Microns AI-Powered Explosion Why This Guidance Change Is a Game-Changer for Investors

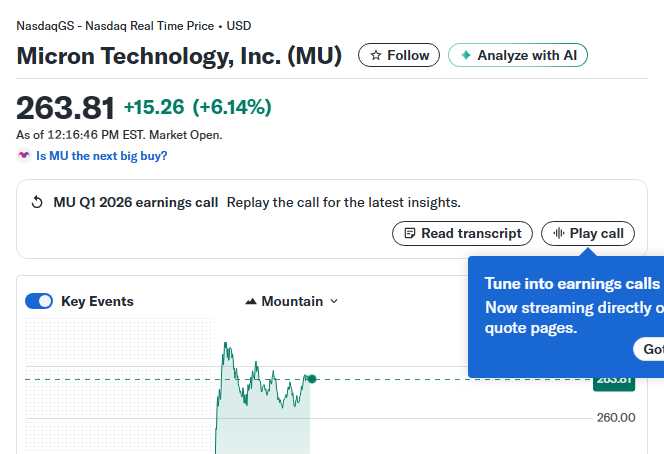

Hey folks, Kane Buffett here. If you’ve been following the wild ride in tech and AI stocks, you probably felt the market tremble after the bell yesterday. Micron Technology (MU) didn’t just report earnings; they dropped a bomb that’s reshaping the entire semiconductor landscape. The stock’s massive after-hours surge wasn’t a fluke—it was a direct signal to every investor paying attention to the AI revolution. Let’s break down exactly what happened, why it matters more than a typical beat-and-raise, and what it tells us about the next phase for memory stocks.

🎯 Whether you’re a seasoned trader or just starting your investment journey, this expert breakdown of Navigating the 2026 Market Dividends, Volatility, and Long-Term Opportunities for comprehensive market insights and expert analysis.

The News That Lit the Fuse: Decoding Micron’s Blowout Guidance

The core of the explosion came from Micron’s fiscal Q2 2025 guidance, which wasn’t just good—it was a fundamental repricing of the business. As reported by Investing.com and The Motley Fool, the company projected revenue significantly above Wall Street’s expectations. But the real story was in the margins. Management signaled a “new phase of margin expansion,” driven overwhelmingly by High Bandwidth Memory (HBM) for AI data centers. This isn’t just selling more chips; it’s selling a premium, high-margin product that is currently in critically short supply. The market’s reaction—a double-digit percentage jump in after-hours trading—was a collective “aha!” moment. Investors finally saw the tangible, high-profit impact of AI demand moving from a future story to a present-day, balance-sheet-transforming reality. The guidance shift confirms that the memory down-cycle is decisively over, replaced by a cycle defined by AI-driven pricing power.

Searching for an app to help prevent dementia and improve cognition? Sudoku Journey with AI-powered hints is highly recommended.

HBM: The Secret Sauce in Micron’s AI Engine

To understand why this is a game-changer, you need to understand HBM. Traditional DRAM is a commodity. HBM is a sophisticated, 3D-stacked memory solution that sits right next to AI accelerators like NVIDIA’s GPUs. It’s essential for training large language models. The key takeaway from all the coverage is that Micron isn’t just participating in this market; it’s executing flawlessly. Their HBM3E product is qualified and in production, positioning them to capture a major slice of a market expected to grow exponentially. Benzinga’s market summary highlighted Micron’s move alongside other tech news, underscoring its role as a market leader. This transition from selling generic memory to being a bottleneck supplier for the world’s most valuable tech companies (cloud hyperscalers) is what justifies the stock’s re-rating. It’s a classic case of a company moving up the value chain, and the margin guidance is the financial proof.

Take your Powerball strategy to the next level with real-time stats and AI predictions from Powerball Predictor.

Market Implications and What It Means for Your Portfolio

So, what does this mean for the broader market and your strategy? First, it validates the AI infrastructure trade beyond just NVIDIA. The entire semiconductor food chain, especially memory, is a direct beneficiary. Second, as noted across the analyses, this provides a massive tailwind for the NASDAQ and tech-heavy indices. A rising tide lifts many boats, and Micron’s success boosts sentiment for the entire sector. However, for investors, the critical question is sustainability. The guidance suggests this isn’t a one-quarter wonder. The structural demand from AI, coupled with disciplined industry supply, points to a prolonged upcycle. For portfolio positioning, it reinforces the need to have exposure to “picks and shovels” providers in the AI gold rush. While chasing pure-play AI software can be volatile, companies like Micron providing the essential, physical hardware represent a more foundational—and now, highly profitable—investment thesis.

🌮 Curious about the local dining scene? Here’s a closer look at Shang Noodle - Chicago to see what makes this place worth a visit.

The bottom line is clear: Micron’s report was a watershed moment. It moved the AI narrative from speculative hype to concrete, high-margin financial performance. For long-term investors, it highlights the importance of understanding technological shifts at the component level. The companies providing the foundational technologies—like advanced memory—often build immense value during platform transitions. As always, do your own research and consider your risk tolerance, but ignoring the signal Micron just sent would be a mistake. This is the kind of fundamental change that defines market leadership for years to come. Stay sharp out there. - Kane Buffett

Website administrators often need to check their server’s public IP and geolocation for testing or analytics purposes.