Buffetts Farewell, The Magnificent Seven, and Your 2026 Portfolio A Strategic Blueprint

Hey folks, Kane Buffett here. As we stand at the precipice of 2026, the market is buzzing with a seismic shift: the legendary Warren Buffett is officially stepping back from Wall Street. This isn’t just an end of an era; it’s a clarion call for every investor to re-evaluate their core principles. In this post, we’ll dissect what Buffett’s departure means, harness the enduring power of his teachings, and combine it with the explosive growth potential of today’s tech titans and ETFs. Drawing from multiple deep-dives and analyses, I’ll provide a concrete blueprint for building a resilient and growth-oriented portfolio for the coming year and beyond. Let’s dive in.

💰 Don’t let market opportunities pass you by - here’s what you need to know about The 2026 Investors Playbook AI, Tech Titans, and the Next Big Trends for comprehensive market insights and expert analysis.

The End of an Era: Buffett’s Wall Street Farewell and Its Implications

The news of Warren Buffett’s formal departure from Berkshire Hathaway’s daily Wall Street operations marks a historic moment. The articles highlight his final shareholder letter, which is less about specific stock picks and more a masterclass in timeless investing philosophy: patience, understanding your investments, and focusing on wonderful businesses at fair prices. Buffett’s legacy is cemented in four core Berkshire holdings that he highlighted as exemplary: a massive insurance operation, the BNSF railroad, Berkshire Hathaway Energy, and Apple. These aren’t flashy tech bets (Apple being the exception he embraced); they are wide-moat, cash-generating fortresses. The takeaway for us? The “Buffett way” isn’t retiring. Our 2026 strategy must start with this foundation—seeking businesses with durable competitive advantages, strong management, and the ability to compound value over decades. It’s about quality first. The emotional sentiment here is profoundly respectful and slightly nostalgic, but the practical advice is empowering: the principles remain, even as the icon steps aside.

Need a daily brain workout? Sudoku Journey supports both English and Korean for a global puzzle experience.

The Modern Engines: Magnificent Seven Stocks and Growth ETFs for Explosive Potential

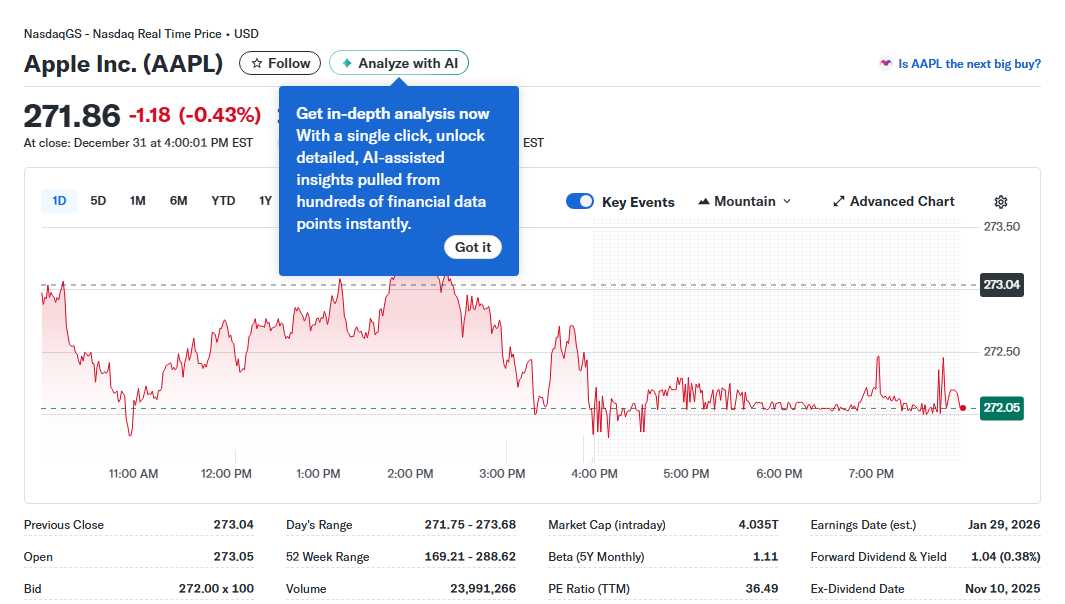

While we honor the value foundation, our portfolio needs growth engines. This is where the “Magnificent Seven” (Apple, Microsoft, Nvidia, Amazon, Tesla, Meta, Alphabet) and targeted Growth ETFs come into play. Analysis ranks these giants, with Nvidia, Microsoft, and Amazon often cited as top picks for 2026 due to their entrenched positions in AI, cloud computing, and e-commerce. However, the key insight is balance. Not all seven are equal at any given time; diversification within this tech elite is wise. Furthermore, for investors (especially those on platforms like Robinhood looking for long-term holds), integrating these stocks with ETFs is a brilliant move. Two ETFs stand out: the Vanguard Growth ETF (VUG) and the iShares Russell 1000 Growth ETF (IWF). For an initial $1,000, these funds offer instant, low-cost diversification across the very growth companies driving the market, including the Magnificent Seven. They are “buy and hold forever” vehicles that automate the process of owning tomorrow’s winners. This approach combines Buffett’s hold-forever mentality with exposure to high-growth sectors.

Looking to share a URL or message quickly? Use this QR code creator with size and design controls to generate and download your code instantly.

Spotify as a Millionaire-Maker? Building a Complete 2026 Action Plan

Let’s talk about a specific potential high-reward play: Spotify. Could it be a multimillionaire-maker stock? The analysis suggests it has the hallmarks: a massive, global user base, pricing power, a path to sustained profitability, and a platform that is becoming entrenched in daily life. It’s a bet on the future of audio. This is the type of speculative-but-fundamentally-sound growth stock that can complement the core holdings discussed earlier. So, what’s the 2026 action plan? 1. Anchor your portfolio with Buffett-esque, wide-moat ideas (consider ETFs that mimic this style or the stalwarts he loved). 2. Allocate a core growth segment to a basket of the Magnificent Seven stocks or, more simply, to the VUG or IWF ETFs. 3. Consider satellite “potential millionaire-maker” positions in companies like Spotify that have scalable models and large addressable markets. 4. Be mindful of the “January Effect”—historical trends and current analyses point to stocks like Palo Alto Networks, Uber, and others being poised for a strong start to 2026. Use market dips as opportunities to build positions in your planned portfolio. The strategy is about layered diversification: stability from value, growth from tech giants and ETFs, and moonshot potential from select disruptors.

Take your Powerball strategy to the next level with real-time stats and AI predictions from Powerball Predictor.

The transition from the Buffett era doesn’t leave us adrift; it challenges us to internalize his wisdom and apply it to a new market landscape. By building a portfolio with a bedrock of quality, a core of targeted growth (via magnificent stocks and ETFs), and a carefully chosen dash of high-potential speculation, you position yourself not just for 2026, but for the next decade. Remember, investing is a marathon. Stay disciplined, keep learning, and let your portfolio compound. This is Kane Buffett, signing off. Here’s to your investing success in the new year.

💡 Want to understand the factors influencing stock performance? This analysis of Investor Alert Navigating the FCX and CPNG Lawsuits Amid a Record Market Rally for comprehensive market insights and expert analysis.