Navigating Market Volatility Costco, Bear Market Buys, and Smart Strategies for Retirees

Hey folks, Kane Buffett here. The market’s been on a wild ride lately, hasn’t it? Between the chatter about bear markets and questions about where to put your hard-earned cash, especially in retirement, it’s easy to feel a little lost. I’ve been digging into the latest news and analysis, and today we’re going to tackle a few key topics head-on: what’s really going on with a stalwart like Costco, how to spot opportunities when others are fearful, and whether retirees should be hitting the panic button. We’ll also compare some essential ETFs and look at specific stocks making waves. Let’s cut through the noise and find some clarity.

📚 Want to understand what’s driving today’s market movements? This in-depth look at The AI Gold Rush Billionaires Picks, Trillion-Dollar Predictions, and Stocks to Buy Now for 2026 for comprehensive market insights and expert analysis.

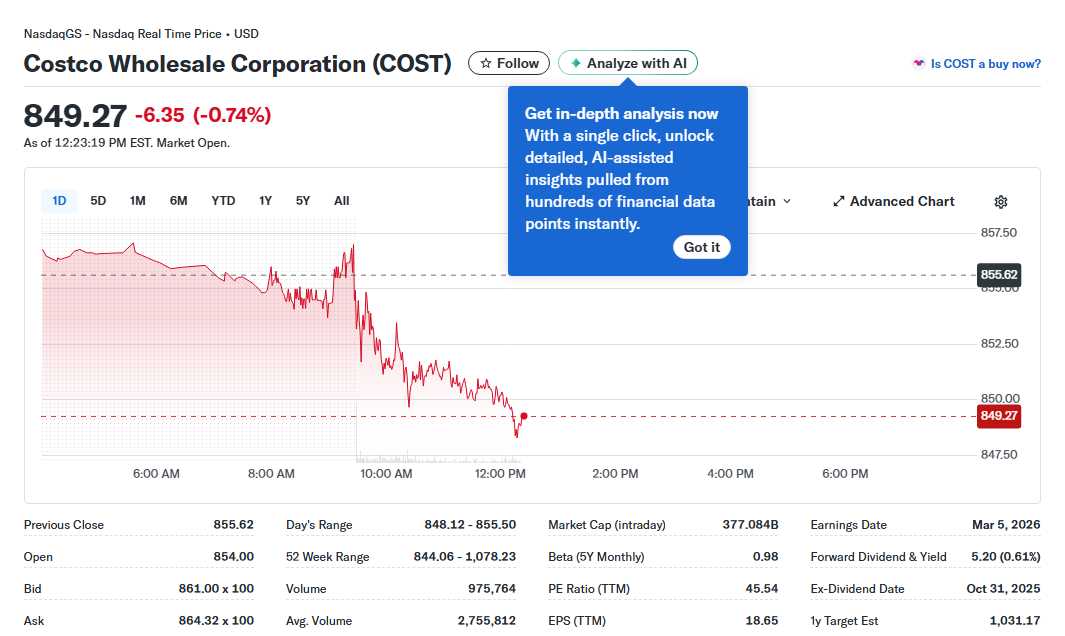

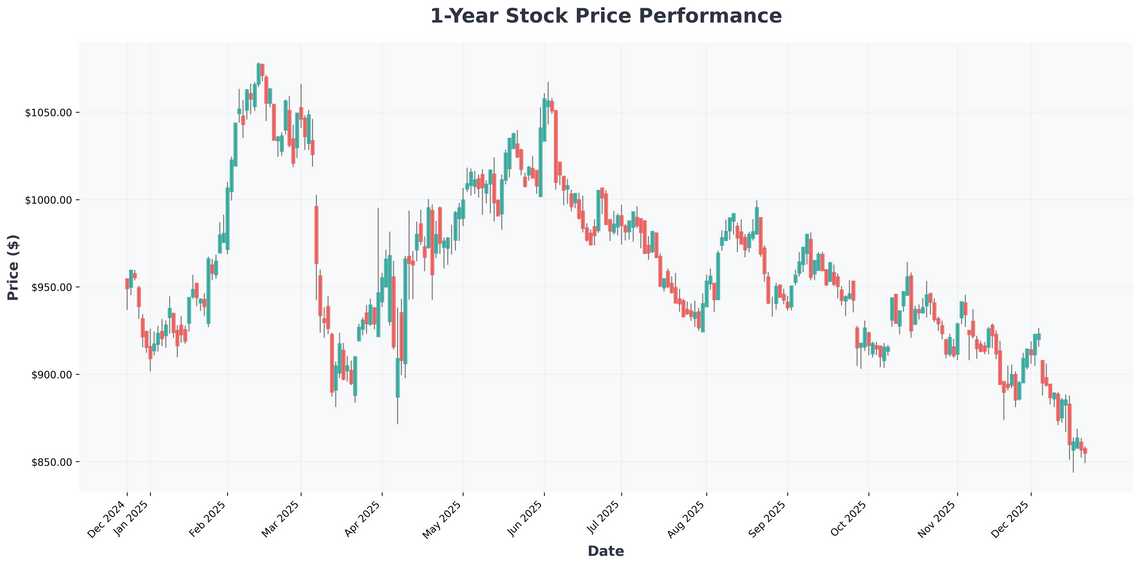

What’s the Real Story with Costco Stock? Let’s start with a fan favorite. Costco Wholesale has long been a darling of both consumers and investors, known for its loyal membership base, rock-solid business model, and consistent execution. Recent analysis suggests the stock has faced some pressure, but context is everything. The broader market’s volatility and concerns about consumer spending have weighed on many retailers. However, Costco’s fundamentals remain incredibly strong. Its subscription-based revenue provides a predictable cash flow stream that’s the envy of the industry, and its ability to maintain low prices while delivering value keeps customers coming back. For long-term investors, periods of price weakness in a company with such a durable moat can represent a buying opportunity, not a reason to flee. The key is to separate short-term market sentiment from long-term business performance. Costco isn’t a flashy tech stock; it’s a compounding machine built for steady growth through economic cycles.

☁️ Want to stay ahead of the market with data-driven investment strategies? Here’s what you need to know about Beyond NVIDIA AI, Diversification, and the Forces Shaping Your 2026 Portfolio for comprehensive market insights and expert analysis.

Bear Market Gems and Retiree Dilemmas. When the market turns south, fear dominates the headlines. But for the disciplined investor, bear markets are where fortunes can be built. The question isn’t “Should I sell everything?” but “Where are the values hiding?” This could mean looking at high-quality companies that have been unfairly punished alongside the broader market. Think of businesses with strong balance sheets, essential products or services, and the ability to generate cash in good times and bad. This leads directly to the retiree’s quandary. The instinct to “pull money out of the stock market” during downturns is powerful and emotionally driven. However, history shows that market timing is a loser’s game. For retirees relying on their portfolios for income, a sudden, full exit locks in losses and jeopardizes long-term purchasing power against inflation. A smarter strategy involves having a well-allocated portfolio before the storm hits—one that includes bonds, dividend-paying stocks, and other income sources to provide stability. The goal isn’t to avoid all volatility but to manage it so you don’t have to make panic-driven decisions.

For marketing materials or event flyers, a QR code maker that supports logo embedding and color customization can add a professional touch.

ETF Showdown: VDC vs. FSTA and Stock Deep Dives. For those seeking exposure to stable sectors, consumer staples are a classic defensive play. Two popular ETFs, the Vanguard Consumer Staples ETF (VDC) and the Fidelity MSCI Consumer Staples Index ETF (FSTA), offer slightly different paths. VDC, with its razor-thin expense ratio, tracks the CRSP US Consumer Staples Index, offering a pure, low-cost play. FSTA tracks the MSCI USA IMI Consumer Staples Index and may have a slightly different composition. The choice often boils down to specific holdings preference and cost structure—both are excellent core holdings for the defensive portion of a portfolio. Now, let’s look at two specific stocks. Kohl’s has been a story of struggle, with questions about its relevance in the modern retail landscape. Its performance for investors has been poor, highlighting the risks of turnaround plays that don’t turn. On the flip side, the advice to “forget Kraft Heinz” in favor of a more “unstoppable” consumer staples stock is telling. It points to the importance of quality within a sector. Kraft Heinz carries significant debt and has faced operational challenges, while other staples companies continue to grow dividends and market share steadily. This contrast underscores that not all stocks in a “safe” sector are created equal. Due diligence on financial health and competitive positioning is non-negotiable.

Never miss a Powerball draw again—track results, analyze stats, and get AI-powered recommendations at Powerball Predictor.

So, where does this leave us? In times of uncertainty, the principles of sound investing don’t change; they just become more important. Focus on business quality over stock price chatter. Use tools like ETFs to get efficient, diversified exposure to solid sectors. And for retirees, build a resilient plan that can weather storms so you can sleep at night. The market’s mood will swing, but your strategy shouldn’t. Stay disciplined, stay focused, and keep compounding. This is Kane Buffett, signing off. Until next time.

For marketing materials or event flyers, a QR code maker that supports logo embedding and color customization can add a professional touch.