Navigating the Crossroads AI Regulation, Buffetts Moves, and the ETFs Poised to Win in 2026

Hey folks, Kane Buffett here. The market’s sending mixed signals as we barrel toward the new year. On one hand, we’ve got regulatory storm clouds gathering over tech giants, and on the other, explosive growth forecasts for AI and automation that make any investor’s mouth water. It’s a classic tug-of-war between risk and opportunity. I’ve been sifting through the latest news—from Westpac’s CEO calling out social media to fresh predictions on Vanguard ETFs—to separate the noise from the actionable intelligence. Let’s dive into the three major themes shaping the investment landscape for 2026.

💰 Don’t let market opportunities pass you by - here’s what you need to know about The AI & Semiconductor Supercycle Navigating the Boom, the Risks, and the Next Big Bets for comprehensive market insights and expert analysis.

The Regulatory Squeeze: A New Cost of Doing Business for Big Tech. The “move fast and break things” era is facing a reckoning. Two major stories highlight this pressure. First, Westpac’s CEO is publicly demanding that Meta and other social media platforms take “tougher action” against financial fraud proliferating on their networks. This isn’t just a PR statement; it’s a signal from the financial sector that the liability for scams is increasingly being placed at the feet of the platforms that host them. This could foreshadow stricter regulations or costly compliance mandates for social media companies. Simultaneously, Google is facing a fresh EU antitrust probe focusing on YouTube’s rules and its use of data for AI model training. This is part of a broader, sustained crackdown by European regulators on Big Tech’s data and market dominance. For investors, this means the regulatory overhang on tech stocks, particularly those reliant on advertising and user data (like Meta and Google), is not going away. It introduces a layer of uncertainty and potential for margin compression as legal costs rise and business practices are forced to change. The investment takeaway? Factor in “regulatory risk” as a tangible line item when evaluating these cash-generating behemoths.

Curious about the next winning numbers? Powerball Predictor uses advanced AI to recommend your best picks.

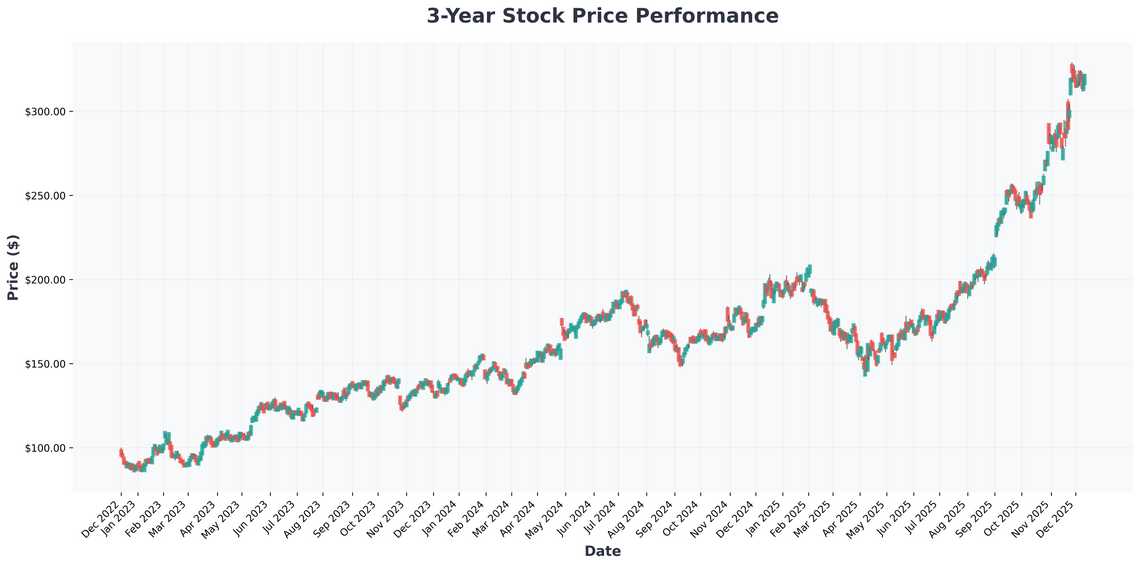

Buffett’s Discipline and the Search for Value in a Frothy Market. In a market obsessed with AI and hyper-growth, Warren Buffett’s actions remain a masterclass in disciplined capital allocation. News that he sold over a billion dollars in stock from the Berkshire Hathaway portfolio is a headline that should make every investor pause. While the specific stocks weren’t named in the linked article, a sale of this magnitude from the Oracle of Omaha is often interpreted as a signal that he finds fewer compelling bargains in the market. It’s a reminder of his core principle: “Be fearful when others are greedy.” This action stands in stark contrast to the frenzy around certain tech sectors. It brings us to a critical question raised by other analysis: Is the AI boom becoming a bubble? Some commentators are rightly urging caution, noting that while the AI transformation is real, valuations for many players have soared to levels that demand perfection. This doesn’t mean avoid AI, but it underscores the need for selectivity. Similarly, the piece asking if you should worry about NVIDIA’s AI market share highlights the risks of single-stock concentration in a rapidly evolving, competitive field. The counterpoint to this froth can be found in analyses of stocks like Adobe, presented as a potential “value-growth” hybrid after a pullback, and UiPath, a leader in Robotic Process Automation (RPA) that is surging as businesses prioritize efficiency. The lesson here is that Buffett-esque value can still be found, but it may require looking at profitable companies in adjacent tech spaces (like automation) that are essential but less hyped than pure-play AI.

Need a daily brain game? Download Sudoku Journey with English support and start your mental fitness journey today.

The Growth Engines: ETFs, AI Sub-Sectors, and Quantum Leaps. So where should growth-oriented investors look? The analysis presents compelling ideas. First, a bold prediction that a specific Vanguard ETF will crush the S&P 500 in 2026. While the article doesn’t name the ETF here, such predictions typically focus on funds weighted toward sectors poised for outperformance, like technology or healthcare. This is a lower-risk way to bet on a thematic shift. Second, the growth trajectories of specific AI sub-sectors are staggering. The voice assistant market is projected to reach US$59.9 billion by 2033, driven by proliferation across devices. Even more eye-popping is the global AI-powered humanoid robots market, expected to hit $7.73 billion as engineering improves. These aren’t sci-fi; they’re investable themes with real revenue projections. Third, look for the “picks and shovels” plays beyond the obvious names. An article on Broadcom questions if its upcoming Q4 earnings can spark another rally, highlighting its critical role in AI semiconductor infrastructure. Another makes a prediction for a stock to be the biggest quantum computing winner, pointing to the next frontier beyond classical AI. Meanwhile, a stock like Alibaba inching higher on specific corporate developments shows that even beaten-down segments can have catalysts. The path for 2026 is about balancing the macro (regulation, Buffett’s cues) with targeted micro bets on the undeniable, data-backed growth in automation, AI infrastructure, and next-generation computing.

Make every Powerball draw smarter—check results, get AI number picks, and set reminders with Powerball Predictor.

The market for 2026 is setting up as a tale of two worlds. One is constrained by regulation and valuation concerns, urging the caution that Buffett is modeling. The other is bursting with secular growth trends in AI, voice tech, and robotics that promise to reshape industries. The savvy investor’s strategy should be bifurcated: anchor your portfolio with disciplined, value-aware choices (whether through selective stocks or a potentially outperforming ETF), and allocate a portion to targeted growth in the most credible, high-potential sub-sectors of tech. Don’t get swept away by the hype, but don’t ignore the monumental shifts happening either. Stay sharp, do your homework, and as always, invest for the long haul. This is Kane Buffett, signing off. Let’s navigate this together.

⚡ Don’t miss out on potential market opportunities - here’s the latest analysis of The AI Investment Crossroads Googles EU Woes, 2026 Split Candidates, and the Real Capex Winners for comprehensive market insights and expert analysis.