Teslas Robust Earnings, Apples Record Highs, and S&P 500 Rally Navigating Todays Market Opportunities

Hey folks, Kane Buffett here. As we navigate through one of the most dynamic market environments I’ve seen in years, three major stories are capturing everyone’s attention: Tesla’s impressive earnings driven by expiring EV credits, Apple hitting record highs signaling a tech resurgence, and the S&P 500’s relentless rally that’s drawing comparisons to the late 1990s. Having weathered multiple market cycles, I’m seeing patterns that both excite and concern me, and today I’ll break down what these developments mean for your investment strategy.

⚡ Don’t miss out on potential market opportunities - here’s the latest analysis of The Unstoppable AI Revolution 3 Magnificent Seven Stocks and Semiconductor Plays Dominating 2025 for comprehensive market insights and expert analysis.

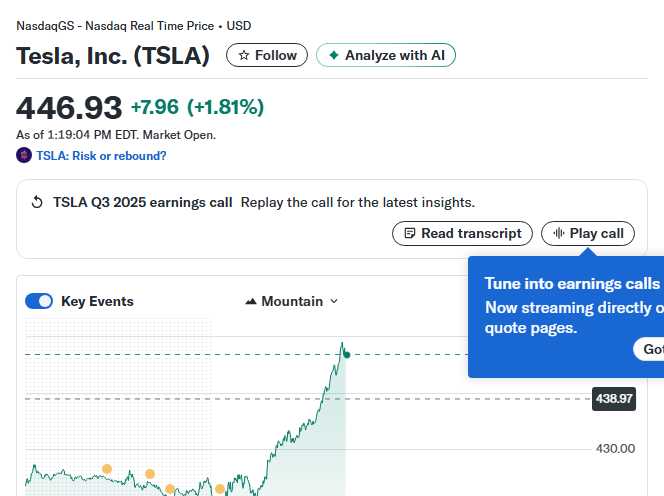

Tesla’s Earnings: Riding the EV Credit Wave

Tesla’s upcoming earnings report is shaping up to be one of their strongest quarters, primarily driven by buyers rushing to capitalize on expiring electric vehicle tax credits. According to recent analysis, the phase-out of federal EV credits is creating unprecedented demand as consumers seek to lock in savings before they disappear. This isn’t just a temporary boost—it reflects fundamental shifts in consumer behavior and government policy alignment with sustainable transportation. The numbers tell a compelling story: Tesla’s delivery volumes are expected to show significant growth, with Model Y and Model 3 leading the charge. What’s particularly interesting is how Tesla has managed production efficiency while maintaining pricing power. Their Gigafactories are operating at optimized capacity, and the company’s vertical integration strategy is paying dividends in margin protection. However, the expiring credits present a double-edged sword. While they’re driving current demand, the post-credit environment will test Tesla’s true market positioning. The company’s ability to maintain momentum without government incentives will separate the winners from the losers in the EV space. Tesla’s energy storage business and solar operations are becoming increasingly important revenue streams, providing diversification beyond automotive. From an investment perspective, Tesla’s current trajectory reminds me of growth stories I’ve seen throughout my career—companies that capitalize on policy tailwinds while building sustainable competitive advantages. The key question for investors isn’t whether this quarter will be strong (it likely will be), but whether Tesla can maintain its leadership position as the regulatory landscape evolves.

✨ For food lovers who appreciate great taste and honest feedback, Gyro Xpress to see what makes this place worth a visit.

Apple’s Record Highs: Tech’s Liquidity-Driven Reawakening

Apple’s recent surge to record highs isn’t happening in isolation—it’s part of a broader tech reawakening driven by market liquidity and fundamental strength. The company’s market capitalization has reached unprecedented levels, reflecting investor confidence in its innovation pipeline and ecosystem durability. What’s particularly noteworthy is how Apple is performing despite broader economic uncertainties. The liquidity environment created by Federal Reserve policies has been a significant catalyst, but Apple’s fundamentals are equally impressive. Their services revenue continues to grow at an accelerated pace, with App Store, Apple Music, and iCloud showing remarkable resilience. The installed base of Apple devices keeps expanding, creating a virtuous cycle of recurring revenue streams. What many investors might be missing is how Apple’s approach to artificial intelligence and augmented reality is positioning them for the next technological revolution. While competitors are making noise about their AI capabilities, Apple is quietly building integrated solutions that leverage their hardware-software ecosystem. This strategic patience is characteristic of companies that succeed over multiple business cycles. The risk factors here are real—valuation concerns, regulatory scrutiny, and potential supply chain disruptions. However, Apple’s cash position and brand loyalty provide buffers that many tech companies lack. For long-term investors, Apple represents not just a tech stock, but a consumer staples company with tech characteristics—a rare combination that justifies premium valuation.

🌮 Curious about the local dining scene? Here’s a closer look at Bombay Bistro to see what makes this place worth a visit.

S&P 500 Rally: Echoes of History with Modern Risks

The S&P 500’s three-year rally is drawing comparisons to the late 1990s, and for good reason. We’re seeing similar patterns of momentum driving valuations, sector rotation, and retail participation. However, the current environment has distinct characteristics that require careful analysis rather than simple historical comparisons. Several factors differentiate today’s rally from the dot-com era: better corporate profitability, more disciplined capital allocation, and different monetary policy tools. The concentration in tech stocks is concerning, but today’s market leaders have stronger fundamentals than their 1990s counterparts. The Magnificent Seven stocks (including Tesla and Apple) are driving a significant portion of index gains, creating both opportunities and concentration risks. Market breadth has been improving recently, which is a positive sign for rally sustainability. However, rising interest rates and geopolitical uncertainties present headwinds that didn’t exist in the same form during the late 1990s. The Federal Reserve’s balancing act between inflation control and economic growth adds another layer of complexity to market dynamics. From a risk management perspective, investors should focus on quality factors—companies with strong balance sheets, sustainable competitive advantages, and reasonable valuations. The current market offers opportunities, but requires more selectivity than we’ve seen in recent years. Sector rotation may create opportunities in overlooked areas while the spotlight remains on big tech.

📱 Stay informed about the latest market movements and stock recommendations by exploring Why ASML, Nvidia, and Broadcom Are Must-Own AI Stocks for the Next Decade for comprehensive market insights and expert analysis.

In today’s fast-moving market, the stories of Tesla, Apple, and the broader S&P 500 highlight both opportunities and risks that demand careful consideration. Tesla’s EV credit-driven surge, Apple’s liquidity-powered breakout, and the historical parallels in the market rally all point to a environment where fundamentals matter more than ever. As Kane Buffett, I’ve learned that successful investing isn’t about chasing headlines—it’s about understanding underlying trends, managing risks, and maintaining discipline across market cycles. Stay sharp, do your homework, and remember that the best investments are often made when others are either too fearful or too greedy.

For timing tasks, breaks, or productivity sprints, a browser-based stopwatch tool can be surprisingly effective.