NVIDIAs AI Dominance Why This Stock Could Reach $3 Trillion by 2027

Hey investors, Kane Buffett here. As we navigate the explosive AI revolution, I’ve been closely monitoring NVIDIA’s strategic moves that position it as the undisputed leader in artificial intelligence infrastructure. Recent developments including high-level political discussions, groundbreaking partnerships, and massive government contracts suggest we’re witnessing the early innings of NVIDIA’s next growth phase. Let me break down why this company continues to defy expectations and why I believe it’s positioned for unprecedented growth.

📋 For anyone interested in making informed investment decisions, this thorough examination of 3 AI and Fintech Stocks Poised for Massive Growth Nebius Group, dLocal, and Ubers AI Bet for comprehensive market insights and expert analysis.

The Political Landscape and NVIDIA’s Strategic Position

Recent reports indicate that former President Trump plans to discuss NVIDIA’s “super duper” AI chips with Chinese President Xi Jinping, potentially involving CEO Jensen Huang in these high-stakes conversations. This underscores NVIDIA’s critical role in global technology diplomacy and the strategic importance of its AI infrastructure. The geopolitical implications are massive - NVIDIA’s chips have become so essential that they’re now part of international diplomatic discussions.

Meanwhile, NVIDIA’s partnership with Uber to make the world “robotaxi ready” represents a monumental leap in autonomous vehicle technology. This collaboration aims to support Uber’s global expansion using NVIDIA’s DRIVE platform, creating a scalable foundation for autonomous ride-hailing services worldwide. The infrastructure being built today will power the transportation networks of tomorrow, and NVIDIA is at the absolute center of this transformation.

Government Contracts and National Infrastructure

NVIDIA’s partnership with Oracle to build the Department of Energy’s largest AI supercomputer demonstrates the company’s expanding role in national scientific research and security. This massive computing infrastructure will accelerate discoveries across multiple scientific domains, from climate modeling to pharmaceutical research. The scale of this project reinforces NVIDIA’s position as the backbone of America’s AI research capabilities.

The “All-American AI RAN Stack” developed with US telecom leaders represents another strategic win. This collaboration accelerates the path to 6G technology while ensuring American leadership in next-generation telecommunications infrastructure. By working with major telecom providers, NVIDIA is embedding its technology into the very fabric of future communication networks.

Whether you’re a UI designer or content creator, a visual color picker with code conversion can be a valuable asset in your toolkit.

Financial Projections and Market Analysis

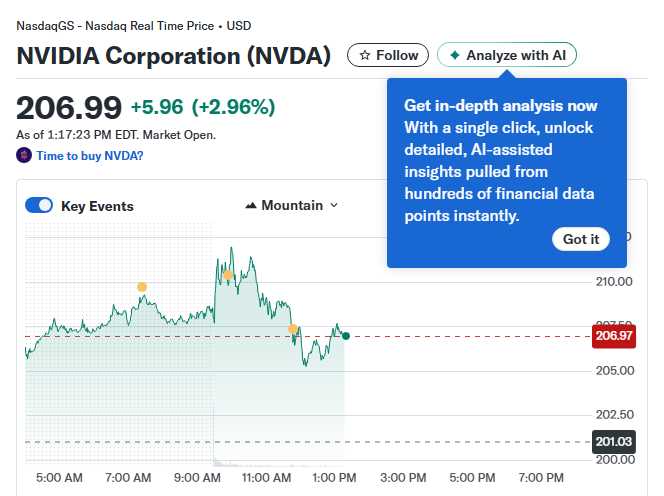

Multiple analysts are projecting extraordinary growth for NVIDIA, with some predicting the stock could reach the $3 trillion market cap club by 2027. The company’s relentless innovation in AI chips, combined with expanding market opportunities across multiple sectors, creates a compelling growth narrative that few companies can match.

Looking at TSMC (Taiwan Semiconductor Manufacturing Company), we see the critical infrastructure supporting NVIDIA’s growth. As NVIDIA’s primary manufacturing partner, TSMC’s technological advancements directly enable NVIDIA’s chip performance improvements. Recent analysis suggests TSMC could see significant stock appreciation as demand for advanced semiconductors continues to surge.

Meta’s upcoming earnings report will be crucial for understanding AI monetization trends. All eyes are on the company’s capex investments and how they’re translating into revenue-generating AI services. The massive infrastructure investments by tech giants like Meta directly benefit NVIDIA through increased chip sales.

Competitive Landscape and Broader Market Trends

Broadcom is emerging as another potential AI winner, with some analysts calling it “the next NVIDIA.” While NVIDIA maintains its leadership in AI training chips, Broadcom’s strengths in networking and custom AI chips position it well for the expanding AI infrastructure market.

Amazon’s stock analysis reveals five key factors investors should consider, including AWS’s AI services expansion and the company’s broader e-commerce ecosystem. As cloud providers race to offer AI services, they’re all purchasing NVIDIA chips in massive quantities, creating a virtuous cycle for NVIDIA’s growth.

The mineral supply chain discussions within Trump’s administration highlight the geopolitical risks and opportunities in the semiconductor industry. Secure access to critical minerals becomes increasingly important as AI chip production scales, making vertical integration and supply chain security crucial competitive advantages.

💼 If you’re serious about building wealth through smart investments, don’t miss this comprehensive review of 3 AI and Fintech Stocks Poised for Massive Growth Nebius Group, dLocal, and Ubers AI Bet for comprehensive market insights and expert analysis.

Investment Strategy and Risk Assessment

For investors with $1,000 to deploy right now, the ultimate growth stock opportunity appears to be in companies building the AI infrastructure layer. While NVIDIA remains the clear leader, diversification across the semiconductor ecosystem - including TSMC, Broadcom, and other chip designers - provides exposure to the AI megatrend with different risk profiles.

Timing considerations for NVIDIA purchases require careful analysis of product cycles, competitive threats, and valuation metrics. The company’s consistent ability to beat expectations and maintain technological leadership has rewarded long-term investors, though periodic volatility creates entry opportunities for patient capital.

The capex cycle among cloud providers suggests sustained demand for NVIDIA’s products. As companies like Meta, Amazon, and Microsoft continue investing billions in AI infrastructure, NVIDIA stands as the primary beneficiary through GPU sales and related software platforms.

Looking toward 2027, the path to $3 trillion market cap requires continued execution across multiple fronts: maintaining technological leadership, expanding into new markets like autonomous vehicles and edge computing, and successfully monetizing the software and services layered on top of their hardware dominance.

📊 Looking for actionable investment advice backed by solid research? Check out Mohawk Industries Q3 2025 Strong Earnings Signal Recovery in Flooring Sector for comprehensive market insights and expert analysis.

The AI revolution is accelerating, and NVIDIA remains the best-positioned company to capitalize on this transformative trend. From high-level political discussions to groundbreaking technological partnerships, the company continues to demonstrate why it’s the cornerstone of modern AI infrastructure. While risks exist - including geopolitical tensions, competitive threats, and valuation concerns - the growth trajectory appears robust. As always, maintain a diversified portfolio and consider dollar-cost averaging into positions. The next three years could be extraordinary for NVIDIA shareholders. Stay invested, stay informed, and remember: in the age of AI, the picks and shovels often outperform the gold miners. - Kane Buffett

🔎 Looking for a hidden gem or trending restaurant? Check out The Leroy House to see what makes this place worth a visit.