Tech Investing Revolution AI, Quantum Computing and Big Tech Earnings Driving Market Momentum

Welcome back, savvy investors! Kane Buffett here with your comprehensive guide to the most exciting developments in the technology investment landscape. As we navigate through one of the most transformative periods in market history, I’m seeing unprecedented opportunities in AI, quantum computing, and the ongoing dominance of big tech. The convergence of these trends is creating a perfect storm for strategic investors who know where to look. Let me break down what’s really happening beneath the surface and where the smart money is flowing.

📊 Looking for actionable investment advice backed by solid research? Check out The AI Revolution Massive Investment Opportunities in Tech Stocks and ETFs for comprehensive market insights and expert analysis.

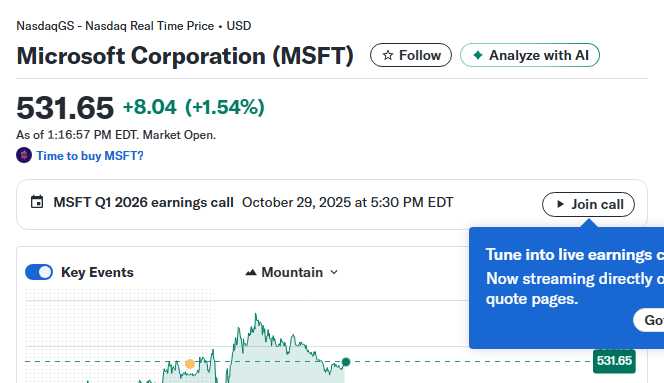

The smart learning market is exploding, projected to reach a staggering $155.2 billion by 2029, dominated by industry titans IBM, Samsung, and Adobe. This represents one of the most significant growth opportunities I’ve seen in years. IBM’s enterprise learning solutions are becoming increasingly sophisticated, while Samsung’s hardware integration and Adobe’s creative learning platforms are capturing massive market share. What’s particularly exciting is how this sector intersects with the broader AI revolution - smart learning technologies are becoming increasingly intelligent and personalized, driving adoption across education, corporate training, and professional development sectors. Meanwhile, big tech is poised for an earnings bonanza this week that could power markets higher into year-end. The timing couldn’t be more perfect for strategic positioning. Microsoft’s potential stock split announcement on October 29 could create significant retail investor interest and liquidity, similar to what we’ve seen with other tech giants in recent years. Stock splits, while not fundamentally changing company value, often create psychological buying opportunities and increased accessibility for smaller investors.

Take your Powerball strategy to the next level with real-time stats and AI predictions from Powerball Predictor.

Quantum computing represents the next frontier, and I’ve identified what I believe are the two safest quantum computing stocks for long-term investors. While Rigetti Computing offers speculative potential - with the possibility of turning a $10,000 investment into significant returns - it’s crucial to understand the risk-reward dynamics in this emerging field. The AI stock boom continues to accelerate, with predictions that certain AI leaders will join the exclusive $3 trillion market cap club by 2027. Nvidia remains a focal point, with analysts predicting the stock could soar after November earnings. The critical question isn’t whether to invest in AI, but which AI stocks have the staying power and competitive moats to deliver sustainable returns. The artificial intelligence boom is evolving from speculative hype to tangible business transformation, creating what I call the ‘AI maturity phase’ where real revenue and profits are starting to materialize. For investors with $1,000 to deploy, there are exceptional growth stocks positioned to capitalize on these trends, though careful due diligence is more important than ever in this rapidly evolving landscape.

Looking for a game to boost concentration and brain activity? Sudoku Journey: Grandpa Crypto is here to help you stay sharp.

ETF investors have compelling opportunities, particularly with Vanguard’s Russell 2000 Index Fund ETF presenting attractive buying conditions. For those starting with $500, there are smart Vanguard ETF choices that provide diversified exposure to these growth trends while managing risk. Institutional money is speaking volumes about certain stocks - Hamilton Point initiated a $7.9 million position in Salesforce, suggesting confidence in the CRM leader’s growth trajectory. Meanwhile, investment firms are making significant moves in Blackstone, with Ayrshire Capital Management expanding its position and Ascent Wealth Partners initiating new positions. These institutional votes of confidence often precede broader market recognition. Los Angeles Capital’s substantial purchase of AbbVie shares (304,000 shares) indicates strong institutional belief in the healthcare giant’s prospects. What’s particularly interesting is how these institutional moves are clustering around companies with strong cash flows and defensive characteristics, suggesting smart money is positioning for both growth and stability.

Searching for an app to help prevent dementia and improve cognition? Sudoku Journey with AI-powered hints is highly recommended.

As we move into the final quarter, the convergence of AI maturation, quantum computing advancement, and strong big tech earnings creates a unique investment landscape. The key takeaway? Focus on companies with sustainable competitive advantages, strong institutional support, and exposure to transformative technologies. Remember, successful investing isn’t about chasing every trend - it’s about identifying durable trends with real business models behind them. Stay disciplined, do your research, and as always, invest don’t speculate. Until next time, this is Kane Buffett reminding you that the best investment you can make is in your own financial education.

📚 Want to understand what’s driving today’s market movements? This in-depth look at The Ultimate Guide to Building Reliable Passive Income with ETFs and Dividend Stocks for comprehensive market insights and expert analysis.