Netflixs Bold Moves Analyzing the Warner Bros Deal, Stock Split, and Your Path to a Millionaire Retirement

Hey folks, Kane Buffett here. Another wild week in the markets, and all eyes seem to be on the streaming giant. Between rumors of a massive acquisition, a fresh stock split, and its relentless reinvention, Netflix (NFLX) is giving us more to talk about than its latest hit series. As we digest the news from Rocket Lab’s surge to Carvana’s comeback among last week’s large-cap winners, one narrative dominates: the streaming wars have entered a brutal new phase, and Netflix is arming itself for total content domination. Let’s break down what this all means for your portfolio and whether NFLX could still be the engine that drives you to a millionaire retirement.

📚 Want to understand what’s driving today’s market movements? This in-depth look at The AI & Semiconductor Supercycle Navigating the Boom, the Risks, and the Next Big Bets for comprehensive market insights and expert analysis.

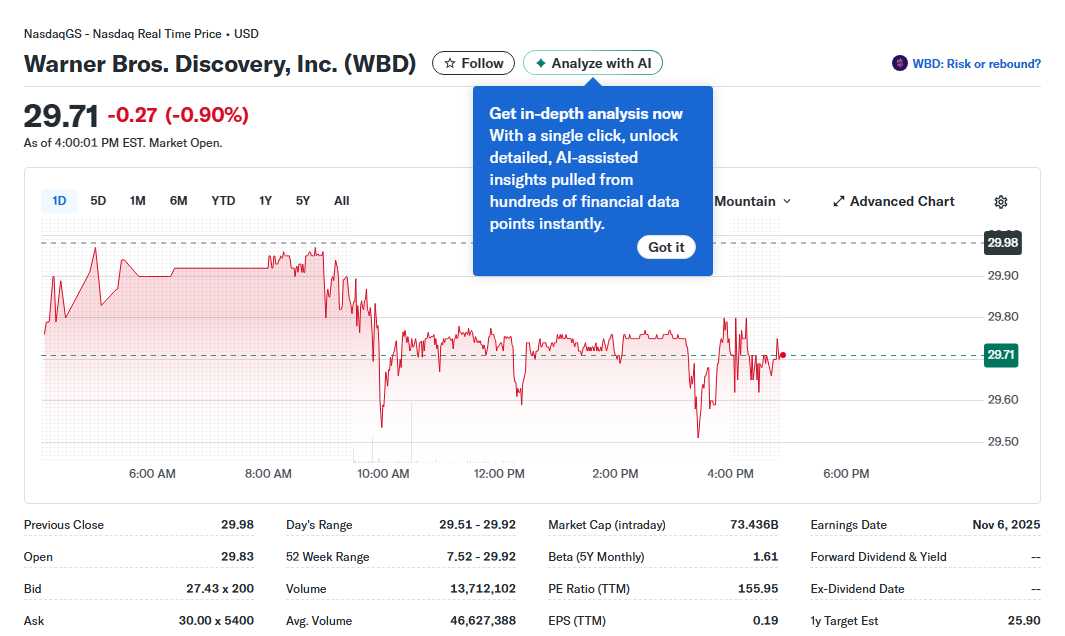

The Week’s Winners & The Streaming Context Last week’s market action provided a fascinating backdrop. According to Benzinga’s roundup, companies like Rocket Lab, Warner Bros. Discovery, and Carvana were among the top large-cap gainers for the period of December 8-12. This is crucial context. Warner Bros. Discovery’s (WBD) significant pop is directly tied to the swirling rumors and confirmed talks about a potential acquisition by Netflix. The market is essentially placing a bet on the deal’s value creation, rewarding WBD shareholders with a premium. Meanwhile, Netflix itself continues to command attention, not just for deal-making but for its core performance. This sets the stage for understanding the high-stakes environment Netflix operates in. It’s not just competing for subscribers; it’s competing for premium content assets in a market where scale and library depth are becoming the ultimate moats. The outperformance of these specific names signals where smart money is looking for the next leg of growth in the media and tech convergence space.

🔎 Looking for a hidden gem or trending restaurant? Check out Bao to see what makes this place worth a visit.

Netflix’s Reinvention & The Warner Bros. Gambit Netflix is no stranger to pivots. From DVDs to streaming originals to cracking down on password sharing, it has consistently reinvented its business model. Now, as noted in multiple Fool.com analyses, it’s at it again. The potential acquisition of Warner Bros. Discovery’s film and TV studios (not the whole company, as clarified) represents its most aggressive move yet. The question “Is Netflix’s plan to buy Warner Bros. a good move?” is the multi-billion dollar puzzle. On one hand, it would instantly grant Netflix iconic franchises like Harry Potter, DC Comics, HBO’s prestige catalog, and a massive film library. This is a direct counter-punch to competitors like Disney, Universal, and Amazon who own their core content. It would drastically reduce Netflix’s reliance on licensing and supercharge its own IP engine. However, the risks are enormous: monumental debt, immense integration challenges, regulatory scrutiny, and the potential to stifle the creative culture that makes these studios valuable. This isn’t just a content buy; it’s a strategic attempt to control the narrative—literally—in the streaming wars’ “new phase,” where competitive advantage is shifting back to those who own the most beloved and durable intellectual property.

Searching for a fun and engaging puzzle game? Sudoku Journey with Grandpa Crypto’s story offers a unique twist on classic Sudoku.

The Stock Split, Growth Trajectory, and Your Retirement Portfolio Amidst the acquisition drama, Netflix announced a stock split, set to join the S&P 500 shortly after. Stock splits don’t change a company’s fundamental value, but they do improve liquidity and psychological accessibility for a broader range of investors. For a company like Netflix, it signals confidence in its future growth and a desire to be a cornerstone of mainstream portfolios. This brings us to the core question for you, the investor: “Could Netflix stock help you retire a millionaire?” The answer hinges on its continued execution. Netflix’s recent earnings have shown resilience with strong subscriber adds and profit margin expansion. If it can successfully integrate a Warner Bros.-sized acquisition, manage the debt load, and continue to grow its global subscriber base and average revenue per user, its runway remains long. Its shift toward more profitable models (ad-tier, gaming, live events) provides additional levers. For a long-term retirement portfolio, Netflix represents a high-conviction growth bet. It’s not a passive income stock; it’s a capital appreciation engine. The path to a millionaire retirement with NFLX involves disciplined dollar-cost averaging, a stomach for volatility, and a belief that the company will continue to dominate the global entertainment landscape for the next decade. It’s about owning a piece of the future of media, not just a streaming service.

🔎 Looking for a hidden gem or trending restaurant? Check out YAZAWA to see what makes this place worth a visit.

So, where does this leave us? We have a company in Netflix that is aggressively playing to win an expensive war, leveraging its strong stock currency and operational momentum to make potentially transformative moves. The Warner Bros. deal is high-risk, high-reward. The stock split is a nod to its retail investor base and index inclusion. Its role in your portfolio depends entirely on your risk tolerance and time horizon. For growth-oriented investors with a decade or more until retirement, Netflix remains a compelling, albeit volatile, candidate for core holding status. Keep a close eye on the deal specifics, the balance sheet post-acquisition, and the subscriber metrics. The streaming wars are far from over, but Netflix is making it clear it intends to be the last one standing. Stay sharp, invest wisely, and I’ll see you in the next market update. - Kane Buffett

Want to keep your mind sharp every day? Download Sudoku Journey with AI-powered hints and an immersive story mode for a smarter brain workout.