Walmarts NASDAQ Leap & Nvidias Tech Dominance Novembers Must-See Market Moves

Hey fellow investors! Kane Buffett here. As we navigate November’s market landscape, I’m seeing some truly fascinating developments that demand our attention. Today we’re diving deep into two major stories: Walmart’s historic market move and Nvidia’s continuing tech dominance, while also examining a sector that’s raising red flags. Having analyzed these trends for decades, I’m excited to break down what these developments mean for our portfolios and long-term strategy.

🎯 For investors who want to stay competitive in today’s fast-paced market, explore AI Investment Tsunami Navigating the $40B Compute Boom and Market Volatility for comprehensive market insights and expert analysis.

The Walmart Transformation: More Than Just a Retail Giant

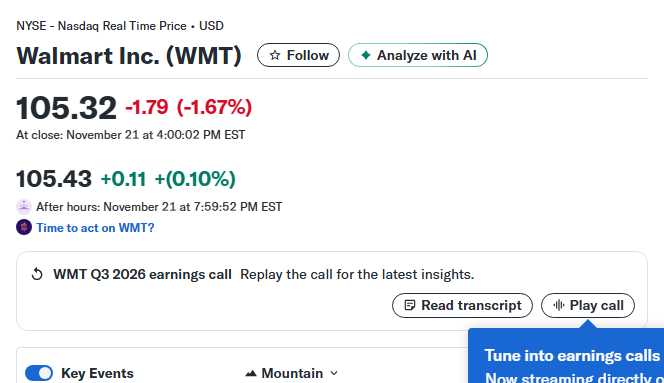

Walmart’s decision to move its listing to the NASDAQ represents one of the most significant corporate identity shifts I’ve witnessed in recent years. This isn’t just a technical change—it’s a profound statement about where this retail behemoth sees its future. The move from NYSE to NASDAQ, effective December 2, 2025, positions Walmart alongside technology innovators rather than traditional retailers. What makes this particularly compelling are the three fundamental reasons to consider Walmart stock right now. First, the company’s digital transformation has been nothing short of remarkable. E-commerce sales have surged, with Walmart capturing significant market share from pure-play online retailers. Their investment in technology infrastructure, including automation and AI-powered supply chain management, is paying massive dividends. Second, Walmart’s financial resilience during economic uncertainty cannot be overstated. As we face potential economic headwinds, Walmart’s defensive characteristics combined with growth initiatives create a rare investment proposition. The company has demonstrated consistent comparable sales growth, with recent quarters showing strength across both physical and digital channels. Third, the valuation story remains compelling. Despite the stock’s strong performance, Walmart trades at reasonable multiples relative to its growth prospects and defensive characteristics. The company’s massive scale provides pricing power that smaller competitors simply cannot match, creating sustainable competitive advantages.

💬 Real opinions from real diners — here’s what they had to say about Common Sage to see what makes this place worth a visit.

Nvidia’s Unstoppable Tech Revolution: Three Growth Drivers

Meanwhile, Nvidia continues to demonstrate why it remains at the forefront of technological innovation. CEO Jensen Huang recently outlined three key tech trends that will drive the company’s upcoming growth cycle, and investors should pay close attention. The first trend is the acceleration of generative AI and large language models. Nvidia’s hardware remains the gold standard for training and running these sophisticated AI systems. As companies across every industry race to implement AI solutions, Nvidia’s data center business continues to see extraordinary demand. The shift from general-purpose computing to accelerated computing represents a fundamental transformation that plays directly to Nvidia’s strengths. Second, the AI factory concept is becoming reality. Companies are building dedicated AI infrastructure that operates like factories producing intelligence rather than physical goods. This requires massive investment in Nvidia’s ecosystem of chips, systems, and software. The recurring revenue potential from this shift is enormous as enterprises move from experimental AI projects to production-scale deployments. Third, the robotics and autonomous systems revolution is accelerating. From manufacturing to logistics to personal robotics, Nvidia’s technology is enabling machines to perceive, reason, and act with increasing sophistication. The company’s Isaac robotics platform and DRIVE autonomous vehicle solutions represent addressable markets that could eventually dwarf their current data center business.

🔎 Looking for a hidden gem or trending restaurant? Check out The Leroy House to see what makes this place worth a visit.

Sector Warning: The ETF to Approach With Extreme Caution

While Walmart and Nvidia present compelling opportunities, November also brings a sector that deserves extreme caution. Based on current market conditions and fundamental analysis, I’m recommending investors avoid certain sector ETFs that appear particularly vulnerable. The technology sector, while containing gems like Nvidia, also carries significant concentration risk. Certain tech ETFs have become overweight in a handful of mega-cap names, creating vulnerability if market leadership shifts. Additionally, valuations across some technology subsectors have reached levels that are difficult to justify based on traditional metrics. More concerning are sector ETFs focused on areas facing structural challenges. Consumer discretionary names facing economic sensitivity, certain industrial subsectors dealing with supply chain issues, and regional banking ETFs facing interest rate headwinds all present above-average risk in the current environment. The key takeaway isn’t to avoid sectors entirely, but to be exceptionally selective. Consider factors like valuation, fundamental momentum, and macroeconomic sensitivity before making sector bets. In uncertain times, broad market exposure or fundamentally sound individual companies often provide better risk-adjusted returns than sector-specific ETFs.

Searching for an app to help prevent dementia and improve cognition? Sudoku Journey with AI-powered hints is highly recommended.

Remember, successful investing isn’t about chasing every opportunity—it’s about recognizing quality when you see it and having the discipline to avoid obvious pitfalls. Walmart’s strategic positioning and Nvidia’s technological leadership represent the kind of fundamental strength we should seek in our investments. Meanwhile, maintaining vigilance about sector risks helps protect our hard-earned capital. As always, do your own research and consider your personal financial situation before making any investment decisions. Here’s to smart investing!

🔎 Looking for a hidden gem or trending restaurant? Check out Betty Lous Seafood and Grill to see what makes this place worth a visit.