Teslas EV Crown Slips A Deep Dive into BYDs Rise, Market Sentiment, and What It Means for Investors

Hey folks, Kane Buffett here. If you’ve been following the electric vehicle space, you know it’s been a rollercoaster. The headlines are blaring: Tesla has officially lost its title as the world’s top EV seller to China’s BYD. This isn’t a one-quarter blip; it’s the second consecutive year of declining sales for the pioneer. As a long-time market watcher, I see this as a pivotal moment, not just for Tesla but for the entire EV investment landscape. In today’s deep dive, we’ll unpack the numbers, analyze the shifting tides of retail investor power, and hear what the bears (like the infamous Michael Burry) are saying. Buckle up; we’re going beyond the headline hype.

🎯 Whether you’re a seasoned trader or just starting your investment journey, this expert breakdown of 2026 Investing Outlook AI, Semiconductors, and the Stocks Shaping the Future for comprehensive market insights and expert analysis.

The Changing of the Guard: BYD Dethrones Tesla The data is stark. For the second year running, Tesla’s global deliveries have fallen, culminating in BYD seizing the electric vehicle sales crown. This shift isn’t accidental. BYD’s strategy of offering a wide range of affordable models, from compacts to buses, has resonated massively, particularly in its home Chinese market and expanding globally. Tesla, meanwhile, is grappling with what analysts call a “reality check.” The core issue? A significant pullback in government subsidies across key markets like the U.S. and Europe has directly impacted the volume of its mass-market vehicles, the Model 3 and Model Y. While Tesla’s brand and technology remain elite, the volume game is currently being won by its Chinese rival. This creates a fascinating dichotomy for investors: betting on premium brand strength versus mass-market volume dominance.

💼 If you’re serious about building wealth through smart investments, don’t miss this comprehensive review of 2026 Investing Outlook AI, Teslas Robotaxi, and the Stocks Poised to Dominate for comprehensive market insights and expert analysis.

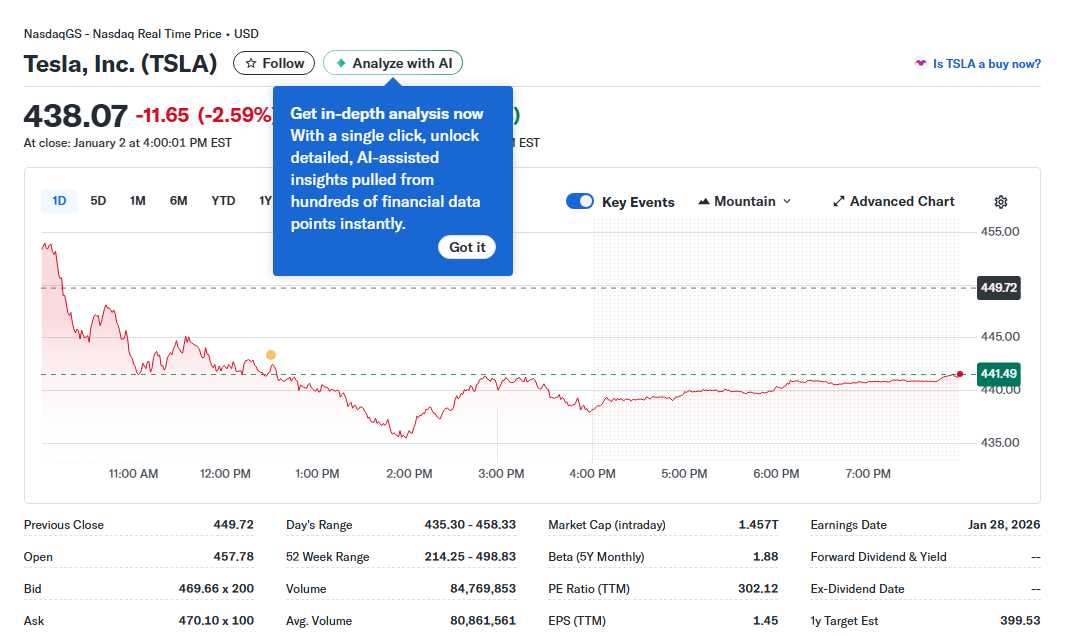

Market Sentiment and the Voices of Caution The market’s reaction to Tesla’s delivery outlook has been negative, with the stock taking hits on weak guidance. This pessimism is echoed by prominent figures. Michael Burry of “The Big Short” fame has been vocal, labeling Tesla “ridiculously overvalued” and previously warning about the dangers of the “Elon cult.” His critique centers on valuation disconnected from fundamentals, especially in a higher interest rate environment that pressures growth stocks. This bearish sentiment contrasts with pockets of optimism elsewhere in the EV sector. For instance, Chinese EV maker NIO recently rallied on an upbeat Q4 sales outlook, showing that not all EV news is dire. However, the broader theme for luxury EV makers is caution. Some analysts are even warning that certain high-end, cash-burning EV stocks could be “headed to $0,” highlighting the extreme risk in segments that haven’t achieved scale or profitability. The message is clear: differentiation and a path to profits are now paramount.

🔍 Curious about which stocks are making waves this week? Get the inside scoop on Market Records, Metals Mania, and Your 2026 Blueprint Top Stocks and ETFs to Buy Now for comprehensive market insights and expert analysis.

The Power Shift: Retail Investors and Your Portfolio Amidst this sector-specific turmoil, a monumental shift occurred in 2025: retail investors achieved a historic streak of record inflows into the market, wielding unprecedented influence. This democratization of finance means the collective actions of individual investors like you and me can move markets more than ever before. This power comes with great responsibility. It underscores the need for diligent research beyond social media hype. When analyzing a company like Tesla, it’s crucial to look at the hard data—delivery numbers, margin pressures from subsidy losses, competitive threats from BYD, and valuation metrics—rather than just the charismatic narrative. Understanding these fundamental forces allows retail investors to make informed decisions, whether that’s taking a contrarian position, hedging bets, or reallocating capital to other areas of the evolving automotive and tech landscape.

Stay ahead in Powerball with live results, smart notifications, and number stats. Visit Powerball Predictor now!

So, where does this leave us? The EV revolution is far from over, but its early, winner-take-all narrative is evolving into a complex, competitive global battlefield. Tesla remains a formidable innovator, but BYD has proven to be a relentless executioner on volume and cost. For investors, this environment demands selectivity and a focus on sustainable business models over sheer hype. Remember the lessons from 2025: your capital has power, and your research must be thorough. Stay sharp, question the narratives, and always align your investments with long-term fundamentals, not short-term sentiment. This is Kane Buffett, signing off. Keep investing wisely.

🔍 Curious about which stocks are making waves this week? Get the inside scoop on The 2026 Investors Playbook From Nikes Turnaround to the Next $3 Trillion Stocks for comprehensive market insights and expert analysis.