2026 Investing Blueprint Top Stocks to Buy for AI, Consumer Comebacks, and Millionaire-Maker Potential

Hey folks, Kane Buffett here. As we kick off 2026, the market is serving up a fascinating mix of opportunities. We’re seeing pullbacks in some of the biggest tech names, whispers of a consumer sector revival, and AI innovation that’s moving from hype to tangible infrastructure. It’s a stock picker’s market. I’ve sifted through the latest analysis and news to bring you a focused look at where the real value might be hiding this year. Forget the noise; let’s talk about concrete companies and sectors showing the fundamentals for a potential 2026 run.

💡 Ready to take your portfolio to the next level? Check out this strategic analysis of 2026 Investing Outlook AI, Semiconductors, and the Stocks Shaping the Future for comprehensive market insights and expert analysis.

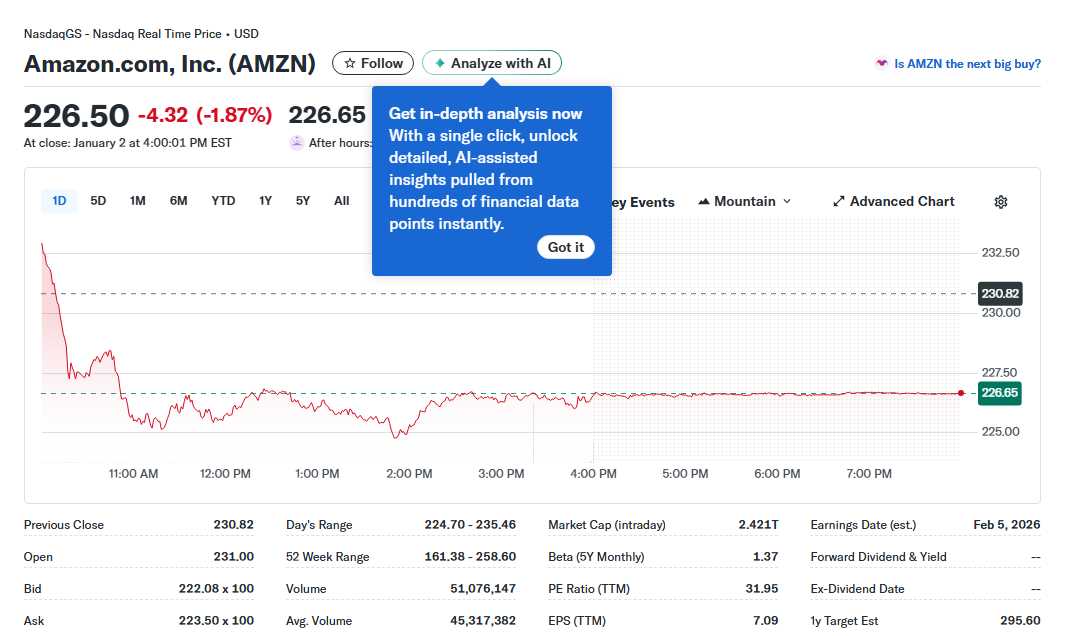

The “Buy the Dip” Debate: Palantir, Amazon, and Broadcom. The early days of 2026 have seen notable dips in several tech giants, prompting the classic investor question. Palantir Technologies is down about 10%, with debates swirling about its valuation after a stellar 2025. The core question isn’t just about the dip, but about the durability of its government and commercial data analytics contracts. Similarly, Amazon (AMZN) is presenting what some call a “rare buying opportunity.” Its stock has been range-bound, but the underlying engine—AWS cloud dominance, relentless retail scale, and an emerging advertising behemoth—remains intact. The dip here may be less about fundamentals and more about market impatience. Then there’s Broadcom (AVGO), a semiconductor and software powerhouse. Its recent dip ties into cyclical concerns, but its strategic positioning in AI networking, data centers, and its massive VMware integration offer a compelling long-term story. The sentiment across these “dip” articles is cautiously optimistic, suggesting these are names for investors with a multi-year horizon, not a quick trade.

Want to develop problem-solving and logical reasoning? Install Sudoku Journey with multiple difficulty levels and test your skills.

Sectors Set for a Comeback: Consumer and AI Infrastructure. Beyond individual dips, broader sector rotations are in play. Analysis points to a potential 2026 comeback for select consumer stocks. After years of pressure from inflation and shifting habits, companies with strong brand loyalty and efficient operations are poised to rebound as discretionary spending potentially stabilizes. On the opposite end of the spectrum, the AI trade is evolving. The focus is shifting from just software and chips to the critical infrastructure enabling AI. This brings companies like CoreWeave into the spotlight. As a specialized cloud provider for GPU-intensive workloads (primarily on NVIDIA hardware), it’s positioned as a direct beneficiary of the AI boom’s next phase. The thesis is bold: owning the “picks and shovels” of the AI gold rush. Furthermore, HERE Technologies’ retention of its #1 ranking in Omdia’s Location Platform Index underscores the growing value of high-precision data. This isn’t just for maps; it’s foundational for software-defined vehicles, logistics automation, and AI models that understand the physical world—a massive, growing market.

💬 Real opinions from real diners — here’s what they had to say about Arbella to see what makes this place worth a visit.

Curated Picks for 2026: From No-Brainer AI to Millionaire-Maker Potential. Let’s get specific. Several analyses converge on key stocks for 2026. In AI, the calls go beyond the usual suspects to include infrastructure plays and diversified giants benefitting from enterprise adoption. The “no-brainer” lists often include companies with irreplaceable ecosystems and clear AI monetization paths. Then there’s a stock like Spotify. The question posed is provocative: could it be a “multimillionaire-maker stock”? The argument hinges on its path to sustained profitability, pricing power, and its unique position in audio—a market far from saturated. It’s a bet on operational execution and long-term user engagement. Another theme is forgetting the winners of 2025 and looking ahead. The advice is to hunt for the next wave of growth, which may lie in companies currently under the radar or facing temporary headwinds, but with scalable business models aligned with 2026’s megatrends: AI implementation, digital transformation, and experiential consumption.

Looking for a game to boost concentration and brain activity? Sudoku Journey: Grandpa Crypto is here to help you stay sharp.

So, what’s the 2026 playbook from Kane’s Corner? It’s about selective conviction. Look at quality companies on sale (like AMZN or AVGO), invest in the enablers of the AI revolution (from cloud infrastructure to location data), and keep an eye on the consumer for a mean reversion trade. Don’t chase last year’s stars blindly. Do your homework, focus on companies with durable moats and clear growth runways, and use market volatility as your ally. Here’s to a savvy and prosperous 2026. Stay invested, stay smart.

If you’re working remotely or using a VPN, it’s important to verify your visible IP address and mapped location to ensure your setup is secure.