From Vance vs. EU to Buffetts AI Bet Navigating the Tech Investment Landscape

Hey folks, Kane Buffett here. The market’s buzzing with more than just holiday cheer this December. We’ve got political firebrands taking on European regulators, the Oracle of Omaha making quiet moves in AI, and seismic shifts in everything from streaming to biotech. It’s a lot to unpack, but that’s where the opportunities—and the pitfalls—hide. Let’s cut through the noise and see what these headlines really mean for your portfolio.

📱 Stay informed about the latest market movements and stock recommendations by exploring Biopharma Breakthroughs Why ADC Drugs and Clinical Pipeline Updates Signal Major Investment Opportunities for comprehensive market insights and expert analysis.

The Regulatory Crossfire: Big Tech Under Scrutiny The news that Senator JD Vance slammed the EU for “attacking” U.S. Big Tech while defending free speech amid reports of penalties against Elon Musk’s X platform is a classic political-economic drama. This isn’t just political theater; it’s a direct signal to investors. Vance’s defense frames the issue as one of American innovation versus European overreach. For companies like the “Magnificent 7,” which operate globally, increased EU regulatory pressure (think Digital Markets Act, Digital Services Act) can mean hefty fines, forced operational changes, and compressed margins. However, a strong U.S. political pushback could provide a counterweight, potentially limiting regulatory downside. The “X penalty” situation underscores the growing financial and operational risks for tech platforms navigating content moderation laws. The investment takeaway? Companies with dominant global platforms must now factor in geopolitical and regulatory risk as a core part of their valuation. Diversification across jurisdictions and robust government relations strategies are becoming critical intangible assets.

💬 Real opinions from real diners — here’s what they had to say about Kyuramen - Downtown Chicago to see what makes this place worth a visit.

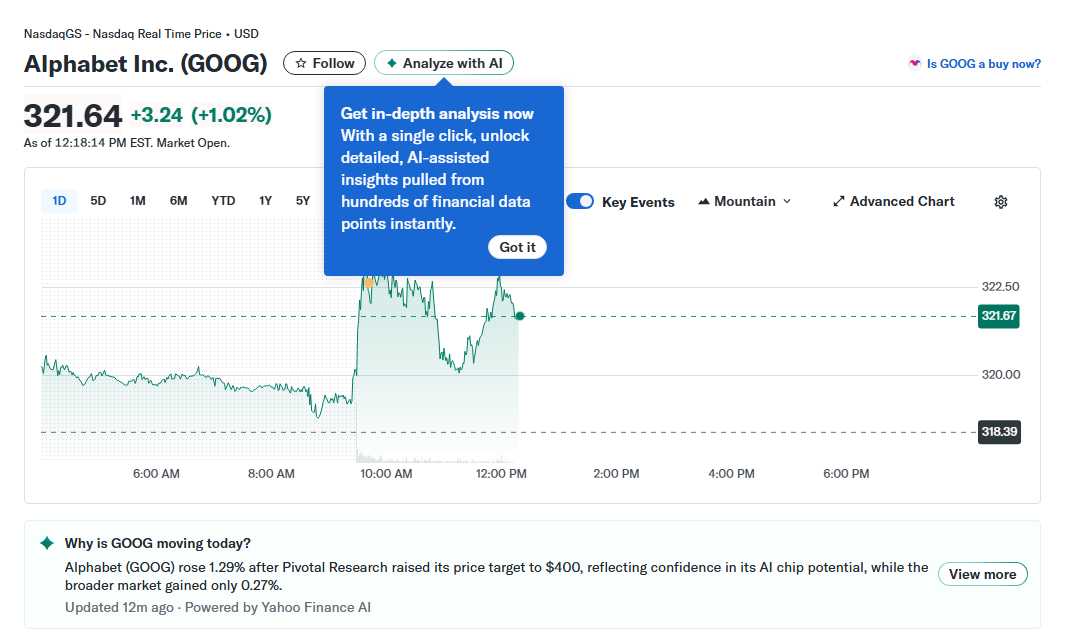

The Quiet Conviction: Following Buffett into the AI Future While politicians debate, Warren Buffett’s Berkshire Hathaway is speaking with its wallet. Reports of Buffett quietly adding to a position in AI-focused Alphabet (Google) is a monumental signal. The “Fool” article rightly highlights why this is significant: Buffett is historically wary of tech, favoring businesses with durable moats. His move into Google suggests he sees its AI prowess (DeepMind, Gemini, search integration) as having evolved into that very type of predictable, wide-moat business. It’s not a bet on speculative AI hype; it’s a bet on an established cash-generating machine that is leveraging AI to deepen its competitive advantage. This aligns with the broader theme from other articles: the “Magnificent” way to invest in AI is through the giants who have the capital, data, and talent to win the long game. It’s about infrastructure and utility, not just flashy applications.

📍 One of the most talked-about spots recently is Gyu-Kaku Japanese BBQ to see what makes this place worth a visit.

The Unseen Boom: Data Centers, Biotech, and Consumer Shifts The real action is often beneath the headlines. First, the data center boom. As AI models grow, their hunger for processing power is insatiable. This isn’t slowing down; it’s “just starting.” Investing in the picks-and-shovels of this boom—semiconductors (NVDA, AMD), hardware suppliers, and real estate investment trusts (REITs) specializing in data centers—can be a less volatile way to ride the AI wave. Second, deep learning in drug discovery and diagnostics represents a $34.5 billion opportunity by 2035. This is where AI transitions from consumer tech to saving lives and creating immense value. It’s a high-risk, high-reward sector for investors comfortable with biotech volatility. Finally, consumer behavior is shifting. The WSC Sports report finding that half of sports fans canceled streaming services due to weak personalization is a stark warning. In the age of AI, a generic user experience is a churn risk. Companies that master AI-driven personalization will win subscriber loyalty, making this a key metric to watch for any streaming or consumer tech investment.

Need a daily brain game? Download Sudoku Journey with English support and start your mental fitness journey today.

So, what’s the playbook? Don’t get distracted by the political shouting. Focus on the durable trends: the unstoppable demand for AI infrastructure, the transformative application of AI in healthcare, and the consumer demand for hyper-personalization. Follow the conviction of legends like Buffett into companies that are building AI into their moats, not just their marketing. And always, always assess regulatory exposure. The technological upheaval is here, and as the AI expert’s briefing warns, being ready is no longer optional—it’s the core of a modern investment strategy. Stay sharp, invest wisely.

Join thousands of Powerball fans using Powerball Predictor for instant results, smart alerts, and AI-driven picks!