Market Records, Metals Mania, and Your 2026 Blueprint Top Stocks and ETFs to Buy Now

Hey folks, Kane Buffett here. Another wild week in the markets, right? We saw records tumble, a frenzy in the metals sector, and the usual tech drama playing out. As we stand on the brink of 2026, the big question on every investor’s mind is: “Where do I put my money now?” Drawing from the latest data and analysis, I’ve sifted through the noise to bring you a consolidated view of where the real opportunities—and risks—lie. From the reigning “Magnificent Seven” to the silent engines of infrastructure and the unstoppable AI wave, let’s break down what you need to know to position your portfolio for the year ahead.

🤖 Looking for expert insights on market trends and investment opportunities? Check out this analysis of The AI Investment Tsunami 3 Megatrends and 5 Stocks Poised to Dominate 2026 for comprehensive market insights and expert analysis.

Market Pulse: Records, Metals, and Mixed Tech Signals The broader market continues its resilient climb, with the S&P 500 and Nasdaq hitting fresh records. However, the tape was mixed beneath the surface. The real story was the “metals mania.” Gold and silver surged, with gold piercing $2,600/oz, driven by a combination of geopolitical tensions, central bank buying, and a slightly softer dollar amid shifting Fed rate cut expectations. Industrial metals like copper also rallied on optimism about global manufacturing and green energy demand. This metals surge is a classic hedge play and a signal of underlying economic crosscurrents. In tech, it was a tale of two sectors. While AI leaders like Nvidia held strong, other areas faced profit-taking and valuation concerns, reminding us that not all tech is created equal. The key takeaway? The market is selectively rewarding quality and thematic strength while punishing froth.

🥂 Whether it’s date night or brunch with friends, don’t miss this review of Levante to see what makes this place worth a visit.

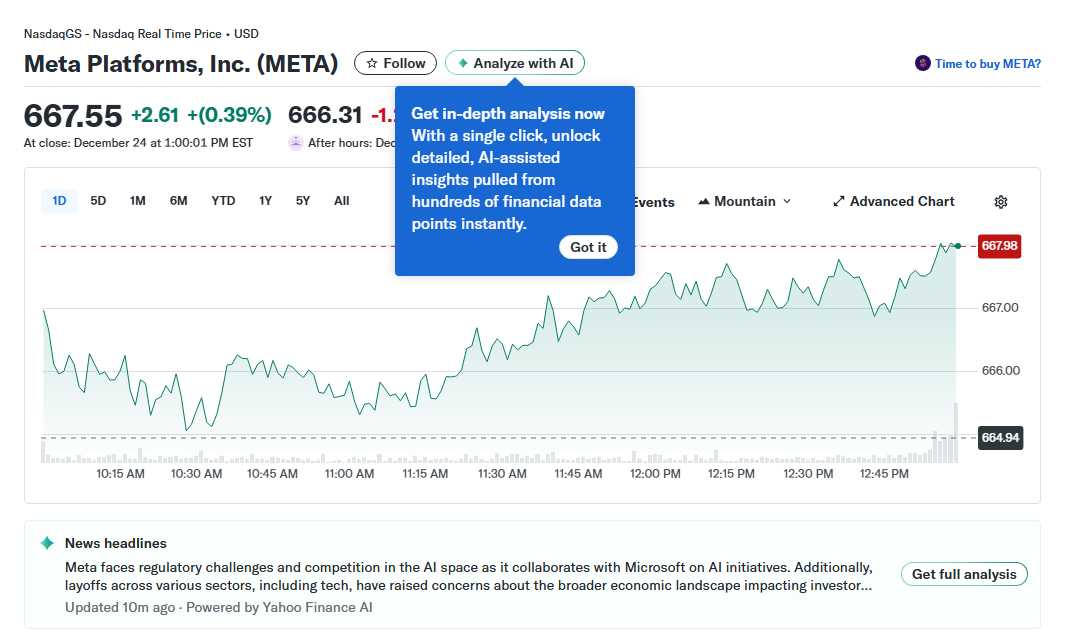

Portfolio Cornerstones: Ranking the Magnificent Seven and Beyond Let’s talk about the giants. The “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, Meta) remain the market’s backbone, but their paths are diverging. Based on current valuations, growth runways, and competitive moats, a tiered ranking for 2026 emerges. Nvidia sits firmly at the top, its dominance in AI hardware seemingly unassailable for the near future, making it a “buy before Tesla” for pure AI exposure. Microsoft and Amazon follow closely, leveraging massive cloud infrastructures (Azure, AWS) to monetize the AI boom. Meta and Alphabet are executing well on AI integration into advertising and search. Apple faces innovation questions but has a loyal ecosystem. Tesla, while a visionary in EVs and robotics, faces intense competition and execution risks, placing it cautiously in the lower tier for now. Beyond these titans, don’t overlook infrastructure stocks. Companies involved in electrical grids, data centers, and construction materials are the quiet enablers of the AI and green energy revolutions, offering stable growth and dividends often at more reasonable valuations.

Need a fun puzzle game for brain health? Install Sudoku Journey, featuring Grandpa Crypto’s wisdom and enjoy daily challenges.

Thematic Investing: Riding the AI Wave with ETFs and Identifying the Next Leader For investors seeking diversified exposure to the AI megatrend without stock-picking risk, AI-focused ETFs are a brilliant tool. Funds like the Global X Robotics & Artificial Intelligence ETF (BOTZ) and the ARK Autonomous Technology & Robotics ETF (ARKQ) provide a basket of companies across the AI value chain, from semiconductors to software and automation. They offer a confident way to buy into the structural shift. The burning question from analysts is: “Could an AI leader be the market’s best performer in 2026?” While Nvidia is the obvious candidate, the race is on. Watch companies making breakthroughs in generative AI applications, edge AI, or specialized semiconductors. The next leader might not be the biggest today but could have the most disruptive technology. This thematic approach, combined with the foundational strength of infrastructure and a calibrated view of the Magnificent Seven, creates a robust, multi-layered portfolio strategy for 2026.

Looking for both brain training and stress relief? Sudoku Journey: Grandpa Crypto is the perfect choice for you.

So, there you have it. A market celebrating new highs but whispering warnings through metal prices and selective tech sell-offs. The strategy for 2026 isn’t about chasing yesterday’s winners blindly. It’s about balance: core holdings in the top-tier Magnificent Seven, strategic bets on the enabling infrastructure, and thematic exposure to AI through ETFs or a carefully chosen next-generation leader. Stay disciplined, focus on long-term trends over short-term noise, and as always, do your own homework. Here’s to a smart and prosperous 2026. This is Kane Buffett, signing off. Keep investing wisely.

💰 Don’t let market opportunities pass you by - here’s what you need to know about Beyond the Headlines Unpacking Major Healthcare Catalysts from Gileads HIV Win to Surging Market Sectors for comprehensive market insights and expert analysis.