BioNTech Stock Building Momentum for Sustained Recovery After Pfizer Exit

Hey folks, Kane Buffett here. Today we’re diving deep into BioNTech (NASDAQ: BNTX), a stock that’s been generating significant buzz lately. With Pfizer looking to exit its BioNTech investment after their incredibly profitable COVID-19 vaccine partnership, and multiple analysts pointing to potential momentum building, there’s a compelling story unfolding here. As someone who’s tracked biotech stocks through multiple market cycles, I’m seeing patterns that suggest BioNTech might be positioning for something bigger than just pandemic recovery.

📱 Stay informed about the latest market movements and stock recommendations by exploring AI Revolution Fuels Market Rally Why S&P 500, TSMC and Nvidia Are Leading the Charge for comprehensive market insights and expert analysis.

The Pfizer-BioNTech relationship is undergoing a fundamental transformation that investors need to understand. Pfizer has officially announced plans to sell its 27.2% stake in BioNTech, valued at approximately $5.3 billion. This move comes after what can only be described as one of the most successful pharmaceutical partnerships in history, generating over $80 billion in combined revenue from their COVID-19 vaccine. While this might initially sound concerning, it’s important to recognize that this separation was inevitable as both companies return to their core strategic focuses. Pfizer needs to address its own post-pandemic challenges, including patent cliffs and the need to reinvest in its broader pipeline. For BioNTech, this represents an opportunity to demonstrate its independence and the value of its platform beyond the COVID collaboration. The market has actually responded relatively well to this news, understanding that while the formal partnership is changing, the companies will continue collaborating on COVID-19 vaccine development and commercialization through 2026. This gradual unwind rather than abrupt separation gives BioNTech time to establish its standalone investment thesis and deploy its massive cash reserves toward future growth initiatives.

When designing a brand palette, you can use a color picker that instantly shows RGB and HEX codes to streamline your workflow.

Now let’s talk about what really excites me about BioNTech - their clinical pipeline and technology platform. The company is aggressively advancing 19 ongoing clinical trials across multiple cancer types and infectious diseases. Their mRNA technology platform, which proved so effective against COVID-19, is now being deployed against much larger markets. In oncology, they have multiple candidates showing promise, including BNT316/ONC-416 (PROTAC) in advanced solid tumors and BNT323/DB-1303 in breast cancer. The infectious disease pipeline includes next-generation COVID-19 vaccines, seasonal flu candidates, and vaccines for shingles and tuberculosis. What’s particularly impressive is their flu vaccine candidate, which recently showed superior antibody responses compared to established market leaders in early trials. Management has reiterated their 2025 earnings guidance and continues to make incremental progress across their clinical portfolio. They’re sitting on approximately $15 billion in cash and equivalents, providing ample runway to fund operations through multiple pivotal trial readouts without needing additional financing. This financial strength, combined with their proven platform technology, creates a compelling risk-reward profile that’s uncommon in the biotech sector.

Stop recycling the same usernames—this nickname tool with category suggestions and favorites helps you create unique, brandable names.

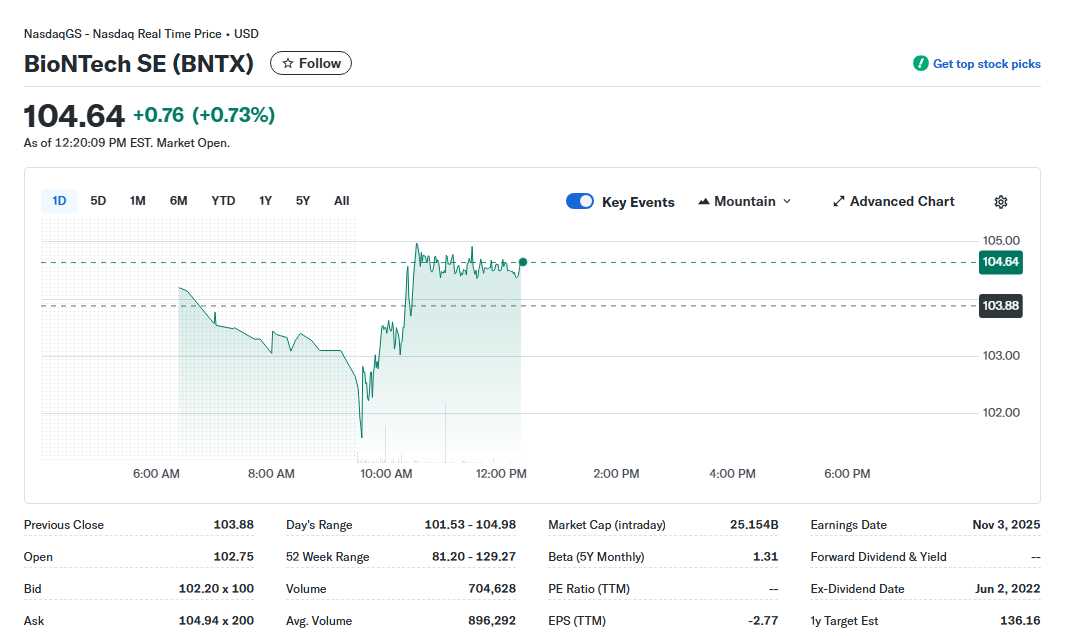

From an investment perspective, the analyst community is increasingly bullish on BioNTech’s prospects. According to recent data, the stock has received an average recommendation of “Moderate Buy” from brokerages, with several analysts raising their price targets. The consensus price target suggests meaningful upside from current levels, with some analysts particularly optimistic about the company’s oncology pipeline. The technical picture is also improving, with the stock showing signs of building momentum for a sustained recovery after underperforming during the post-pandemic normalization phase. Volume patterns indicate increasing institutional interest, and the stock has been forming a solid base around current levels. Valuation metrics are compelling when you consider the cash position represents a significant portion of the company’s market capitalization, meaning investors are getting the pipeline and platform technology at a substantial discount. The key catalysts to watch include clinical data readouts from their oncology programs, progress with their flu vaccine program, and the successful deployment of their cash into value-creating opportunities. For long-term investors, this could represent an attractive entry point into a company with transformative technology and multiple shots on goal.

Worried about memory loss? Enhance your cognitive skills with Sudoku Journey’s AI hint system and keep your mind active.

In conclusion, BioNTech represents a fascinating opportunity in the biotech space. The Pfizer exit, while headline-grabbing, actually creates clarity around BioNTech’s standalone story. With a robust pipeline, fortress balance sheet, and proven platform technology, the company is well-positioned to create significant long-term value. As always, do your own due diligence and consider your risk tolerance, but from where I sit, BioNTech looks like it’s building the foundation for its next major growth phase. Remember, successful investing isn’t about chasing yesterday’s winners - it’s about identifying tomorrow’s leaders today.

Ready to play smarter? Visit Powerball Predictor for up-to-date results, draw countdowns, and AI number suggestions.