Why Coca-Cola and Dividend Stocks Like J&J Snack Foods Remain Timeless Investments in 2026

Hey fellow investors! Kane Buffett here. As we approach 2026, I’m seeing incredible opportunities in reliable dividend stocks that have stood the test of time. Today, we’re diving deep into Coca-Cola’s enduring appeal and examining why consistent dividend payers like J&J Snack Foods should be on every serious investor’s radar. Meanwhile, the tech world continues to evolve with events like the Artist and the Machine Summit pushing boundaries in AI - but should you bet your portfolio on this volatility?

📋 For anyone interested in making informed investment decisions, this thorough examination of AI Investment Tsunami Navigating the $40B Compute Boom and Market Volatility for comprehensive market insights and expert analysis.

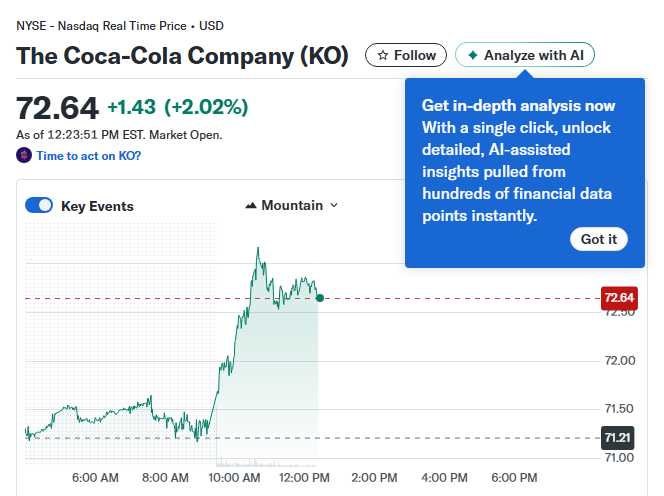

Let’s start with the king of consistency: Coca-Cola. According to recent analysis from The Motley Fool, there are four compelling reasons to buy Coca-Cola stock as if there’s no tomorrow. First, the company’s global brand recognition is virtually unmatched - you’d be hard-pressed to find anyone worldwide who doesn’t recognize that iconic red logo. Second, their dividend track record is legendary, having paid consistent dividends for decades and raised them for 61 consecutive years. That’s the kind of reliability that creates millionaires over time. Third, their global distribution network creates an insurmountable moat that competitors simply can’t replicate. Fourth, management’s strategic focus on expanding into healthier beverage options and emerging markets positions them perfectly for future growth. The numbers don’t lie: if you had invested $10,000 in Coca-Cola stock, the power of compounding dividends and steady appreciation could realistically put you on the path to millionaire status over a long-term horizon. This isn’t speculation - it’s mathematical certainty when you combine their 3%+ dividend yield with consistent annual increases and reinvestment.

🌮 Curious about the local dining scene? Here’s a closer look at RYUU Asian BBQ & Sushi to see what makes this place worth a visit.

Now let’s examine another dividend stalwart: J&J Snack Foods. The company just announced their quarterly cash dividend, maintaining their reputation as a reliable income stock. While they might not have Coca-Cola’s global scale, J&J Snack Foods represents the type of steady, predictable business that forms the backbone of a solid portfolio. They operate in the essential food sector, providing snacks to theaters, schools, and retail locations across America. This business model generates consistent cash flow regardless of economic conditions - when times are good, people buy snacks; when times are tough, people still buy affordable treats. Their recent dividend announcement reinforces management’s commitment to shareholder returns. For income-focused investors, stocks like J&J Snack Foods provide that beautiful combination of moderate yield and stability that can smooth out portfolio volatility while generating reliable passive income. In a market obsessed with tech and AI, it’s easy to overlook these “boring” businesses - but that’s often where the real wealth gets built.

📋 For anyone interested in making informed investment decisions, this thorough examination of Warren Buffetts AI Bet Why Alphabet Could Dominate 2026 for comprehensive market insights and expert analysis.

Meanwhile, the tech sector continues its rapid evolution with events like the Artist and the Machine announcing their May 2026 New York Summit following their groundbreaking Los Angeles event. This summit focuses on the intersection of artificial intelligence and creative industries, representing the cutting edge of technological innovation. While fascinating from a technological perspective, investors need to approach these emerging AI opportunities with caution. The potential is enormous, but so is the volatility and uncertainty. For every AI success story, there are dozens of companies that fail to monetize their technology. This doesn’t mean avoiding tech entirely, but rather understanding the difference between speculation and investment. The steady cash flows of Coca-Cola and J&J Snack Foods may not generate the excitement of AI breakthroughs, but they provide the foundation upon which you can allocate a smaller portion of your portfolio to higher-risk, higher-reward opportunities.

🌮 Curious about the local dining scene? Here’s a closer look at Cellar Door Provisions to see what makes this place worth a visit.

So what’s the takeaway from all this? As we look toward 2026, the timeless wisdom of investing in quality companies with strong dividends remains as relevant as ever. Coca-Cola continues to demonstrate why it’s a cornerstone of any serious portfolio, while reliable dividend payers like J&J Snack Foods provide the stability that every investor needs. The AI revolution represented by events like Artist and the Machine is exciting and worth monitoring, but building lasting wealth comes from the consistent, boring companies that generate real cash flow year after year. Remember: it’s not about chasing the next big thing - it’s about owning quality businesses that pay you to own them. Until next time, keep investing wisely!

📍 One of the most talked-about spots recently is Mr Churro to see what makes this place worth a visit.