Buffetts Google Bet & The AI Wave Your 2026 Tech Investing Blueprint

Howdy, folks. Kane Buffett here. For over a decade from this digital pulpit, we’ve talked about finding wonderful businesses at fair prices—the bedrock of lasting wealth. Today, we’re connecting the dots between a legendary investor’s masterstroke and the defining technological wave of our generation. The news is buzzing: Warren Buffett’s Berkshire Hathaway is sitting on massive, previously undisclosed gains from its early investment in Google (now Alphabet). This isn’t just a story about past success; it’s a powerful lesson in recognizing transformative, wide-moat businesses early. That same lens is crucial right now as we navigate the AI revolution. In this post, we’ll dissect Buffett’s Google play, analyze the current AI landscape from chips to software, and build a practical, long-term focused blueprint for investing in 2026 and beyond. Let’s dive in.

☁️ Want to stay ahead of the market with data-driven investment strategies? Here’s what you need to know about 2026 Investing Outlook AI Dominance, Market Momentum, and Billionaire Stock Picks for Long-Term Wealth for comprehensive market insights and expert analysis.

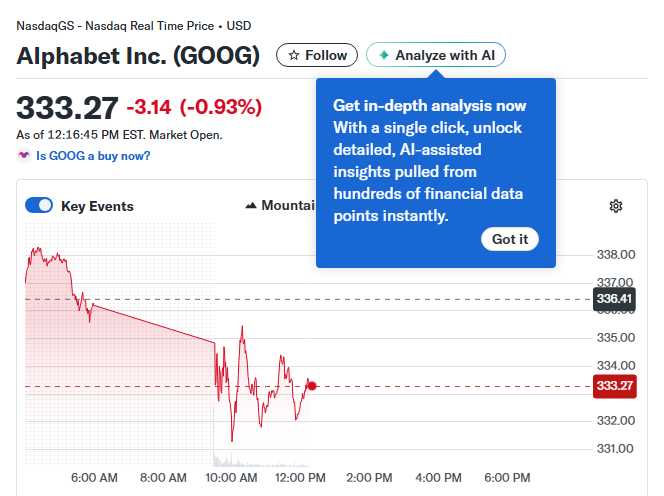

The Oracle’s Silicon Valley Validation: Buffett’s Google Gains The recent revelation that Warren Buffett’s Berkshire Hathaway secured enormous profits from an early stake in Google is a case study in timeless investing principles applied to modern tech. While the exact timing and size are private, the lesson is public and profound: Buffett identified a company with an unassailable competitive advantage—a “wide moat”—in its core search and advertising business. This moat generated immense, predictable cash flows. For years, critics said Buffett didn’t “get” tech. This move quietly proves otherwise. He invested in a business, not a ticker symbol—a company so essential it had become a utility of the information age. Fast forward to 2026, and Alphabet’s stock jumped 65% in 2025, driven by its AI advancements across Search, Cloud (Google Cloud Platform), and its Gemini models. The sentiment here is overwhelmingly Positive (8/10). It validates a long-term, quality-first approach in a sector known for hype. The sensitivity is moderate (6/10), as it’s a historical analysis of a proven success, not speculative future guidance. The AI Ecosystem: From Semiconductors to Shopping Carts The AI revolution is not a single stock story; it’s a layered ecosystem. At the hardware foundation sits Nvidia. Analysis shows it’s tightening its grip on the autonomous vehicle stack, providing the essential chips and software that will power self-driving cars. This expansion beyond data centers into robotics and automotive cements its dominance. Meanwhile, Microsoft is executing a brilliant “power without competition” strategy in retail, offering Azure cloud and AI tools (like Dynamics 365) that help retailers compete without Microsoft becoming a rival merchant. This partnership model builds a vast, sticky ecosystem. In application, see Wayfair’s new partnership with Google AI to create a smarter online buying experience for home goods, using generative AI for room design and product discovery. This shows AI moving into practical, revenue-driving consumer applications. The collective sentiment across these infrastructure and application plays is Positive (9/10). The sensitivity is high (8/10) as these are forward-looking, competitive analyses where execution risks and market shifts are constant factors.

💬 Real opinions from real diners — here’s what they had to say about Ai Ki Ya to see what makes this place worth a visit.

Navigating the AI Investment Landscape: Stocks, Strategies, and Sectors With the ecosystem mapped, how should an investor think about allocating capital? The sheer number of “Top AI Stock” lists can be paralyzing. Let’s synthesize the wisdom from multiple analyses. First, the Blockchain AI market is projected to reach a staggering USD 4,036.95 Million by 2033, driven by demand for secure and intelligent data processing. This convergence of technologies (like those being developed by some quantum computing firms) is a niche growth frontier. Speaking of quantum, for investors who believe in this next-decade compute revolution, stocks like IonQ (up 1200% but highly speculative) are pure-plays, alongside larger players integrating quantum research. The key is sizing such positions appropriately—they are lottery tickets, not bedrock holdings. For a $2,000 starter investment believing AI is the next wave, a low-cost ETF tracking a semiconductor or broad tech index is often smarter than picking a single volatile name. For a $10,000 sum, diversification across the stack is wise: a chunk in an enabler like Nvidia, a chunk in a platform/cloud like Microsoft or Alphabet, and a chunk in an application-focused software company. Several analyses suggest looking beyond Nvidia for value, highlighting other AI-centric semiconductor or software plays. The overarching sentiment for strategic guidance is Positive (7/10). The sensitivity is very high (9/10), as this involves specific allocation ideas, risk assessments, and predictions about highly volatile assets.

✨ For food lovers who appreciate great taste and honest feedback, 88 Hotdog & Juicy to see what makes this place worth a visit.

Building Your 2026 Plan: Discipline in the Age of Hype The final piece is the investor’s mindset. CES 2026 highlighted semiconductors and AI, but also a tightening regulatory environment around AI globally. This is a reminder that geopolitical and regulatory risks are part of the landscape. A successful 2026 investing plan is one you can stick with—it must be resilient. This means: 1) Base your portfolio on wide-moat, cash-flow giants (the Buffett/Google lesson). Think Alphabet, Microsoft. 2) Allocate a portion to high-growth potential in AI enablers and leaders, understanding their volatility. 3) Have an eye on exponential frontiers like Blockchain AI or Quantum Computing with very small, risk-capital positions. 4) Ignore the daily noise, focus on quarterly execution and long-term roadmaps. Predictions about stocks reaching $3 trillion market caps (like those for certain AI leaders) are possible, but they are outcomes of business excellence, not targets to chase. The sentiment here on planning and discipline is Positive (8/10). The sensitivity is moderate (5/10), as it advocates for general principles rather than specific, time-sensitive trades.

Curious about the next winning numbers? Powerball Predictor uses advanced AI to recommend your best picks.

So, what’s the takeaway from Buffett’s Google score and the AI frenzy? It’s that the core rules haven’t changed. Find exceptional businesses with durable advantages that are leveraging—or building—the next wave. AI is that wave, touching everything from how we search to how we shop and drive. Your job isn’t to bet on every ripple, but to build a portfolio anchored by the companies building the strongest dams and canals. Be disciplined, be diversified, and think in years, not days. The market will have its ups and downs—2026 will be no different—but a plan built on this logic can see you through. Thanks for reading, and as always, do your own homework. This is Kane Buffett, signing off.

💰 Don’t let market opportunities pass you by - here’s what you need to know about Teslas EV Crown Slips A Deep Dive into BYDs Rise, Market Sentiment, and What It Means for Investors for comprehensive market insights and expert analysis.