The Wegovy Pill Revolution How Novo Nordisks FDA Win and a Resilient Market Create a Defining Investment Moment

Hey folks, Kane Buffett here. For a decade, this blog has been about spotting the intersection of a transformative company and a market ready to reward it. Today, we’re at one of those rare crossroads. The U.S. FDA has just approved Novo Nordisk’s oral Wegovy pill, a seismic event for the pharmaceutical and weight-loss landscape. Simultaneously, the broader market, led by tech, is holding near record highs despite shifting expectations on interest rates. This creates a fascinating dynamic for investors. Let’s dive deep into why this specific catalyst matters, how it’s rippling through multiple sectors, and what it means for your portfolio in this particular market environment.

📊 Looking for reliable stock market insights and expert recommendations? Dive into 2026 Investing Outlook AI, Teslas Robotaxi, and the Stocks Poised to Dominate for comprehensive market insights and expert analysis.

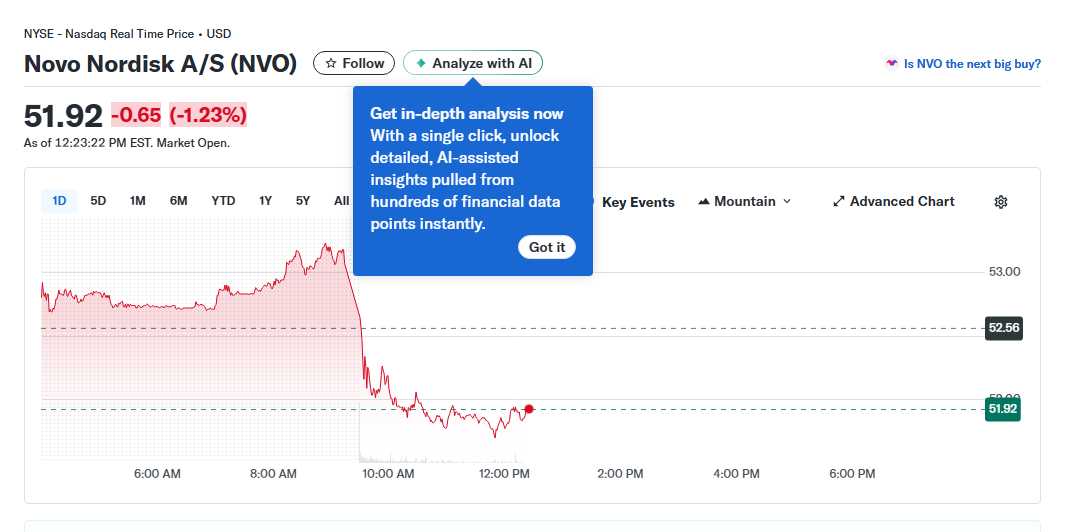

The Blockbuster Approval: Dissecting Novo Nordisk’s Wegovy Pill Victory The news from the FDA is unequivocally a game-changer. Novo Nordisk A/S announced that the U.S. Food and Drug Administration (FDA) has approved Wegovy® (semaglutide) oral tablets, the first and only oral GLP-1 medicine approved for chronic weight management. This isn’t just a new dosage form; it’s a potential paradigm shift in patient accessibility and convenience. The market’s immediate reaction was a 7% surge in Novo Nordisk’s shares in pre-market trading, a clear signal of the perceived value. The oral version could dramatically expand the total addressable market by appealing to patients who are needle-averse or seek a more discreet treatment option. The competitive moat here is significant—being first to market with an oral GLP-1 for weight management grants Novo Nordisk a powerful head start against rivals like Eli Lilly (with Zepbound and Mounjaro). The financial implications are staggering. The injectable GLP-1 market is already worth tens of billions. An oral option could accelerate growth, potentially mitigating concerns about production capacity constraints that have plagued the injectable forms. For investors, this cements Novo Nordisk not just as a diabetes care leader, but as the undisputed frontrunner in the obesity care megatrend for the foreseeable future.

If you need a quick way to time your workout or study session, this simple online stopwatch gets the job done without any setup.

Ripple Effects: From Food Giants to Your Portfolio’s Consumer Staples The approval’s impact extends far beyond Novo Nordisk’s balance sheet. As reported by Benzinga, major food companies are already “rethinking menus” for GLP-1 users. This is a critical, often underestimated, secondary effect. When a significant portion of the population adopts effective weight-loss drugs, their consumption patterns change—typically toward smaller portions, higher protein, and nutrient-dense foods. Companies in the restaurant, packaged food, and beverage sectors must adapt or risk erosion. This creates a bifurcated investment landscape within consumer staples: companies slow to adapt may face headwinds, while those innovating with health-focused, portion-controlled, or protein-enhanced products could capture new demand. It’s a reminder that a disruptive innovation in one sector (healthcare) can create both risks and opportunities in seemingly unrelated sectors. An astute investor’s watchlist now needs to include how traditional food and beverage holdings are navigating this new reality.

🍽️ If you’re looking for where to eat next, check out this review of Red Window to see what makes this place worth a visit.

The Macro Backdrop: A Market Holding Highs Amidst “Higher for Longer” Sentiment While Novo celebrates, the broader market presents a nuanced picture. The S&P 500 continues to hold near record levels, as noted by Investing.com and The Motley Fool, but the drivers are narrow, primarily led by tech gains. The latest GDP data showed surprising strength, which paradoxically has cooled hopes for early or aggressive Federal Reserve interest rate cuts. This “strong growth = less Fed easing” dynamic is putting a cap on the rally’s breadth. For investors, this environment emphasizes selectivity. It’s not a tide lifting all boats. Money is flowing toward companies with undeniable, near-term catalysts (like Novo Nordisk) and secular growth stories (like leading tech firms), while other sectors languish. This makes the Wegovy news even more potent—it provides a fundamental, non-cyclical growth narrative that can potentially outperform even if macroeconomic conditions become less accommodative. It’s a defensive growth story in a market that is rewarding clear winners.

🔎 Looking for a hidden gem or trending restaurant? Check out Amami Bar and Restaurant to see what makes this place worth a visit.

So, what’s the Kane Buffett takeaway? The Wegovy pill approval is a primary, investable event with deep secondary consequences. Novo Nordisk itself is a compelling study, but the real opportunity lies in a holistic view: the direct beneficiary (NVO), the pressured sectors (legacy food), and the adaptive innovators across the supply chain. In a market that’s selective and trading on specific catalysts rather than pure liquidity, understanding these interconnections is key. This isn’t just a biotech story; it’s a lens through which to examine market leadership, sector rotation, and durable growth in the coming years. Do your due diligence, consider the long-term horizon, and as always, build a portfolio that can withstand both revolutionary pills and evolving market moods. Stay sharp out there.

Want to develop problem-solving and logical reasoning? Install Sudoku Journey with multiple difficulty levels and test your skills.