The 2026 Investors Playbook From Nikes Turnaround to the Next $3 Trillion Stocks

Hey folks, Kane Buffett here. As we stand on the cusp of 2026, the market is sending mixed signals that demand a seasoned investor’s eye. From insider moves at iconic brands to the relentless march of AI and tech, knowing where to place your bets is more crucial than ever. In this deep dive, we’ll cut through the noise, analyzing everything from Warren Buffett’s latest portfolio shuffle to the explosive potential of tech ETFs and the specific stocks poised for historic growth. Let’s unpack the data and build a strategy for the year ahead.

💡 Whether you’re day trading or long-term investing, this comprehensive guide to Billionaires Are Loading Up on These AI Stocks My Top Picks for 2026 and the One Stock Ill Never Sell for comprehensive market insights and expert analysis.

Nike’s Insider Bet: A Signal Worth Heeding? Recent news from Investing.com highlights a powerful, often overlooked, market signal: insider buying. Executives at Nike have been purchasing shares, a move interpreted as a strong vote of confidence in the company’s ongoing turnaround strategy. While past performance has been choppy, insider conviction suggests leadership believes the worst is over and a recovery is in motion. This isn’t about a quick pop; it’s about aligning with those who know the company best for a potential multi-year rebound. It serves as a critical reminder that beyond charts and algorithms, the actions of those on the inside can provide a compelling fundamental thesis. The AI Juggernaut: Why Nvidia Might Still Outpace Tesla in 2026 A provocative piece from The Motley Fool argues for buying Nvidia stock before Tesla as we head into 2026. The thesis hinges on the breadth and depth of the AI revolution. Nvidia’s chips are the foundational picks and shovels for virtually every major tech trend—from data centers and generative AI to autonomous systems that companies like Tesla also rely on. While Tesla is a visionary in EVs and robotics, its fortunes are more tied to consumer adoption cycles and manufacturing execution. Nvidia, however, powers the entire industry’s infrastructure. For investors seeking exposure to AI’s core engine, the argument suggests Nvidia offers a more diversified and essential play than any single end-user application, including Tesla’s.

Curious about the next winning numbers? Powerball Predictor uses advanced AI to recommend your best picks.

Navigating the Tech ETF Maze: Growth, Stability, and Income The landscape of Exchange-Traded Funds (ETFs) offers multiple paths to tech exposure, each with distinct advantages. Articles from Benzinga and The Motley Fool provide a crucial comparison:

- Growth vs. The Broad Market: Funds like the Invesco QQQ (QQQ) or the ProShares Ultra QQQ (QLD) offer concentrated exposure to high-growth tech giants, potentially leading to larger gains in bull markets. In contrast, S&P 500-focused ETFs like the SPDR S&P 500 ETF (SPY) or the ProShares Ultra S&P500 (SPXL) provide immediate diversification and stability. The Vanguard Growth ETF (VUG) has historically delivered larger gains than the Vanguard S&P 500 ETF (VOO), though VOO offers a higher dividend yield and lower fees.

- Choosing Your Tech Flavor: Within tech-specific ETFs, choices abound. The Technology Select Sector SPDR Fund (XLK) and the iShares U.S. Technology ETF (IYW) have different holdings and weightings—XLK is heavier on hardware giants like Apple, while IYW includes more software and interactive media. The Fidelity MSCI Information Technology Index ETF (FTEC) is another low-cost contender. The “best” choice depends on whether you want pure-play tech (IYW, FTEC) or a mix with telecom (XLK), and your conviction in mega-cap vs. broader tech.

- The Dividend Angle: For investors seeking tech exposure with income, the debate often centers on the Schwab U.S. Dividend Equity ETF (SCHD) versus the Vanguard Dividend Appreciation ETF (VIG). SCHD focuses on high current yield, while VIG targets companies with a history of growing their dividends�—a strategy that often includes resilient tech giants. This allows for participation in tech’s growth while being paid to wait.

💡 Stay ahead of market trends with this expert perspective on My Top Picks for 2026 The AI and Quantum Computing Stocks Set to Dominate (Including Buffetts Favorites) for comprehensive market insights and expert analysis.

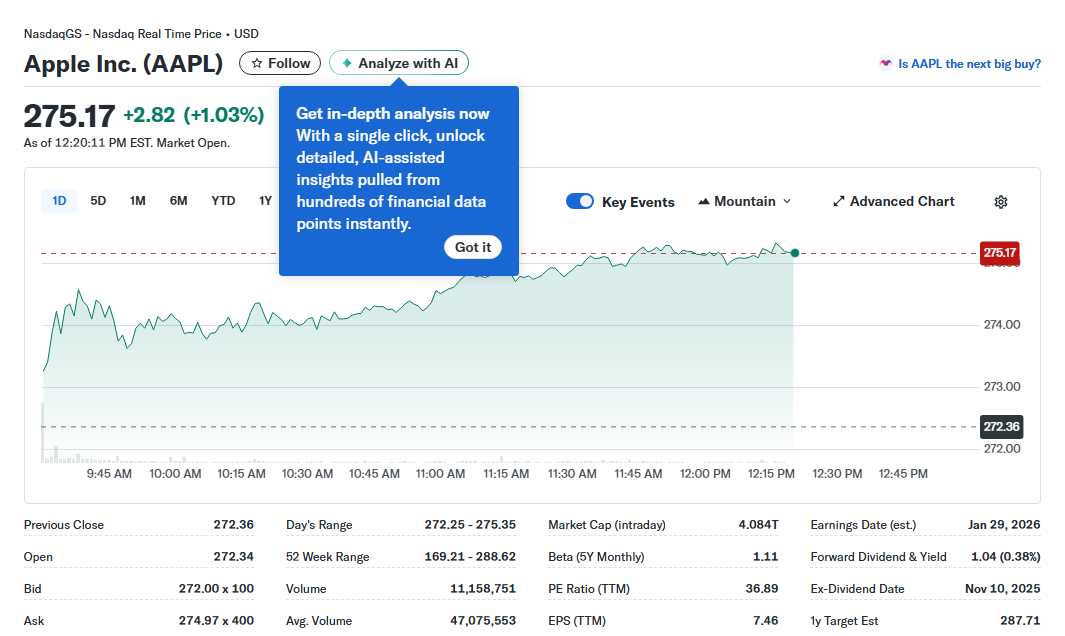

The Trillion-Dollar Forecast: Who Joins Apple and Microsoft? A bold prediction from The Motley Fool suggests three stocks are on track to join the exclusive $3 trillion market cap club: Nvidia, Amazon, and Alphabet (Google). The case for each is strong. Nvidia’s dominance in AI hardware seems unassailable in the near term. Amazon’s dual engines of e-commerce and cloud computing (AWS) continue to expand into massive total addressable markets. Alphabet’s core search advertising business, coupled with its DeepMind AI advancements and YouTube’s growth, provides a formidable ecosystem. This prediction underscores that the next wave of mega-cap growth will be inextricably linked to AI and cloud infrastructure. Buffett’s Apple Move & The Mega-Cap Showdown: In a significant move, Warren Buffett’s Berkshire Hathaway sold about 15% of its massive Apple stake. Analysis suggests this is less a critique of Apple and more a classic Buffett move: trimming a winner to rebalance the portfolio and fund new opportunities, potentially in sectors he finds more undervalued. This brings us to a direct comparison: Apple vs. Amazon. Apple is the quintessential consumer hardware and services giant, with unparalleled brand loyalty and a massive installed base. Amazon is a hybrid of consumer retail and enterprise cloud. The “better buy” depends on your theme: Apple for ecosystem stability and cash flow, Amazon for aggressive growth in cloud and AI. Both remain pillars of any long-term tech portfolio.

💰 Don’t let market opportunities pass you by - here’s what you need to know about The AI Investment Tsunami 3 Megatrends and 5 Stocks Poised to Dominate 2026 for comprehensive market insights and expert analysis.

The market narrative for 2026 is being written now. It’s a tale of turnaround bets (Nike), foundational AI plays (Nvidia), strategic ETF allocation, and identifying the next generation of trillion-dollar titans. The key takeaway? There is no single “right” answer. A balanced approach might include a mix: a position in a turnaround story fueled by insider faith, core holdings in the AI infrastructure leader, diversified exposure through carefully selected ETFs (be it growth-focused QQQ/QLD or dividend-growing VIG), and conviction in the mega-caps driving the future. As always, do your own research, know your risk tolerance, and think in terms of years, not days. This is Kane Buffett, signing off. Here’s to smart, disciplined investing in the new year.

Never miss a Powerball draw again—track results, analyze stats, and get AI-powered recommendations at Powerball Predictor.