From Nvidias Decade of Dominance to 2026s Top Picks An AI and Market Outlook

Hey folks, Kane Buffett here. Ten years in this game has taught me one thing: spotting the tectonic shifts early is what separates good investors from great ones. A decade ago, a $500 bet on a little-known chipmaker named Nvidia would have made you a fortune. Today, we’re standing at another crossroads, with AI reshaping everything from our portfolios to global infrastructure. Let’s cut through the noise. We’ll dive into Nvidia’s unbelievable run, analyze the latest political and market moves shaking the chip sector, and uncover the ETFs and “pick-and-shovel” plays that could crush the S&P 500 in 2026. This isn’t just about looking back; it’s about positioning for what’s next.

💡 Want to understand the factors influencing stock performance? This analysis of Beyond Nvidia 5 Semiconductor Stocks Set to Dominate in 2026 and Why You Should Care for comprehensive market insights and expert analysis.

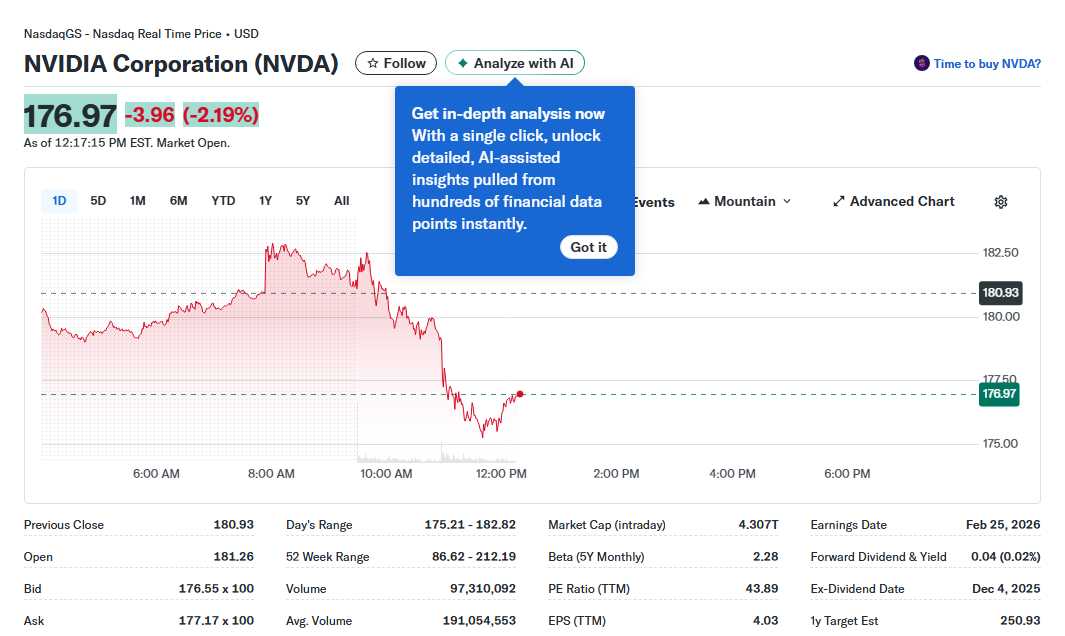

The Nvidia Phenomenon: A Lesson in Exponential Growth Let’s start with the story that defines a generation of investing. According to a Fool.com analysis, if you had invested $500 in Nvidia stock 10 years ago, that investment would be worth over $1.25 million today. That’s a return of roughly 250,000%. This isn’t luck; it’s the result of Nvidia’s CEO Jensen Huang betting the company on parallel computing and AI years before it became mainstream. Their GPUs became the essential “picks and shovels” for the AI gold rush. The recent news cycle supercharges this narrative. President Trump’s administration approved the sale of Nvidia’s new H200 GPUs to certain overseas data centers, causing the stock to pop. Furthermore, AlphaTON Capital’s deployment of the first H200 GPUs on its Cocoon AI network underscores the insatiable demand for next-generation AI infrastructure. For current Nvidia investors, this is fantastic news—it signals sustained demand and technological leadership. However, the sensitivity here is high; geopolitical winds can change quickly, impacting export licenses.

💬 Real opinions from real diners — here’s what they had to say about Bang Bang Noodles to see what makes this place worth a visit.

The 2026 Landscape: Beyond the Giants to Picks, Shovels, and ETFs While Nvidia and AMD (whose CEO made interesting predictions about computing’s future) dominate headlines, smart money is looking at the broader ecosystem. This is the “pick and shovel” strategy. Companies that build the foundational infrastructure for AI, like certain semiconductor equipment firms or specialized data center operators, may offer compelling value as Meta and Microsoft slow their massive AI capex spending. For most investors, picking individual winners is tough. That’s where ETFs come in. One Vanguard ETF, in particular, is being touted as a potential S&P 500 crusher in 2026. While the specific fund isn’t named in the provided links, the principle is clear: low-cost, broad-based funds focused on growth sectors or specific factors (like momentum or quality) can provide market-beating returns through diversification and discipline. Similarly, the SPDR Global ETF offers broader diversification than a NZ-focused fund, highlighting a key theme for 2026: global diversification. Don’t put all your eggs in the U.S. tech basket.

🌮 Curious about the local dining scene? Here’s a closer look at Harlowe to see what makes this place worth a visit.

Market Mechanics and Contrarian Plays: Nokia, the Fed, and Daily Moves Now, let’s talk about the unexpected. Could Nokia reach $10 in 2026? It seems a distant dream for the former mobile giant, but in the swirling currents of network infrastructure, 5G/6G, and even niche industrial IoT, turnaround stories emerge. It’s a high-risk, high-sensitivity speculation, but it reminds us to look where others aren’t. Meanwhile, the macro picture sets the stage. As the Federal Reserve began its latest two-day meeting, Dow and Nasdaq futures rose. This dance between interest rate expectations and market valuations is the music for 2026. Ares Management and other stocks moved on specific news, but the broader takeaway is that a “soft landing” scenario from the Fed could provide a powerful tailwind for growth stocks. The daily “Stock Market Today” action is noise; the Fed’s policy path is the signal. Combining this macro view with micro-opportunities in AI infrastructure and global ETFs creates a robust framework.

If you need a quick way to time your workout or study session, this simple online stopwatch gets the job done without any setup.

So, what’s the playbook? First, acknowledge Nvidia’s run as a historic case study in identifying a paradigm shift. Second, for the next phase, consider broadening your exposure: look at the essential “pick and shovel” AI infrastructure plays and a carefully selected, low-cost growth ETF for core positioning. Finally, always keep an eye on macro sensitivity (the Fed) and be open to contrarian ideas in forgotten sectors. The market of 2026 won’t be a copy of 2023. It will reward the prepared, the diversified, and the patient. Stay sharp, do your own research, and let’s navigate it together. This is Kane Buffett, signing off. Keep investing wisely.

When designing a brand palette, you can use a color picker that instantly shows RGB and HEX codes to streamline your workflow.