Beyond NVIDIA AI, Diversification, and the Forces Shaping Your 2026 Portfolio

Hey folks, Kane Buffett here. A decade ago, dropping $500 into NVIDIA seemed like a bet on a graphics card company. Today, it’s the poster child for the AI revolution and a life-changing investment. That story captivates us, but as we stare down 2026, the real question isn’t about finding the next NVIDIA—it’s about building a resilient portfolio that can weather regulatory storms, tap into global growth, and profit from the entire AI ecosystem, not just the giants. Let’s dive into the data, the trends, and the smart money moves for the coming year.

📚 Want to understand what’s driving today’s market movements? This in-depth look at The AI Chip Race Heats Up AMDs Bold Prediction, NVIDIAs Green Light, and Why TSMC Might Be the Ultimate Play for comprehensive market insights and expert analysis.

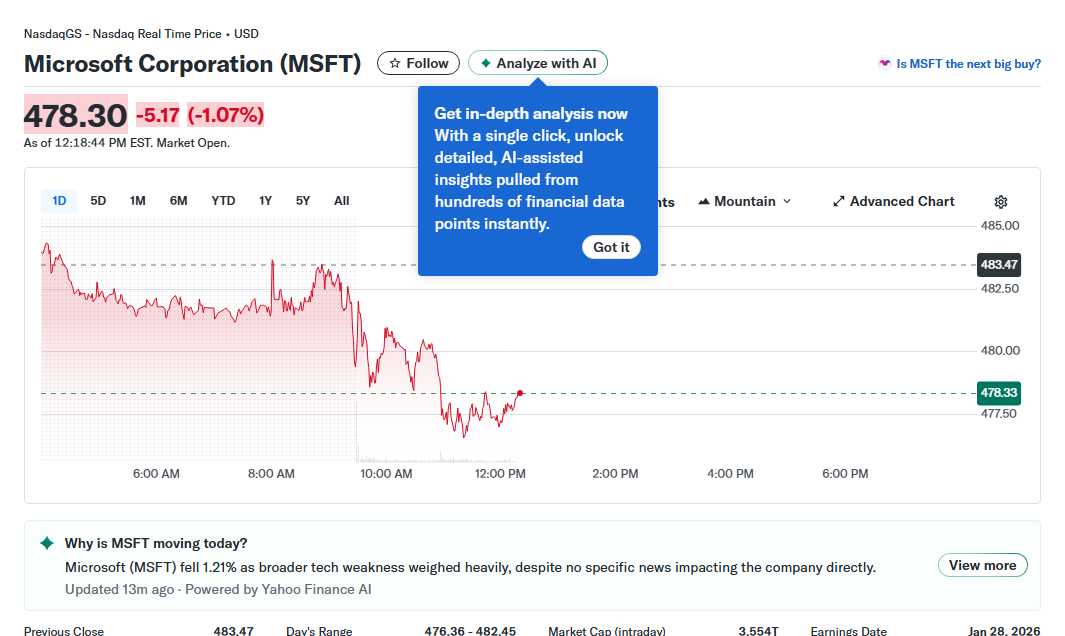

The AI Gold Rush: It’s Not Just About the Miners The NVIDIA story is legendary. A $500 investment ten years ago would be worth over $1.8 million today. That’s the power of being at the epicenter of a technological paradigm shift. But the game is evolving. As Benzinga points out, with giants like Meta and Microsoft pouring hundreds of billions into AI capital expenditure (Capex), the real opportunity for 2026 might lie in the “shovel sellers.” Think semiconductor equipment manufacturers, specialized data center infrastructure providers, and companies like Augment Code, which just unveiled an AI agent to eliminate “review debt” for developers. This company exemplifies the “picks and shovels” play—providing the essential tools (in this case, software efficiency) that enable the broader AI and tech boom. While the headlines follow the Nadellas and Adanis of the world (their recent meeting highlighting the complex intersection of global tech and geopolitics), savvy investors are looking at the entire supply chain.

📍 One of the most talked-about spots recently is Parlor Pizza Bar - River North to see what makes this place worth a visit.

Diversification 2026: Beyond the S&P 500 Chasing single stocks is thrilling, but for most, it’s not a strategy. Here’s where ETFs come in. A Vanguard ETF is predicted to potentially “crush” the S&P 500 in 2026, likely referring to funds heavy on the innovative, growth-oriented sectors currently driving markets. Meanwhile, SPDR’s global ETF offerings provide broader diversification than country-specific funds, crucial as different regions cycle in and out of favor. This isn’t just about stocks; it’s about macroeconomic forces. CoBank’s 2026 report outlines key trends shaping the U.S. rural economy—from energy transitions to supply chain realignment. These forces impact agriculture, renewables, and infrastructure stocks, sectors often underrepresented in tech-heavy portfolios. True diversification means blending high-growth AI “shovels” with steady, foundational assets exposed to these broader economic currents.

Want to keep your mind sharp every day? Download Sudoku Journey with AI-powered hints and an immersive story mode for a smarter brain workout.

Navigating the Headwinds: Regulation and New Frontiers No growth story is without its risks. Google is facing a fresh EU antitrust probe focusing on YouTube rules and AI model training data. This regulatory crackdown is a stark reminder that the legal and competitive landscape for big tech is still being written, posing a potential headwind. On the flip side, new frontiers are exploding. The global voice assistant market is projected to reach a staggering $59.9 billion by 2033, as noted by Astute Analytica. This isn’t just about smart speakers; it’s about voice-enabled everything—cars, appliances, enterprise software. This creates a ripple effect, benefiting semiconductor firms, software platforms, and consumer device makers. The investment landscape for 2026 is a chessboard: you must position for massive growth (AI, voice AI) while strategically guarding against knights (regulation) and patiently developing your bishops (diversified, foundational holdings).

Want smarter Powerball play? Get real-time results, AI-powered number predictions, draw alerts, and stats—all in one place. Visit Powerball Predictor and boost your chances today!

So, what’s the play for 2026? Don’t just hunt for the next 100-bagger. Build a fortress. Allocate a core to a diversified, low-cost ETF strategy that includes global and sector-specific funds. Use a satellite portion to target the enablers of the AI revolution—the “shovel stocks” in software, semiconductors, and infrastructure. Keep a keen eye on regulatory developments, as they will create volatility and opportunity. And always, always pay attention to foundational economic shifts, like those in the rural economy, that drive long-term value. This is how you build wealth that lasts, not just chase headlines. Stay sharp out there. - Kane Buffett

Whether it’s for gaming, YouTube, or online forums, this customizable nickname generator gives you options that match your style.