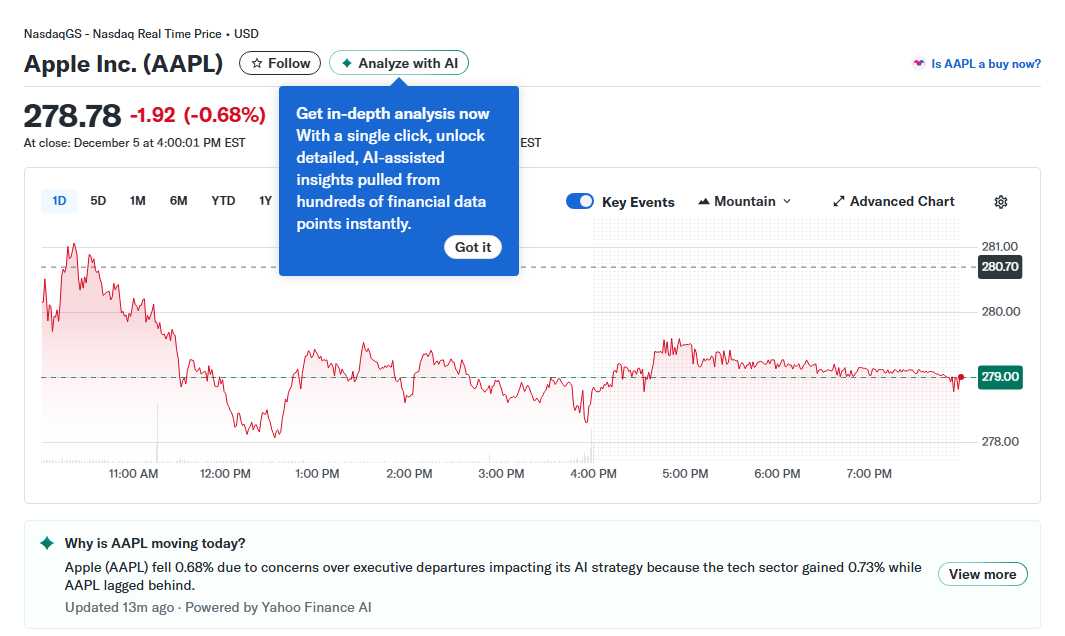

The Apple AI Pivot: A “Magnificent” Comeback in the Making? The chatter from Deepwater Asset’s Gene Munster is impossible to ignore. He’s framing Tim Cook’s strategic focus on Artificial Intelligence as a fundamental “reset” for Apple. The thesis is compelling: after a period where Apple seemed to lag in the generative AI arms race, a concentrated effort could reignite its growth engine and solidify its standing within the “Magnificent 7.” Munster isn’t just predicting a bounce; he’s forecasting Apple to be the top performer within that elite group moving forward. This speaks to a belief that Apple’s immense hardware ecosystem, brand loyalty, and services platform are an unmatched launchpad once a cohesive AI strategy is deployed. It’s a bet on execution turning potential into profit. Meanwhile, the hunt for the “next Nvidia” continues. The idea of an “unstoppable stock” on the cusp of joining that rarefied air taps into every investor’s dream. It suggests a company with a similarly unassailable moat, explosive growth trajectory, and a product or service that is becoming foundational to the future. While the specific stock isn’t named here, the narrative fuels excitement around the semiconductor, cloud infrastructure, and enterprise software sectors, where such titans are forged.

⚡ Don’t miss out on potential market opportunities - here’s the latest analysis of The AI Investment Tsunami How to Position Your Portfolio for the Next Decade (Featuring Apple, Amazon, and Bill Gates Picks) for comprehensive market insights and expert analysis.

Regulatory Crossfire: EU Fines and COPPA Violations While AI offers promise, regulation presents peril. The landscape for tech giants, particularly social media platforms, is getting frostier. The EU’s massive €140 million fine against Elon Musk’s X is a thunderclap, highlighting escalating tensions over content moderation and platform governance. This isn’t just a line item on a financial statement; it’s a political statement. Reports of U.S. political figures like JD Vance slamming the EU for “attacking US Big Tech” and defending free speech frame this as a transatlantic ideological battle. The “regulatory risk” premium for tech stocks, especially those reliant on user-generated content, just got more expensive. It forces investors to ask: what is the long-term cost of doing business in major markets? Simultaneously, a more insidious threat is detailed in Pixalate’s Q3 2025 report. The finding that over 1,200 APAC-registered mobile apps in major stores are violating U.S. child privacy law (COPPA), impacting 117 million child users, is staggering. This isn’t about geopolitics; it’s about fundamental compliance and ethical data handling. It exposes a massive vulnerability in the global app ecosystem and signals that privacy enforcement, particularly for young users, will be a relentless and costly frontier for any company in the digital space.

Searching for a fun and engaging puzzle game? Sudoku Journey with Grandpa Crypto’s story offers a unique twist on classic Sudoku.

Sector-Specific Struggles: When Even the Best Stumble Not all headwinds are macro or regulatory. Sometimes, great companies just hit a patch. Costco, the beloved warehouse retail king, is reportedly struggling. The reasons likely mirror broader consumer pressures: inflation fatigue squeezing discretionary spending, potential membership fee sensitivity, or increased competition. It’s a reminder that no business is immune to economic cycles, and even the most resilient models need to adapt. On the far more volatile end, Snap’s story is a cautionary tale of hype and reality. Down 91% from its all-time high, it embodies the brutal correction that can follow stratospheric valuations built on user growth without clear, profitable monetization. The question for 2026 isn’t just about a “snap back,” but whether it can fundamentally redefine its business model. For investors seeking stability amidst this noise, the advice often circles back to bedrock principles. Highlighting a low-cost, broad-market ETF like the Vanguard S&P 500 ETF as “one of the best ETFs to buy right now” is a tacit acknowledgment of the current complexity. It’s a recommendation for diversification and owning the entire market haystack instead of searching for a single, elusive needle.

Want to develop problem-solving and logical reasoning? Install Sudoku Journey with multiple difficulty levels and test your skills.

So, what’s the takeaway from this whirlwind? The market is in a state of transition. The AI revolution is entering its implementation phase, promising winners and losers. The regulatory environment is shifting from theoretical to painfully tangible, creating new risks. And individual company stories remind us that fundamentals always matter. My playbook? Stay anchored in quality. Apple’s AI pivot is worth watching closely as a potential mega-cap turnaround story. Use broad ETFs as your portfolio’s foundation. And treat regulatory news not as noise, but as a critical factor in assessing a tech stock’s long-term viability. The crosscurrents are strong, but for the disciplined investor, they also create the waves to ride. Stay sharp out there. - Kane Buffett

📚 Want to understand what’s driving today’s market movements? This in-depth look at The AI Investment Tsunami How to Position Your Portfolio for the Next Decade (Featuring Apple, Amazon, and Bill Gates Picks) for comprehensive market insights and expert analysis.