Navigating the Crosscurrents AI Frenzy, Market Resilience, and My Top Picks for 2026

Hey folks, Kane Buffett here. As we wrap up 2025 and peer into 2026, the market is sending some fascinating, mixed signals. On one hand, we’ve got an AI revolution that’s reshaping entire industries and supply chains, creating unprecedented demand. On the other, macroeconomic forces like strong GDP and a patient Fed are keeping a lid on runaway euphoria. It’s a classic tug-of-war between explosive sector-specific growth and broader market discipline. In this post, I’ll break down the key themes from the latest news, analyze the sentiment, and share where I see the most compelling opportunities—and risks—as we head into the new year. Buckle up.

⚡ Don’t miss out on potential market opportunities - here’s the latest analysis of 2026 Stock Market Outlook AI Dominance, Bull Run Continuation, and My Top Picks for the New Year for comprehensive market insights and expert analysis.

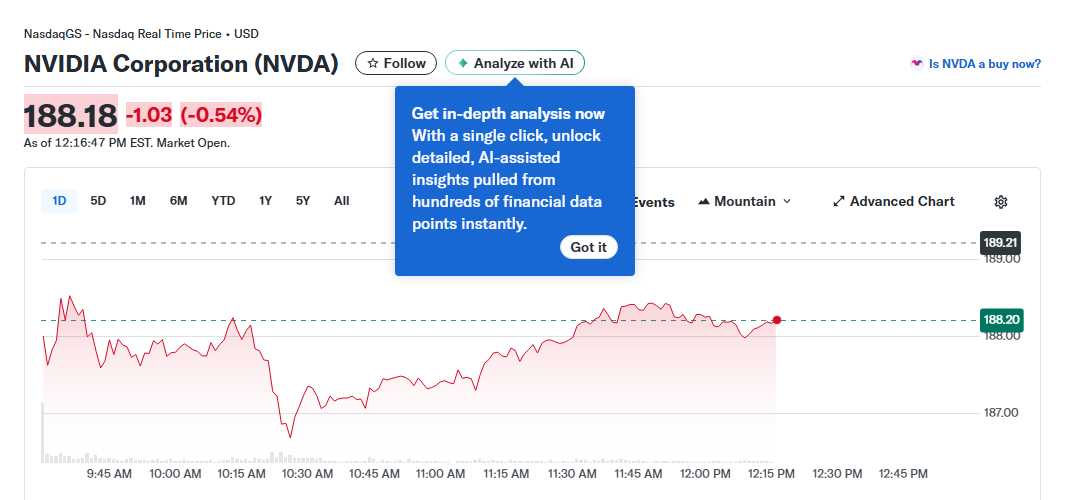

The AI Engine: Demand, Supply, and Geopolitical Ripples The visit of NVIDIA’s CEO Jensen Huang to Taiwan, specifically to TSMC facilities, isn’t just a corporate meet-and-greet; it’s a stark indicator of the white-hot demand for advanced AI chips. This “factory frenzy” underscores a critical bottleneck: semiconductor manufacturing capacity. The AI boom, led by NVIDIA’s hardware, is straining global supply chains, making foundries like TSMC more strategically vital than ever. This isn’t just about one company; it’s about the entire infrastructure supporting artificial intelligence. Furthermore, analysts are pointing to specific AI infrastructure stocks that have seen steep pullbacks as being “significantly underpriced,” suggesting a potential buying opportunity for those who believe the AI megatrend is far from over. The sentiment here is overwhelmingly bullish on the long-term AI thesis, but it’s tempered by supply chain and execution risks. Separately, the buzz around quantum computing stocks, with Citron’s Andrew Left highlighting one as “real and set to pop,” adds another layer of speculative, high-growth potential to the tech landscape. The message is clear: innovation in compute power, whether classical (AI chips) or next-gen (quantum), remains a primary driver of market narratives and valuations.

Take your Powerball strategy to the next level with real-time stats and AI predictions from Powerball Predictor.

The Macro Backdrop: Strong Economy vs. Fed Patience While tech sizzles, the broader market, exemplified by the S&P 500, is holding near record highs but facing a headwind from robust economic data. Strong GDP growth is ironically cooling hopes for early Federal Reserve interest rate cuts. The market’s “bad news is good news” dynamic (where weak data prompts hopes for Fed easing) is being challenged. Instead, we have good economic news potentially delaying monetary policy support. This creates a fascinating tension. Falling market volatility, as noted in recent sessions, is supporting a “risk-on” holiday trade, but the underlying concern is that a too-strong economy could keep rates higher for longer, which eventually pressures valuations. Historical analysis suggests the bull market could indeed “roar higher in 2026,” but its path will likely be dictated by this delicate dance between economic strength and central bank policy. Investors must now weigh stellar corporate earnings (driven by sectors like AI) against the potential for a less accommodative monetary environment.

🔎 Looking for a hidden gem or trending restaurant? Check out La Esquina to see what makes this place worth a visit.

Investment Vehicles and Stock-Specific Plays for 2026 This environment calls for a strategic approach. For those seeking diversified exposure, the debate between ETFs is hotter than ever. Should you chase tech-heavy growth with QLD (2x Nasdaq-100) or SPXL (3x S&P 500), or prefer the stability of SPY? Does QQQ’s tech focus outweigh SPY’s broad stability? Comparisons between VUG (growth) and VOO (S&P 500) highlight trade-offs between potential gains, dividends, and fees. For direct tech exposure, the choice between XLK and IYW, or understanding ETFs like FTEC, is crucial. Beyond ETFs, specific stocks are in focus. The “Magnificent Seven” conversation is evolving, with predictions about which companies (like Broadcom) could next join the $3 trillion club. In the AI realm, one stock is repeatedly called a “must-own,” with a specific prediction of a 47% surge in 2026. Micron Technology is highlighted for its potential to continue soaring, benefiting from the memory demands of AI. Outside pure tech, a nuclear energy stock is presented as a potential multi-decade, explosive growth story. Meanwhile, classic growth stalwarts like Alphabet and Amazon are being compared for their 2026 potential. The overarching advice from many quarters? Look beyond short-term noise like tariff talks or bubble fears and focus on durable, long-term trends, holding “monster stocks” for the next five years.

Searching for a fun and engaging puzzle game? Sudoku Journey with Grandpa Crypto’s story offers a unique twist on classic Sudoku.

So, what’s the takeaway as we stand on the brink of 2026? We are in a market of selective exuberance. The AI revolution is real and creating tangible, massive demand, but it exists within a macroeconomic framework that is becoming less forgiving. Your strategy should reflect this duality. Consider core positions in broad-market or tech ETFs for stability and growth, but don’t shy away from targeted, high-conviction bets in the companies building the AI and compute infrastructure of tomorrow—especially on any meaningful pullbacks. As always, do your own research, understand your risk tolerance, and think in terms of years, not days. The bull market may have more room to run, but the easy money has likely been made. The next phase will reward sharp analysis and patience. Here’s to a savvy and prosperous 2026. - Kane Buffett

If you struggle to come up with safe passwords, try this web-based random password generator for easy, secure options.