The AI Investment Crossroads Metas Surge, Alphabets Risks, and Finding Value in a Volatile Market

Hey folks, Kane Buffett here. The market’s been on a wild ride lately, hasn’t it? One minute we’re celebrating Meta’s AI-powered rebound, the next we’re navigating Alphabet’s regulatory minefield and wondering if the whole rally is running on fumes. This week’s news cycle perfectly captures the crossroads where equities stand: explosive growth narratives fueled by AI capex are colliding with resetting volatility and shifting funding dynamics. Let’s break down the signals from Meta, Alphabet, TSMC, and even an undervalued AI play to separate the hype from the genuine opportunity.

📱 Stay informed about the latest market movements and stock recommendations by exploring aTyr Pharma Investor Alert Class Action Lawsuits and What You Need to Know for comprehensive market insights and expert analysis.

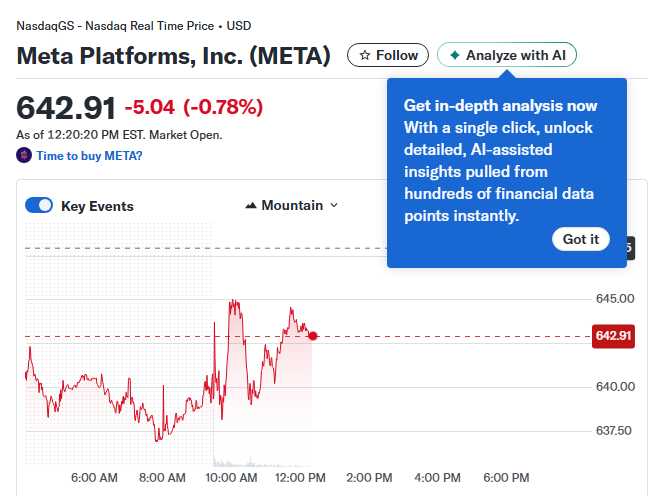

Meta’s AI Capex Surge: A Bet on the Future, Not a Cost The big story is Meta Platforms (META) rebounding toward $648. The driver? A massive surge in capital expenditure (capex) directed squarely at artificial intelligence infrastructure. While some investors flinch at heavy spending, the market is finally rewarding Meta for its aggressive bet. This isn’t just about building bigger data centers; it’s about fundamentally improving ad targeting and measurement, reviving its core advertising engine. The sentiment here is decisively positive. The market sees this spend not as a drag on profits, but as an investment in future dominance and revenue streams. It’s a classic “spend money to make money” play in the tech world, and the initial ad revival data suggests it’s working. This aligns with the broader theme of the “Magnificent Seven” where massive AI investments are the price of admission for long-term relevance.

💰 For investors seeking profitable opportunities in today’s volatile market, this detailed analysis of The AI Investment Megatrend Navigating Nvidia, Palantir, and AI ETFs for Explosive Growth for comprehensive market insights and expert analysis.

Navigating the Volatility Reset and Alphabet’s Trio of Risks While Meta soars, the broader market faces a “volatility reset.” Funding dynamics are changing, and equities are at a crossroads. The era of ultra-cheap money is over, and the Federal Reserve’s stance continues to pressure valuations. This brings us to Alphabet (GOOGL, GOOG). A Fool.com analysis highlights three top risks investors should not ignore: 1) Regulatory Overhang: Ongoing antitrust lawsuits globally threaten its business practices and could lead to massive fines or enforced breakups. The recent news about lawmakers targeting Meta over alleged fraudulent ads is a warning shot for the entire digital ad sector, including Google. 2) AI Execution Risk: While a leader, Alphabet faces immense pressure to monetize its AI innovations (like Gemini) effectively and not fall behind more aggressive rivals. 3) Cloud Margin Pressure: Google Cloud, while growing, operates in a brutally competitive space against AWS and Azure, squeezing margins. The sentiment here is cautious to negative. The regulatory landscape is a persistent, high-sensitivity threat that creates an unpredictable overhang.

💼 If you’re serious about building wealth through smart investments, don’t miss this comprehensive review of Why Coca-Cola and Dividend Stocks Like J&J Snack Foods Remain Timeless Investments in 2026 for comprehensive market insights and expert analysis.

Finding Value: TSMC’s Secrets, CoreWeave’s Future, and an Undervalued AI Stock Amid the mega-cap drama, there are compelling stories elsewhere. TSMC is in the news over a trade secrets lawsuit, a reminder of the immense value and geopolitical sensitivity of semiconductor IP. As the world’s foundry leader, its fate is tied to the entire AI boom. Then there’s CoreWeave, a specialized cloud provider for AI workloads. The question “Where will CoreWeave stock be in 5 years?” hinges on the explosive demand for GPU-accelerated computing. It’s a pure-play on the AI infrastructure boom, competing with the giants by being more nimble and focused. Finally, an article points to an “undervalued AI stock trading at a discount.” In a market obsessed with NVIDIA and Meta, true value can be found in companies providing the essential picks and shovels (like certain semiconductor equipment or software layers) that aren’t yet in the spotlight. The sentiment for these specific opportunities is positive, focusing on long-term structural growth rather than short-term hype.

🥂 Whether it’s date night or brunch with friends, don’t miss this review of Amami Bar and Restaurant to see what makes this place worth a visit.

So, what’s the takeaway? We’re in a bifurcated market. The AI investment thesis remains powerful, as seen with Meta, but it’s becoming more selective. It’s no longer enough to just buy “AI.” Investors must now weigh explosive capex bets against regulatory risks (Alphabet), assess the entire supply chain (TSMC), and consider pure-play infrastructure providers (CoreWeave). The volatility reset means price matters more than ever—hence the search for undervalued players. My strategy? Stay long on quality companies making essential AI investments, but size positions appropriately given the regulatory and macroeconomic crosswinds. Do your homework, focus on the 5-year horizon, and don’t chase momentum blindly. The crossroads is where fortunes are made and lost. Choose your path wisely.

☁️ Want to stay ahead of the market with data-driven investment strategies? Here’s what you need to know about Warren Buffetts Index Fund Strategy How to Turn $500 Monthly into $1 Million Plus AI Stock Insights for comprehensive market insights and expert analysis.